Trust in a transaction. In another one of my favorite books (Design Rules: modularity) there exists the concept of trust between physical components of an integrated system. This book stands in contrast to Nobel Economists’ work in defining the “Firm” and organizational boundaries in Transaction Cost Economics (TCE). But the technical theory of modularity is amazingly consistent with the concepts of “boundaries” in TCE. In modularity, there are 4 core rules for separating technical components:

Continue readingJPMC/Mastercard – Tokenizing BillPay and DDA

Free Article

Continue readingPart 2 – The Power of Bank Networks

The Bull Case for V/MA (24 pages).

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Part 1 – US Payments Environment covered the complexity of the US payment environment and the challenges faced by top banks in modernizing their systems (where all systems live forever). There are many types of payments: bill payments, A2A, P2P, wires.. Today the focus is on how banks intermediate commerce. Banks MUST have networks as every bank can’t connect to every consumer/merchant. Effective Bank networks (aka rails) are NOT a commodity service, but one that allows the banks to leverage their unique ability to assume risk.

Merchants Tokenize – eCom Wallet Challenges

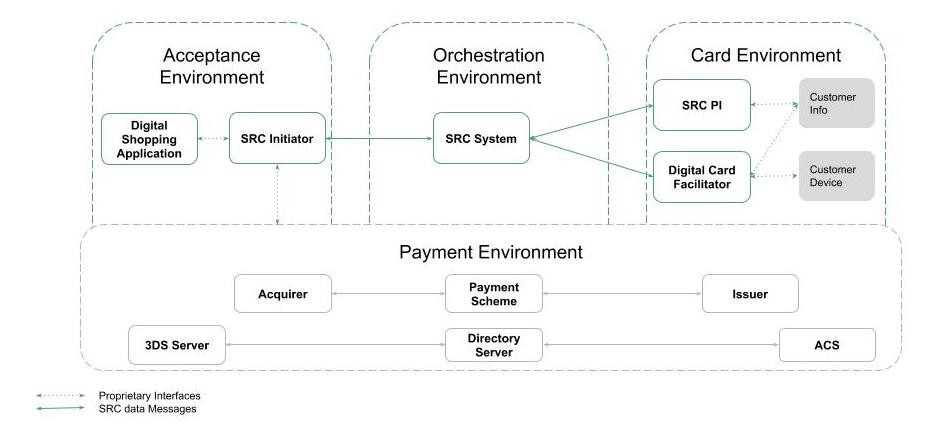

UPDATE – Nov 29 2022 – Note that I have conflated the relationship between SRC and 3DS 2.0. 3DS 2.0 is the authentication protocol used by SRC. 3DS 2.0 has been widely adopted as a mandatory replacement to 3DS 1.0. Part of the driver for adoption was the EU SCA mandate. SRC has NOT been widely adopted as it is a fairly broken consumer experience at the moment.

I’m at M2020 today and it has been a “back to normal” fantastic event. Let me put my “merchant hat” on for a story from their perspective.

Apple Launches High Yield Savings

Apple and Goldman Sachs announced the forthcoming launch of high yield deposit account focused on increasing the value of Apple Card’s Daily Cash rewards. Operating as a kind of rewards sweep account, customers that register for the new account will have “their Daily Cash [move] into a new high-yield Savings account from Goldman Sachs”.

Short Blog – Key developments this week

I hope to finish part 2 – Power of Bank Networks tomorrow (12-15 pages). In the meantime I have to recap a few key developments this week.

Continue readingPart 1 – US Payments Environment

Assessing the Environment and Setting the Focus (part 2 – Power of Bank Networks)

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner. Please do not share unless you hold an enterprise license.

Must read FT article “How JPMC’s plan to kill credit cards split the bank”. The article discusses Jamie Dimon’s internal mandate to drive a new payment network. I was shocked with the level of internal org quotes here. In my view, Jamie is the best bank CEOs in history (based on performance and talent coming out of JPMC). As a former banker, I know how hard it is to move the ship. However, FT is wrong. Chase’s efforts ARE NOT about killing credit cards, but rather creating something much bigger.

This is a long blog..

Continue readingTCH Phase 1 – eCom Wallet

Short blog – 80% confidence

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Phase 1 of TCH’s token efforts will be in SRC model. A bank branded “wallet” acting in the DCF role for TCH PIs . Just as VAC has enabled the elimination of physical hardware for acceptance, issuers see a plastic-less future for cards. They want to own the issuance of cards and want much more than a token, they want the entire “wallet”.

Go to market is either as:

- TCH as SRC System, or

- Visa as the SRC System for all TCH banks (V and MA) with TCH is a “unique role” managing all consumer data, registration, payment tokenization, …

Apple – #1 Payment Innovator

As Apple is set to launch the iPhone 14 today, I was thinking about the significance of ApplePay’s innovations to V/MA and how these innovations benefit the entire network of merchants and consumers. Making payments easy is hard… Apple is the lead “innovator” within the V/MA networks at the consumer touchpoint (with Google, Samsung, PayPal and others in the mix). Their “wallet” and branded integration into both POS AND mCom is unrivaled and represents 93% of all mobile wallet payments in the US (2021).

This 2021 Pulse Network Debit Whitepaper provides the best public view on performance (US Only), with TPV CAGR over 50%. Quite frankly, when it comes to mobile payments, it’s silly to talk about anything else by ApplePay in the US

Near Term Impacts of Distributed Ledger Technology to Financial Services – Chain of Trust

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Continuation of last week’s blog on “binding” and minting of tokens.

I’m currently immersed in DeFi, DAOs, Blockchain, …etc. Selected readings are at the end of this blog. Keeping Current in DeFi/DLT is almost impossible. I certainly invite comments and corrections to anything I’ve written below. While I have teams building services in this area, my perspective is biased. My purpose in writing is to stimulate discussion so don’t be shy in the comments, I welcome disagreement and discussion.

Topic today: What impacts will the $50B invested in FinTech/DLT/Crypto have on existing financial services in next 5-10 yrs? What is the summary CEO/Investor View?