I’m glad I made the decision to attend my very first Merchant Risk Council event this week. For those that don’t know, MRC Vegas is the second largest payment event in the US (after M2020) but with a VERY different focus. MRC is attended by the “hands on” payment leaders from all the top merchants and the vendors that serve them: Stripe, Adyen, PayPal, V, MA, risk, fraud, …. Etc. Whereas M2020 is attended by FinTech, Crypto, Venture, Institutional investor, and strategy audiences, MRC is much more focused on making payments work.

Tag Archives: paypal

Amazon Takes Venmo…

Big news from PayPal’s earnings yesterday was Amazon taking Venmo. I wanted to summarize the 15 tweets on the topic and provide a little more background into the dynamics.

Amazon is an amazing company from a people perspective, perhaps the best TEAM I’ve had as a customer. They always proceed within a plan and purpose. So why Venmo? As I related 2 weeks ago, Amazon is working to reduce the costs of payments. They have managed fraud down to 3bps.. So why can’t their processing costs look a lot more like Walmart? They have been successful in achieving this in EU (Sepa DD) and India (see blog), but the US remains (by far) the highest cost geography.

Short Blog – PayPal and Pinterest

PayPal and Pinterest – Super Distraction?

What’s behind this deal?

PayPal needs

-

- Increase users and platform engagement (MAU)

- Grow the merchant value proposition

- Get into the START of a consumer shopping experience

- Enable a new mobile first shopping experience – focused on small merchants – from beginning to end (like Alipay)

-

- “Inspiration to Action” – They are missing the action beyond a ad click.

- Stalled user growth

- 50%+ Revenue growth with consistent operating loss.

- 454M Users with ARPU of $5.08/User vs PayPal’s $21/User

- Ad Growth to Action. Advertising business with solid advertising relationships with CPGs and large retailers. However you don’t click to buy from a CPG.

- Needs platform to complete consumer journey.

PayPal’s New Mobile Bank

Quick thoughts on today’s announcement

This is a solid product.. Not a “super app” but perhaps the best mobile first bank in the US (and beyond). What is NEW?

-

- Mobile UI to integrate all those heterogeneous apps (and acquisitions)

- High yield savings account (0.4% APR) powered by synchrony

- Integration of Honey offers/rebates/loyalty programs

- Better Direct Deposit/Bill Pay integration (ex faster clearing/availability of direct deposits)

PayPal – ?Super App?

PayPal has been my #1 holding for last 5 yrs, and it has been on a fantastic ride… especially so over the last 18 months! (see MVP – Continued Domination for more).

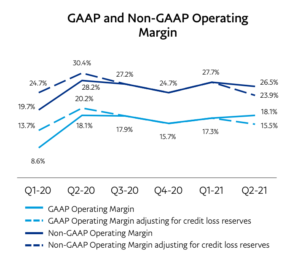

Paypal announced 2Q21 earnings 2 weeks ago (7.28). TPV growth was 40% with eBay, 48% without out, while sales grew at a 32% clip without  eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

Walmart – Banking and FinTech

As always pardon the typos

It seems like only yesterday that 30 members of Congress wrote the acting chairman of the FDIC to stop Walmart Bank.

“Wal-Mart’s plan, to have its bank process hundreds of billions in transactions for its own stores, could threaten the stability of the nation’s payments system,”

30 Members of US Congress, March 2006

Of course, we all know that Walmart pursued a different course to deliver services. Partnerships (MGI, Moneygram, Paypal, …) and banking in a box (literally an isle with prepaid cards). Most analysts discount or “write off” Walmart’s achievements in financial services. Given Walmart doesn’t break out financial performance of Money Center, analysts are left with the tea leaves of MGI and GDOT reports. There is little doubt that comparing Money Center financial metrics to tier 1 banks would leave most unimpressed. However, Walmart has created a portfolio of banking services that supports their overall retail strategy and creates overwhelming loyalty amongst their core customer base.

PayPal Threats – 2020

I’m a big fan of PayPal, but as they approach 100x earnings I’m on the look out for risks. While PayPal is BEST positioned as the ONLY company to solely focus on eCommerce payments AND A UNIQUE ability to “own the rules”as a 3 party network, they are not without significant risk. 2020 has 2 major threats that can hit them very very quickly.

#1 Apple Pay in Browser

I’ve been writing about this for 5 years and it is finally here. While I was certainly off in my projected 2016 timing, I was not off in the user experience. Take 2 minutes to do the following

Payments in the Pandemic – Paypal

First off, best wishes to you and your family during these challenging times. I had intended to get this out last week, but found the need to invest in family. My family is doing fine, I’m fortunate to have all of my children, grandchildren and parents within 10 miles of Davidson North Carolina. We are like the rest of you, navigating needs for family support and volunteering in our community.. All of which has changed up our schedules. My hope is that we all find some way to create good out of this terrible event.

In this Blog

- Massive disruption in Commerce has created fundamental changes in payments and consumer behavior.

- Discretionary and T+E spend is dropping 40-80%. Visa and Mastercard have both revised growth from mid teens to low single digits. Paypal has maintained low end guidance.

- eCommerce is clear winner right now, estimate that Paypal’s core eCommerce TPV could be 40-60% above average

- Consumer behavior changes driven by the pandemic will rapidly accelerate the move away from physical retail (See 1 April WSJ).

- Paypal is very well positioned to capture new volume both short term and long term growth.

Payments 2020 – MVP Continued Domination?

I’m back to blogging after a 5 year hiatus… The CEO thing is rather all consuming. Glad to have an exit so I can get back to my fellow payment geeks.

What to blog about first? Given we are in new decade I thought about writing some grand predictions. But rather than look forward, we must spend a little time in the past, as the past 10 years have been JUST AMAZING in payments. I’m calling this blog series “payment growth vectors” where I hope to recap what has transpired in payments (history) to provide a trajectory for evaluation of the future course.