Category Archives: Delivering Value

Consumer Behavior: Discerning and Capturing Value

Merchant Friendly Card Linked Offers

Random Management Thoughts: IPOs and Innovation

Gemalto QR Codes.. One Giant Leap _________ ?

10 Jan 2013

NFC is a beautiful technology with uses far beyond payment. In the payment use case however, it is not the technology, but rather a business battle over control and ownership (a 12 Party NFC Supply Chain Mess) which has conspired to create many forces against NFC’s payment success.

As I stated yesterday, latest news is that MCX has chosen QR code based approach from Gemalto (following Starbucks success). My guess is that Gemalto has developed a one time use QR code that is derived from device information (it will change for every transaction… ). You can safely assume that ACH will be the primary funding mechanism (just as in Target’s Redcard and Safeway’s FastForward). The banks had some idea of MCX’s plans are thus moving aggressively to create a directory service to “protect” customer DDA information via tokenization. My guess is that this protection will come at a price….

Here is my best guess of the transaction flow (assuming the rumor is true).

Registration

- Customer downloads Gemalto’s wallet

- Account is created unique to the phone

- Consumer registers phone, DDA, loyalty cards, backup funding instrument

- Bank account is validated, consumer risk scored, back up payment instrument run for auth

- Wallet is activated on first use at a participating merchant after ID is validated

Usage

- Customer opens wallet at checkout

- Unique QR code is generated based upon phone information (ex IMEI, time, network, phone #, …)

- Cashier selects “check” or “loyalty card”

- QR code is presented to register and scanned. Note MCX merchants are large multi lane merchants with POS development teams.. there will be some work to be done here

- Authorization – ECR passes QR code to MCX. Example via store controller routed much the same way coupons are done today.

- MCX validates code, performs fraud screen, authorizes payment (performed by FIS).

- Individual stores also will be able to leverage code as key for consumer “cloud wallet” access where coupons are stored and redemption is paperless.

- Coupons are applied

- Loyalty price/promotions are applied

- Payment is applied

- Zero balance

- Consumer gets electronic receipt and paper one.

I like QR codes for their ubiquity and established consumer behavior (thank Starbucks in the US). Stores don’t need to buy any new hardware for this to work, there is a zero cost of issuance, and it will work on a broad spectrum of phones. Development cycles for Store POS software are normally 18 months… so it could be some time before we see something come out.

QR codes may not be rocket science, but NFC has demonstrated the downside of tech heavy solutions. We may not need a $400M F22 when a simple bicycle will do. Carriers face a future as dumb pipes, a future share by banks, as both work to control their market positions instead of delivering value. MNOs and Banks (in the US) have proven themselves equally incapable of succeeding with new walled garden strategies. Commerce will find the path of least resistance, like a mighty river…

The big challenge for MCX will NOT be in technology, but rather a consumer value proposition. Retailers stated goal is to bring death to merchant funded bank card reward programs. What will convince me to part with my Amex card at the POS?… it will need to be something substantial.

Another often asked question is can MCX keep a bunch of fierce competitors working together in the same tent? This approach seems broad enough to insulate MCX from retail competitive forces and align them in fighting a common enemy. Per Sun Tzu “the enemy of my enemy is my friend”. Retailers are looking to turn the tables on the 2% “payment tax” on their business. There is serious enterprise commitment to making MCX work, banks will do well to treat them with respect.

Who will lose in this approach?

- Payment Terminal Manufactures

- Anyone dependent on NFC

- Existing Payment Networks – Debit Volume primarily (if MCX can create a value proposition)

- Retail banks. The primary payment relationship is a strong “daily use”… there are many downside for banks if they loose it.. for example retailers could offer instant credit based upon your history and network reputation.

- Start ups building case for value around bank cards or payment networks

- Consumers that want anonymity.

Other Related Blogs

Reputation – Commerce Implications

9 January 2013

I’m sitting in NYC waiting on my plane.. thinking about reputation, not only explaining the importance of a “good one” to my 12 and 8 yr old boys, but also thinking about its broader importance in commerce. Where do I have reputations today?

- Commercial: Bank, Credit Bureaus, Card Issuers, Local Merchants, Employers, Customers, Suppliers, Amazon, Linkedin, eBay, Blog, Google, …

- Community: Friends, Neighbors, Schools, Church, Organizations,

- Personal: Hospital, Government, Police, Government, Friends, Colleagues

Throughout history reputations were 100% dependent on relationships. These personal networks were the primary conduit of reputation information. Financial services have benefited greatly, over the last century, from improvements made to reputation portability and standardization.

In this modern era, eBay offers many lessons in relevance of reputation, demonstrating what great things can happen when tools exist to manage it. There are also many negative lessons here. For example in 2004, eBay launched into China. Prior to launch eBay’s risk organization wanted to keep the China community separate from the US. Community separation was a logical recommendation given that reputations take time to build, and dependent on community context. In the US buyers and sellers work for years to build trust and “confidence”. Reputations forged by self-dealing, or other fraudulent practices, were ferreted out. Unfortunately Meg didn’t want this community separation… she wanted one big community. Within weeks Meg saw the downside of operating these 2 together, as fraud shot through the roof.. thus separating the communities and opening the doors for other competitors (See this Stanford University Case Study).

Reputation has a very strong societal and community context. I told my sons that a Chef with a great reputation in New York or Paris means something completely different than a great Chef in a community of cannibals (… well it made them laugh). Markets hold people and money accountable, and the ability to measure and convey a commerce reputation is critical for network growth and efficacy. Banks have long held a central intermediary role in commerce as both a “reputation authority” and a manager of the corresponding risk. For example, letters of credit (LOC) are an instrument extended to a supplier receiving an order from an unknown buyer. After all, receiving an order for 100,000 widgets from a known buyer carries a far different weight that one from one that is unknown. Thus an LOC reduces the risk to the supplier by allowing money to be held by a 3rd party bank while the order if fulfilled.

Another excellent reputation example is in serving the poor at the base of the pyramid. In 1976, Muhammad Yunus created the concept which led to Grameen Bank, a success which resulted in the 2006 Nobel Peace prize (see Wikipedia). Muhammad recognized that lending must be tied to a reputation which is critical to maintain: that within the local community. The Grameen model lends money to a community group, whose individual members are mutually responsible for the loan. This is a fantastic model. What further opportunities could exist if participating individuals could expand their reputation outside of the community?

Modern markets have demonstrated that improving the portability of reputation expands the capital attracted to that market. For example financial markets expanded by specialists operating in a securitized model where risks could be aligned to capital. In retail banking, local markets evolved from local banks to national. Each bank could make rational decisions on where to participate and specialize in this market.

In business-business commerce reputation is a critical factor in the success of JIT inventory, virtual supply chains and vendor managed inventory. Few companies would be willing to let an unknown participant into their network. In the online world, eBay and Alibaba have done a tremendous job building communities around reputation. Wouldn’t it be nice if you could take your reputation with you? For example if Prosper or Zopa could get through regulatory hurdles (see here on their issues), lending could be done in an ad hoc community of investors without a banking license. Commerce would be done based upon your community reputation (eBay/Amazon), and risk would be managed through non financial data from retailers, facebook, MNOs, …

Unfortunately few of the holders of your reputation are incented to share it (in a positive sense). Few people know that there are roughly 4 times the number of negative credit bureaus as there are positive. In other words, every bank and supplier are willing to share their negative customer information (ie didn’t pay their bill), very few are willing to share their positive customer information. In most OECD 20 countries, positive bureaus are not the result of commercial initiative, but rather a legal or regulatory one (Wikipedia Equifax).

In the US we have more of an aggregation problem.. how do we manage multiple reputations. In emerging markets the problem is much different: How do you build any kind of reputation? One of the first problems to crack is identity. How do you assign an ID that sticks? We see many government initiatives around National ID, but this takes time. Is there another number or ID that we could use in the interim? It certainly seems that a cell phone number makes the most sense given its global penetration of 5.3B consumers (75%+ of the worlds population). Could emerging market carriers enable an opt in “reputation” consumer service?

I’d love to see a few companies work toward this end.

In the US, I’d love to see a consumer service that just measures my reputation in all of these places (beyond banking).

Sorry for not finishing this blog cleanly…

Future of Retail Banking: Prepaid?

Nov 7 2012 (updated for typos)

Warning.. long monotonous blog. Sorry for the lack of connectedness, written over 7 days and my editor is rather slammed. You have been warned, so don’t complain….

Summary

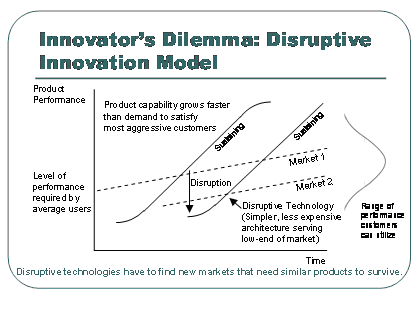

- The competitive dynamics surrounding a “transaction account” (ie DDA) are shifting. For example, Retailer banking/prepaid products (Wal-Mart, Tesco, ..) offer significant fee advantages to most lower mass customers. Three party networks like Amex and Discover have unique advantages when combined with Retailers distribution/service capabilities. This means prepaid has become a disruption: a new good enough product…

- Net interest income is 64% of total US retail bank revenues, yet the bottom four deciles of mass market customers are no longer profitable. Given that the transactional account is the #1 factor for retail bank profitability, what are implications if banks loose it?

- There is a high probability for disruptive value propositions in Payments, as advertising replaces merchant borne interchange. Payments and core banking will become a “dumb pipe” business unless Banks create value and assume a larger orchestration role. POS Payments are the central feature of a transaction account, if banks loose this relationship they will be in a poor position to orchestrate.

Does anyone else have trouble keeping up with state of the art? Who is doing what? My method of keeping up with change is to immerse myself in a given area for a day or two. It also gives me a reason to call my friends and colleagues. This week the theme is retail banking. I’ve spent too much time thinking about payments and how it relates to mobile, advertising, …etc. I thought I would dust off my banking hat and think in terms of a banker.

Retail Banking

I’m struck by how odd retail banking is. Why are banking services not more simple? Why do I have a separate savings, checking and card account? Why not one account? if the account runs in a arrears I pay interest and if it runs in credit the bank pays me interest? Why does a bank take 3-5 days to move money? How on earth do the banks afford all of those stand alone branches when I visit them perhaps once or twice a year? Why all of the regulation? What does my bank do for me? What problems do retail banks solve? Can someone else solve these problems more efficiently?

There is certainly no single answer. Retail banking serves many demographics, from the college student to the billionaire. Historically retail bank relationships were very important relationships, as banks only lent money to people they “knew”, based on the deposits they had. Younger consumers need to borrow, older consumers … savings. Banks focused on things like college student accounts to lock in that relationship as early as possible. Today’s modern financial markets provide for the securitization of loans, thereby spreading risk among various investors willing to assume it. Does a banking relationship matter anymore? to Consumers? to Banks?

I’m struck by how little change has occurred (in the US) on the liabilities side of the banking business? Quite frankly US consumers are treated like idiots who sacrifice “protection of capital” over risk. We now have an entire agency working to protect US consumers  from banks.. (BTW what is predatory lending?). Other markets let consumers take on risk.. and hence have many more choices, and innovation, in savings. For example, I’m very fortunate to have worked with so many fantastic people over the years. The great thing about running Citi’s channels globally is that each and every country had a somewhat unique competitive and regulatory environment. It was like running 27 different banks. There were many different strategies for deposit acquisition, for example:

from banks.. (BTW what is predatory lending?). Other markets let consumers take on risk.. and hence have many more choices, and innovation, in savings. For example, I’m very fortunate to have worked with so many fantastic people over the years. The great thing about running Citi’s channels globally is that each and every country had a somewhat unique competitive and regulatory environment. It was like running 27 different banks. There were many different strategies for deposit acquisition, for example:

- In Spain we had a 10/2 product that paid 10% interest on deposits for the first 2 months.. then went to 1%.

- In Japan Citi leveraged its global footprint, and the poor local consumer rate environment, to create foreign currency (FCY) accounts which allowed consumers earn higher returns by assuming currency conversion (FX) risk in uninsured accounts.

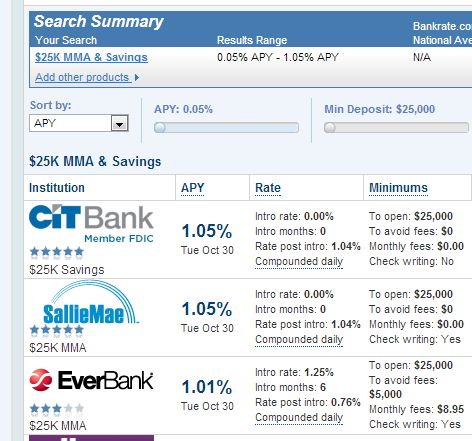

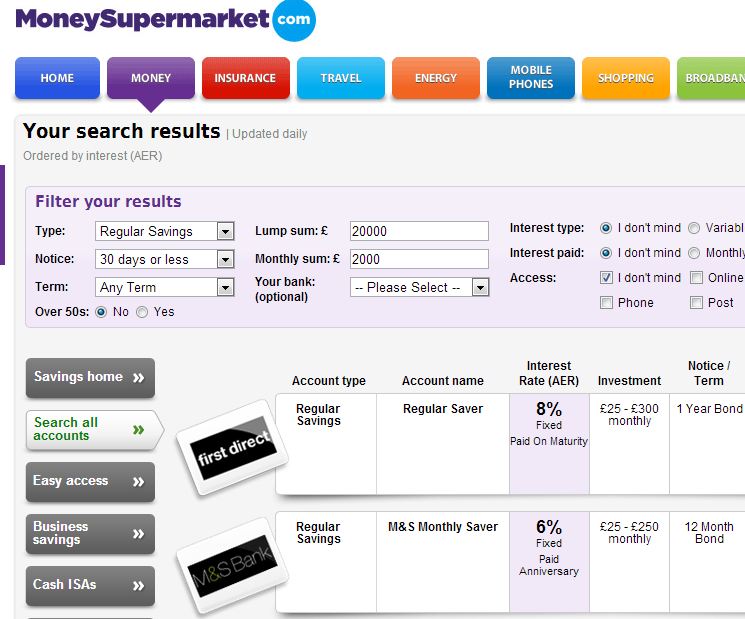

- The UK is perhaps the most competitive retail bank environment in the world. Consumers in the UK can switch banks almost as easily as changing shoes, it was thus essential to enable consumers to switch quickly and then get them into other products quickly. Take a look at today’s UK savings rates from MoneySuperMarket (8% on a fixed $30k deposit) vs the US (1.05% bankrate.com). Rate differences on this scale helped fuel the carry trade in Japan.

In the US, it is well known (inside the banking community) that banks are highly discouraged from competing on rates. Not that it matters, this amazing study by the Chicago Fed (Chicago Fed – Checking Accounts What Do Consumers Value – 2010) shows that US consumers are rate inelastic.. and care much more about fees. You have read this right, consumers don’t care about interest rates on their deposits.. which is certainly NOT intuitive. Perhaps rates are all so close to 0% that 5-10bps doesn’t matter. Or perhaps because the average US consumer does not save at all, and those that do have their money in another place.

Retail Bank Profitability. Net interest income (2011, represented more than 64% of total US bank revenues) is the rate spread between borrowing short and lending long, or more broadly the differential between asset yields and funding costs. Net interest  margins (defined as net interest income over average earning assets) were 3.6% at year-end 2011, just 11% higher from the 20-year low of 3.2% in the last quarter of 2006.

margins (defined as net interest income over average earning assets) were 3.6% at year-end 2011, just 11% higher from the 20-year low of 3.2% in the last quarter of 2006.

From DB Research

As low rates persist, loan-to-deposit spreads fall as prices adjust, and longer-term securities, held as assets, roll over to lower-yielding securities (the same holds true on the funding side, of course, helping to extend the positive impact of falling interest rates into the future). The net impact on banks’ net interest levels may be negative, though. In previous recoveries, this effect has been offset by increased loan volumes, allowing banks to return to sustainable growth levels. Furthermore, as an economy recovers, banks may quickly benefit as short-term assets roll over at higher rates

To summarize: Bank net interest income is important (64%), and falling. Banks have had a key revenue source taken away from them (Debit interchange) and are also facing another merchant led suit on credit card interchange. Bank brands and reputations are on a steady downward trend. Consumers don’t care about rates, but react strongly on fees. … A new regulatory agency to protect consumers is just now forming and looking to make its mark. What are banks to do?

Transaction Account

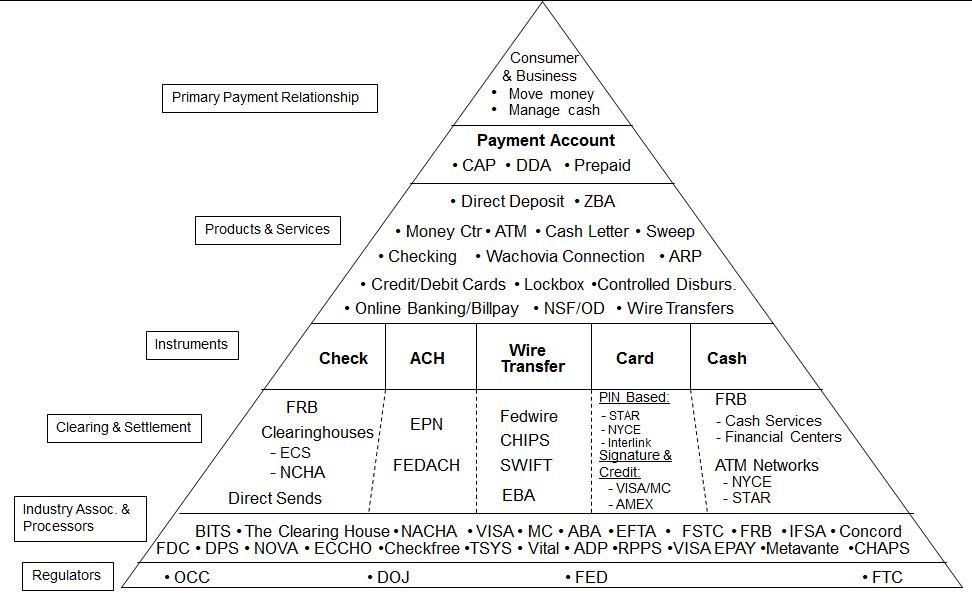

What is the purpose of a bank provided transactional account today? Well certainly our mattresses are a little less lumpy, and the relationship factors have largely gone away. So what is left? Transactionality?

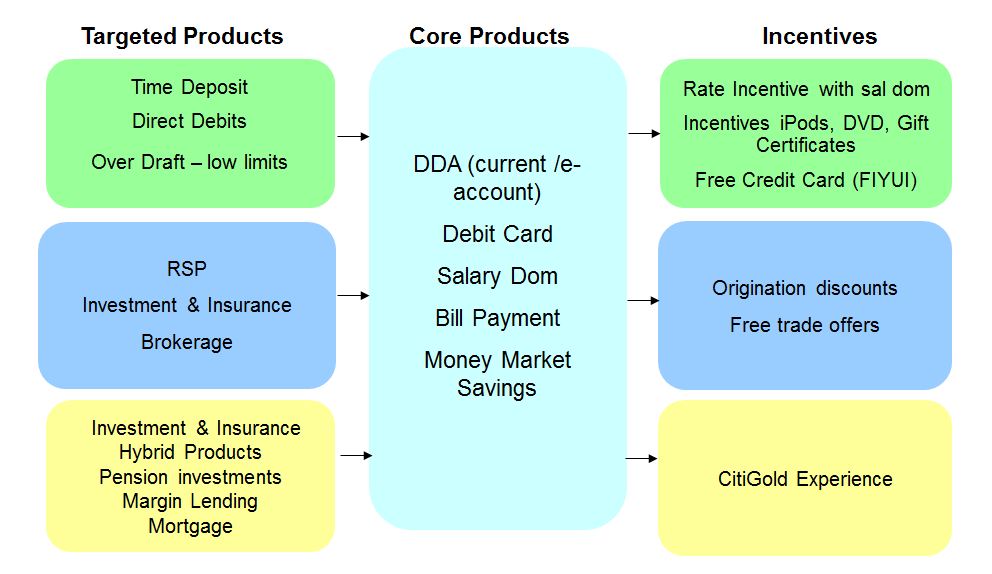

The banks have long recognized that the transactional account is the #1 factor driving a consumer relationship. Virtually every other banking product and service hangs from this account. Most retail banks view direct deposit (internationally known as Salary Domiciliation or Sal Dom) as the key indicator of the transactional relationship. Consumers have limited “energy” to connect to more than one network (as outlined in followed my previous blog on Weak Links).

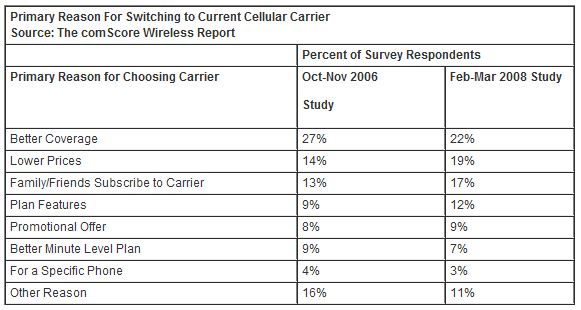

This financial supermarket concept, authored by Sandy Weill and John Reed, has not exactly been a slam dunk success. Nonetheless every retail bank starts selling with a checking account, even if nothing else is attached. What are the key factors influencing the selection of a transactional account?

- Why are deposits important to banks?

- Driver of overall relationship à Customer Net Revenue

- Liquidity ratio ->Risk ->Agency Rating -> Capital Costs

- How do consumers select a bank?

The public compete data above is completely consistent with previous proprietary studies I’ve commissioned. Consumers tend to pick their bank based on how convenient the branch and/or ATM is.

Is there something fundamentally changing? What if consumers don’t visit a branch… or no longer use cash? Are there new value propositions? Where will consumers (and their deposits) go?

Recent market developments/Announcements

- American Express/WalMart BlueBird

- Tesco Bank

- Merchant Consumer Exchange (MCX)

- Safeway activating ACH on Club Card (Fast Forward)

- American Bankers Association – Prepaid from Banks

- Network Branded Prepaid Card Association (analysis)

- Barclays Pingit Service

- Google Wallet goes Plastic

- MNOs rule in Emerging Markets

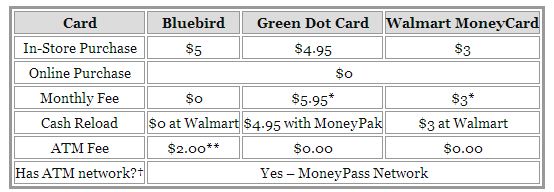

The Amex Bluebird product is revolutionary in terms of fees. It is the lowest cost reloadable card in the market today. Beyond the product, I’m even more impressed with WalMart’s business strategy here. They seem to be willing to break even on payments/banking in order to win the overall consumer relationship and increase foot traffic and loyalty in their stores. Take a look at the suite of products offered by WalMart. While banks are pushing out the bottom forty percent of mass consumers, WalMart has made a bet that it cannot only serve them, but do so profitably.

There are many different types of pre-paid cards (more below), however most are not regulated as bank accounts. In almost every geography, consumer deposits (interest bearing, insured) are regulated because they drive both bank liquidity (which drives lending and cost of capital) and profitability. Remember before capital markets existed to securitize assets (loans) retail banks could only lend to the extent of their balance sheet (deposits). Consumers put their money with banks in order to earn interest (the carrot) with the downside of fees on usage (the stick). In the US consumers are beginning to ask themselves “is the carrot big enough”?

In emerging markets many banks have a poor reputation, additionally access to legal resources are limited, as are consumer protections. How would you feel if you showed up to your bank for a withdrawal and your bank said “sorry your money is gone” and you had no recourse? This dynamic has propelled other banking models in emerging markets. For example my friend Nick Hughes and his Vodafone/Safaricom team created MPESA in Kenya which provided enormous value to consumers. However MPESA caused an apoplectic reaction from the banking regulators as 10% of Kenya’s GDP sat in a non-interest bearing Vodafone owned settlement account. MPESA therefore impacted bank liquidity (IF the funds would have gone into a bank account as opposed to just M1/cash). Visa and MA have worked hard to try to make prepaid the underlying account for mobile money in emerging markets, to very little avail. The problem is not connecting people to the V/MA network.. and giving balances to an approved bank. The problem is first transferring money to entities currently not on any network, then paying a very small number of billers.

Why are consumers defecting in the US? Ernst and Young just published a phenomenal global study on this subject. The result of their analysis was that consumer confidence in banks is degrading. E&Y outlined a call to action by banks: reconfigure your business models around customer needs. My hypothesis is that consumers have reached a tipping point where they view banking services as commodities… In the UK, this is already well established.

Prepaid

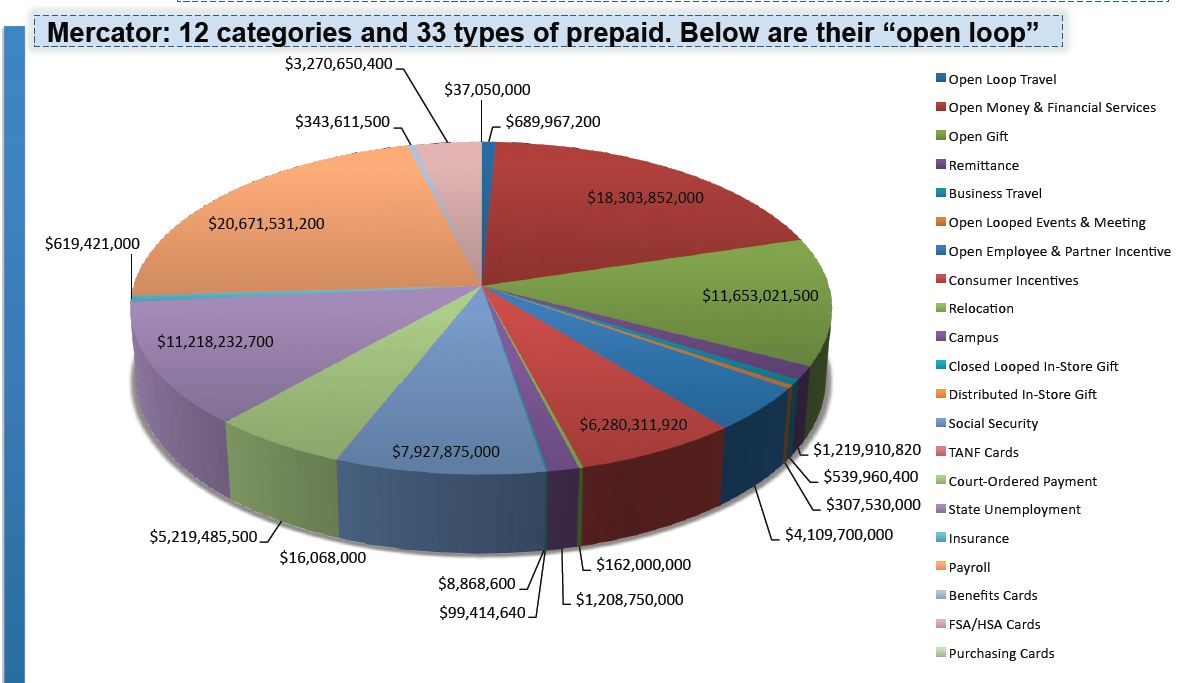

I haven’t spent much time thinking about prepaid cards so I thought it was time to refresh myself, particularly in light of MCX and the prospect of retailers acting as Banks.

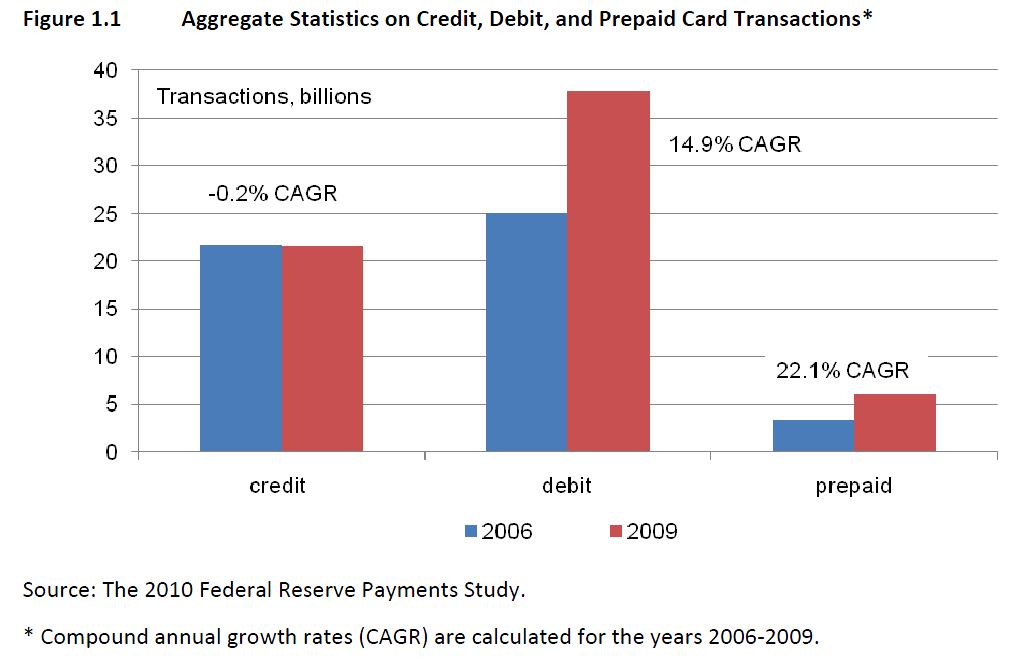

From the US Fed

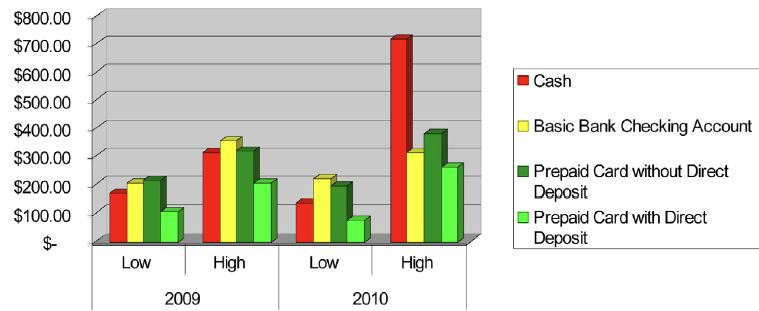

Prepaid cards offer much of the functionality of checking accounts, but that does not mean the underlying economics are the same. A typical prepaid card in the data is active for six months or less, a small fraction of the longevity seen with consumer checking accounts. As a result, account acquisition strategy and the recovery of fixed and variable costs are likely different than for checking accounts. …. prepaid cards with [direct deposit are uncommon but] remain active more than twice as long and have 10 times or more purchase and other activity than other cards in the same program category. As a result, these cards typically generate at least four times more revenue for the prepaid card issuer

Similarly Pre-paid cards also face a complex web of regulation (See Philadelphia Fed Paper 2010), across 31 different types of cards.

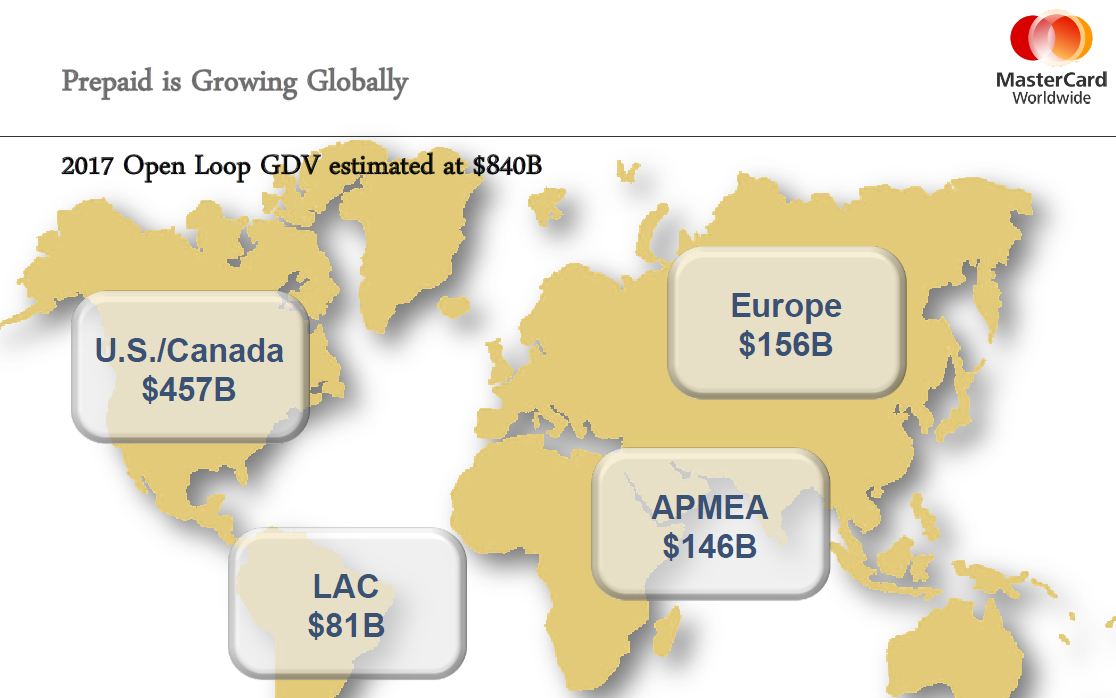

31 types of cards? Did anyone else realize the diversity here? Wow… For the sake of this blog, let’s focus on reloadable (GPR) open loop cards (references to prepaid below are on this card type only). It would seem that GPR pre-paid is following the general disruption pattern of serving a lower tier of the market at a more attractive price point. According to Mercator, In 2009, consumers loaded $28.6 billion onto prepaid cards. By 2015, prepaids will hold $168 billion.

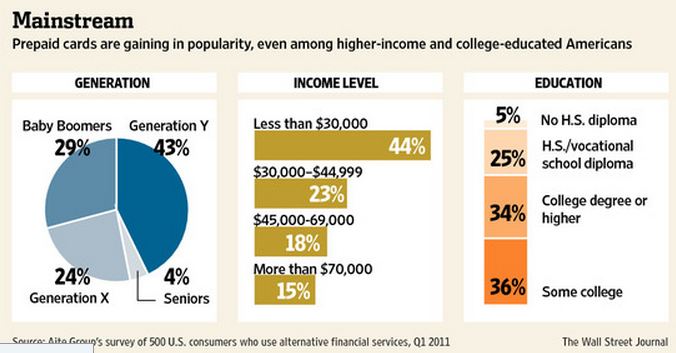

Last month’s WSJ ( Prepaid Enters Mainstream) outlined this dynamic

Traditional leaders in GPR pre-paid have been Green Dot, NetSpend, . The Durbin amendment exempted most prepaid cards. This means that pre-paid is largely example from the Durbin interchange restrictions… (with several conditions). Thus the business case for pre-paid is rather strong, and Banks themselves are assessing if they can make this the new “starter” account (ex Chase Liquid). However Three Party Networks (Discover and Amex) have a significant advantage.

From Digital Transactions, March 2012

While the Federal Reserve’s rule implementing the Durbin Amendment has its greatest effect on traditional debit cards, it affects prepaid cards too, especially its provision that banks’ prepaid cards can avoid Durbin price controls only if cardholders can access the funds exclusively through the card itself. That provision thwarted banks’ efforts to make prepaid cards more like demand-deposit accounts and led them to scale back or end bill payments through prepaid card accounts.

But American Express and Discover are not subject to Durbin’s controversial provisions, Daniel and Brown noted. Both companies are so-called “three-party” payment systems that function both as merchant acquirer and card issuer. In contrast, Visa and MasterCard debit and prepaid cards are part of “four-party” systems in which the issuer and acquirer are usually different companies and rely on the Visa and MasterCard networks to route transactions among them. The Durbin Amendment exempts, or “carves out” in industry parlance, three-party networks from its provisions, including interchange regulation.

“There’s no restriction on what AmEx can pay itself” for prepaid card transactions, said Brown. Thus, AmEx and Discover have a new opportunity to grow their prepaid businesses, the attorneys said.

Clearly Discover (DFS) and American Express (Amex) have an opportunity to “Kill” prepaid cards, what are they missing? Physical distribution, service and reach in the mass market. These are the very things that retailers like WalMart can provide, and in fact economically benefit by providing them.

As you can tell, regulations are driving the business models here. Most large US retailers leverage a fantastic team of attorneys from Card Compliant that specialize exclusively in prepaid cards (run by my friend Chuck Rouse). WalMart’s move to Amex is brilliant both from a regulatory and business model perspective.

Today’s pre-paid dynamics may be the tipping point by which 3 party networks begin to overtake V/MA in growth. A trend that will accelerate when other business models require “control”. This next phase will be centered around merchant/consumer transaction data, which will begin to unlock the advertising revenue pool, which is almost 4 times larger than that of payments.

Payments and core banking will become a “dumb pipe” business unless Banks create value and assume a larger orchestration role. POS Payments are the central feature of a transaction account, if banks loose this relationship they will be in a poor position to orchestrate. 4 party networks are very, very hard to change.

I see a battle where 3 party networks work to branch into orchestration and advertising, and existing orchestrators (ie Apple/Google) integrate legacy dumb pipes (payments and telecommunication) to deliver value to the consumer. What do consumers value today? This is the call to action for bankers… who are not always the best at creating alliances.

Here is one idea, focus on trust and helping consumers solve problems they don’t face frequently. For example,

- Make financial planning easier and less of a sales job.

- Help manufactures and retailers connect to target consumers.

- Become a buyers agent?

- Help navigate the college application and loan process,

- Help buy a new car for the lowest possible price…

I know this is not a clean finish.. but that’s all the time I have.

References

- August 2012 US Federal Reserve – Consumer use of prepaid cards

- Federal Regulation of the Prepaid Card Industry – April 2010

- Chicago Fed – Checking Accounts What Do Consumers Value – 2010

- AT Kearny Retail Banking Profitability – Europe

- Network Branded Prepaid Cards Association (NBPCA)

- American Banker – Amex Prepaid Card

- Center for Financial Services Innovation

- Top Global Brands – Interbrand

- WSJ Prepaid Enters Mainstream

Thank you Kansas City Fed for the fabulous brief from the: CONSUMER PAYMENT INNOVATION IN THE CONNECTED AGE. Bill Keeton and Terri Bradford were nice enough to invite me, but unfortunately I couldn’t attend. In my last visit to the KC fed we spoke about future payments types, but we also spent quite a bit of time discussing where mass market consumers will go if banks view the bottom 4 deciles of retail banking as unprofitable (according to proprietary McKinsey Study). Today I thought I would pull together a compendium of my learnings on retail deposits, MSBs and pre-paid… the “transaction account” by which payments flow.

Future of Phones.. Good Enough?

16 Sept 2012

Quote of the week

It’s not clear that NFC is the solution to any current problem…

Apple Senior VP Marketing – Phil Schiller

A few months ago I was in Hong Kong speaking with institutional investors at CLSA’s annual event. One of my more memorable meetings was with James, a chief investment officer with a top 5 investment bank. The heart of the discussion was on the future of telecom. Although I’m not a telecom expert, James was interested in finding “the next killer app” in mobile. Was NFC it?

His investment thesis was that phones are starting to become commodities: screens, LTE connectivity, cameras, battery life, applications, …etc are all reaching a point of good enough. His time with me was spent drilling down into payments and NFC in order to see if I had any new data which would alter his view. I did not….

What will happen in a world where handset hardware is no longer the basis for competition? The same thing which occurs to any manufacturing area where a “good” becomes a “commodity”: margins compress for the commodity and migrate to the new area which is basis for differentiation/competition. Yesterday I outlined the implications, and investment opportunities, for the mobile operators.

This week we saw the launch of the iPhone 5.. better, brighter, bigger, lighter, clearer, faster, lasts longer, crisper, sturdier, takes better pictures, more tightly integrated to applications that Apple controls, …etc. A great new product. An Evolution… not a revolution. What Apple understands better than almost any consumer product company is: consumer experience matters. While some handsets already exceed those of Apple’s iPhone in feature/function (Samsung’s Galaxy S III)… none can match it on consumer experience. Experience is where Apple is focusing its efforts, and the major shift in iPhone capabilities is NOT in hardware features.. but on orchestrating value in ways it can control.

Apple takes a Clayton Christensen approach to the iPhone: what problems does a customer have, and how do I solve them? For example, I hate typing in my name and address on a little mobile browser to order a good from lets say Gap.com. Apple’s passbook will resolve this by allowing Gap to integrate to passbook to pull all of the “iTune’s account” information over .. so I don’t have to fill this out anymore. Apple is moving to solve real consumer problems… It is looking to orchestrate value delivery.. moving the “hub” of coordination from the phone to iCloud.

This is what I refer to as the Stage 4 Value Shift (see April Blog). Theoretically, an open innovation model (ex Google/Android, Java/Oracle, …) should be able to quickly surpass Apple, as 100s of small companies invest larger amounts (cumulatively) in expanding capabilities of a “platform” (see platform leadership). However, Apple has learned its lessons from its Mac days and has defined competition along the lines of “consumer experience”. In this model, it does NOT CARE about interoperability or standards… rather Apple is maniacally focused on delivering value to consumers with usability, reliability, intuitiveness, … being core measures. Apple’s brilliance is multi-faceted, but by defining product focus along the lines of consumer experience, the iPhone’s closed model of innovation can not only effectively compete, but win easily against open systems. In other words, while open systems compete more effectively in a feature/function war.. they loose in the qualitative measures of “experience”.

Apple will obviously monitor the environment for effective new features, to ensure that the core product hardware remains competitive. For example, the real world transaction data for NFC based payments is a complete joke. There are no phones, there are few terminals, and there is no consumer or merchant value proposition. Sure there are exceptions like Japan, but only closed systems with a monopoly leader have proven the ability to push the solution out.

Apple does see a need to improve device-device communication, as well as shrink the hardware footprint. With these drivers, and given the prototypes in market, I fully expect Apple to redefine phone hardware architecture with a new integrated chipset that would encompass functionality of: controller, radios (wi-fi, BT, 14443, …etc), secure element that would also enable the SIM to be virtualized and placed within the SE. If this is indeed Apple’s direction, it will not be a new basis for hardware competition on feature/function, but rather: battery life, footprint and control (ex. virtualized SIM).

Other players also have unique strategies and assets. For example, Google’s strategy: orchestrate value based on consumer data. In assessing investments I look for one key answer: what problems are platforms trying to solve and in what marketplace?

All about Commerce… and Entertainment

My major issue with Apple’s strategy is the degree to which other entities can participate. I see mobile phone revenue streams in 2 major buckets: Commerce and Entertainment. Entertainment is not a focus for me.. Commerce is. Businesses operating within the retail sector are undergoing fundamental transformation. For 1000s of years, local merchants survived based upon distribution and availability. Today they are left trying to sell a commodity product at a higher price to consumers in a marketplace with near perfect transparency.

What is the roll of any intermediary in commerce? Not just in the selling, and purchasing, but in marketing, product selection, distribution, service, support, … What does the new face of retail look like? This is the focus of Amazon… they are the leader here from a “virtual commerce” (e and m) perspective.

As an investor, I believe we will see a massive new wave of companies redesigning retail. Five years ago I had a camera, an iPod, a PDA, GPS, phone, … today I have one device. What will the bundling (or unbundling) of retail look like? What are the problems to be solved? In the past 15 years mobile has grown up along side of commerce, operating primarily as a replacement to fixed line and then migrating to a replacement for online. We will start to see phones leap into commerce in new ways.. but my firm position is that this leap does not start with payment (the last phase of a commerce) but with marketing (the first phase). Why? Because marketing and retail are fundamentally broken, and Payments is NOT.

It is in this context that I laugh at NFC solutions. My favorite quote on this topic was from head of strategy of top 5 retailer

“Mobile Operators know how to run dumb pipes, not create business platforms for marketing… their current wallet initiatives are akin to a toll bridge, NFC is their toll booth where they stop me before reaching my customer.. to cross their NFC bridge I have to wait in line and when I arrive at the gate they don’t want $0.50 toll.. they want 3.5% of what I’m carrying in my truck, and a copy of the shipping manifest (customers’ names). This model doesn’t work for me. “

Commerce will find another path… one of least resistance … of better “experiences”. This is what Apple is enabling in Passbook, and why Amazon is succeeding in commerce. NFC is just a radio… one who’s standards are largely controlled by banks, mobile operators and card networks. Why would retailers want to participate here at all? We should not act to enrich the complexity of payment networks, or wireless ones, but rather form new networks.

Sorry for the typos.. and re-hash of past blogs.. hope it was useful.

Mobile Operators – Where to Invest?

13 September 2012

Mobile Operators should be quite happy with 2012.. it is turning out to be a good year for them. Wireless data revenues are climbing by around 20% YoY and 4G phones are just coming to market. This means your LTE investments should really start to pay off (if you get your data plans right). Motorola indicated that median usage of a 4G device is 11x more than a 3G device – 89MB/ day vs. 8 MB/ day. Also, 4G users are 62% more likely to check their phones than their 3G counterparts… As Jim Patterson notes, more checks mean more opportunities to display an ad. If you can establish that business.

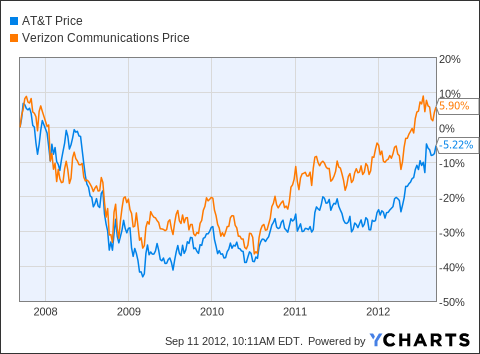

In 2Q2012, AT&T had 69.6 million postpaid customers driving. Operating income margin of 30.3 percent; EBITDA service margin of 45 percent. Wireless data revenues rose by $1.0 billion, or 18.8 percent, from the previous year, to $6.4 billion

For same quarter Verizon had 94.2 million total retail wireless customers, with a 7.3 percent year-over-year increase in wireless revenues; Data revenues were $6.9 billion, up $1.1 billion – or 18.5 percent; 30.8 percent operating income margin and 49.0 percent segment EBITDA margin

Apple – A Faustian Bargain?

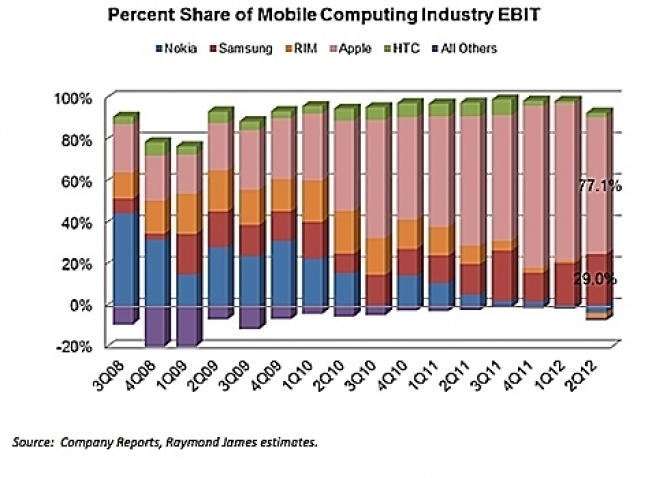

Eating 50% of the cost of a new iPhone will certainly help wireless data growth, but will MNOs develop any other business that can take advantage of this investment? Raymond James analyst Tavis McCourt shows that Apple (AAPL) is expanding its share of profits generated by the mobile industry to 77% in the second quarter of 2012, while also accounting for 43% of its total revenues.

I may be naïve, but I don’t see Apple as the 800lb Gorilla eating everyone else’s lunch. I see Apple as a company executing against a strategy focused on delivering exceptional customer experiences with a solid brand and a fantastic product. Apple is successfully monetizing an environment they control: iTunes, Apps, iOS, iCloud, iPhone, Mac, … They didn’t start with a “control” strategy.. they started with by delivering customer value (and did not go out of their way ease switching costs).

A Strategic Guide to MNO Investment

MNOs, why do customers choose you? This question more than anything else should frame your strategy. Investments in LTE certainly align here, as faster bandwidth improves a key customer requirement and enhances your core revenue.

However, it should be no surprise that consumers don’t want to use your applications and services… your indigenous applications, or your approval (ex control over apps allowed) is not part of their buying decision (except in a negative context). Customers believe that Apple, Google, RIM, … create the platform.. and hold them accountable for delivering value. Customers want freedom to choose how the device works. They make this decision usually before they enter your stores.

These “platforms” will dominate the world much beyond what we witnessed in WINTEL. There is a unique convergence between the mobile and physical world: consumers interaction time, global penetration, portability, connectivity…. The most substantial business impact we have seen due to this convergence (last 5 years) is impact to retail profit margins ( price transparency while shopping – see showrooming). The ability for consumers to check price in the store has been a key driver of retail margin compression, which has decreased from 4.2% in 2006 to 2.4% in 2010 (ref: IMAP’s Retail Industry Global Report 2010).

Even if MNOs could develop applications and services of the quality seen in the core platforms, or by small start ups, MNOs cannot possible coordinate and interconnect at the speed and scale of the platform providers. Google and Apple are quickly moving beyond isolated applications and into the cloud, thereby further accelerating their roles as Orchestrators of Value (See Blog – Stage 4 Value Shift).

MNO opportunities

I’m running out of time here.. need another cup of coffee .. may come back and polish this up. But here are the top areas I see

#1 Empty Space – Mobile Advertising

Leverage your assets in physical distribution, network ownership and consumer PII to reach well beyond anything google could provide. Mobile operators, you have data Google could only dream about… from ISP information (everything done in the mobile browser), to location, to direct customer billing agreements. You could target advertising like no other entity in the world.. plus you now have great 4G assets to deliver unbelievable content.

Mobile advertising is fundamentally broken. There is no one executing well here.. its because this space should belong to you. Go at this strong, hire a strong exec CEO and be willing to pay through the nose for a team comprised of less than 10% industry insiders. This is an advertising company.. not a mobile operator division. If done correctly, the revenue here will dwarf your mainline business in 3-5 yrs. I’ll be glad to quit what I’m doing and run it for you…

#2 Mobile – Physical connection

See my blog KYC $5B Opportunity. Many current businesses (finance, advertising, payments, …) require a physical touch with customer. In emerging markets we see telecom sales “agents” taking on licenses of bank/MSB agents so they can certify documents and take role in opening new accounts. I can tell you first hand as the exec running Citi’s remote channels globally I would love for VZ/Vodafone to take on a role in opening accounts. Additionally, think of the mobile phone operating as a form of digital signature for any type of business.. Or working to complete the biometric locks of Apple/Google/.. with an process that includes non repudiation and physical identification (VZ employee taking and witnessing the biometric registration).

I could think of many more that include Opt In/Opt out for advertising, ticket pick up, virtual concierge, or a cool and hip genius bar (renamed of course) where people are welcome to experiment with all the cool new apps and phones in your store… changing your store “experience” from volume dumb pipe and appliance sales.

#3 Service provider role

The first 2 were “leading roles”, this is “supportive”. Take a look at how your phones are used in the real world, particularly in business. Create customer experience teams. How could your MNO support the business processes of others? In healthcare? In retail? In Airline/travel?

Take healthcare for example, although we have HIPAA, we still have few digital records agents. What could be done here?

You need a complete rework of your partnership strategy. Most MNOs have a model in partnership: buy exclusive rights.. Example is VZ’s deal to sell search to MSFT for $550M in 2009. This model deal continues to be the starting point in most discussions. Change happens rather fast in this industry, exclusive deals also don’t take consumer preferences into account. You must reworks your partnership strategy, away from a control mentality. Focus first on what the consumer wants.. how can you best support it? That can’t be radical… ??

#4 Business wireless

When I go to top 20 retailers to talk about mobile.. their immediate response is: “how do we stop it”? How can MNOs help retailers enhance their business?

Battle of the Cloud – Part 2

Previous Blog – Part 1 – May 11, 2012

Let’s update the Cloud Battle story and discuss events since my last post on the subject

Square, Visa, Google, PayPal, Apple, Banks, … have recognized the absurdity of storing your payment instruments in multiple locations. All of us understand the online implications, Amazon’s One Click makes everything so easy for us when you don’t have to enter your payment and ship to information. (V.me is centered around this online experience). Paypal does the same thing on eBay, Apple on iTunes, Rakutan , …etc. But what few understand is the implication for the physical payment world. This is what I was attempting to highlight with PayPal’s new plastic rolled out last week (see PayPal blog, and Target RedCard). If all of your payment information is stored in the cloud, then all that is needed at the POS is authentication of identity (see blog).

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives

Since May, the following “significant” events “in the battle” have occurred:

- Retailers have launched MCX with Wal-Mart’s Mike Cook as the lead. I want to emphasize, this is not “mobile payments” but rather a low cost payment network (Cook talks about $0.05/payment). Some retailers will seek to integrate their loyalty card, others will create plastic (see Target RedCard), others will certainly couple with mobile. WMT will likely integrate with a virtual wallet that manages digital coupons (Coupons.com likely leading)

- Apple has rolled out Passbook in June.. See my Blog, and hardware analysis from Anandtech of why there is no NFC.

- PayPal had a marketing announcement with Discover. Why would you announce something like this with no customers? Paypal is expanding its network… but merchants are just laughing.. MCX wants a $0.05 payment, Durbin gave them a $0.21 payment and Paypal wants to get 180-250bps. As you can tell, I don’t think much of this, as the Merchants are still in control of their payment terminal. This is also not an exclusive deal with Discover. I expect 2 other major players to partner with Discover in next few months. Paypal just wanted to run with this announcement before the other products come out. I also want to emphasize that DFS is a BUY. They will be a partner of choice as they run a subscale 3 party network that can adapt much more quickly than V/MA. As a side note, Paypal will likely expand distribution of their own plastic. See related blog.

- Google rolled out Wallet 1.5 on August 1 (see blog). This is one of the biggest moves in payments and provides an enormous retailer value proposition (aligned to MCX). Google didn’t follow PayPal, Passbook, or Microsoft.. they rolled out product that was 1.5 yrs in progress. Google’s new cloud wallet allows the consumer to select any payment method, and provides the merchant with a debit rate (Bancorp non-Durbin 1.05% + $0.15 (note Google/Issuer can lower this for merchants, as any issuer could, this is a MAX rate). Google is CURRENTLY loosing money on the payment side of the business in hopes of making it up on the advertising side. This is no marketing announcement like Apple, Microsoft and Paypal.. this is a product announcement.. it is working today in my new Galaxy phone. This is also the first PRODUCTION cloud wallet for the POS. Apple, Amazon and Paypal dominate cloud wallets in eCommmerce and mCommerce. Google and Amex’s Revolution money are the only one’s doing it at the POS.

- Square acquired all 30M Starbucks mobile payment customers (see Blog). Square has done a great job acquiring merchants.. but was hurting on the consumer side. Square wants to build network and needed a pop on the consumer side. Square’s business is pivoting toward marketing and consumer experience. Within the next year, the little Square doggle will be a thing of the past. Starbucks is committing to the Square register experience, and Square is relabeling “card case” to “Pay with Square”.

- LevelUp is making payments “free” for merchants as part of a loyalty value proposition. This is an example deal.. expect more to follow. Issue is that different merchants have different priorities. LevelUp is focused in QSR/Casual Dining and is operating as part of a loyalty play. I’ve outline their revenue in this blog, don’t think it is sustainable unless they can move into acquisition.

- ISIS has lost key executives in its product area, AT&T is rumored to have a NFC/Wallet RFP of its own out and even Verizon is planning to let Google go ahead and put its wallet on the Samsung Galaxy III phones.. after all what choice does it have?

- Card linked offers and incentives in the cloud. No one is making money in this space, large retailers are not participating, hyper local merchants (who are interested) are very hard to sell to, and consumers don’t see relevant content (thus redemption rates under 2%).

Where are the cloud battle lines? Well most significantly the battle lines are forming away from NFC (as I stated in January). Even my old friends at Gartner have caught up and placed NFC in the trough of disillusionment. To restate, NFC is not bad technology.. but it delivers no “value” in itself beyond control. Mobile operators have consistently failed to build a business around a “control” strategy (see my Walled Garden Blog). In the ISIS example they mandated use of credit cards only, as this higher credit interchange was the only way to make revenue. Well guess who pays the freight here? Yep the merchants… Wal-Mart and its peers were not thrilled at giving issuers and MNOs 3.5% of sales for the privilege of accepting a mobile payment.

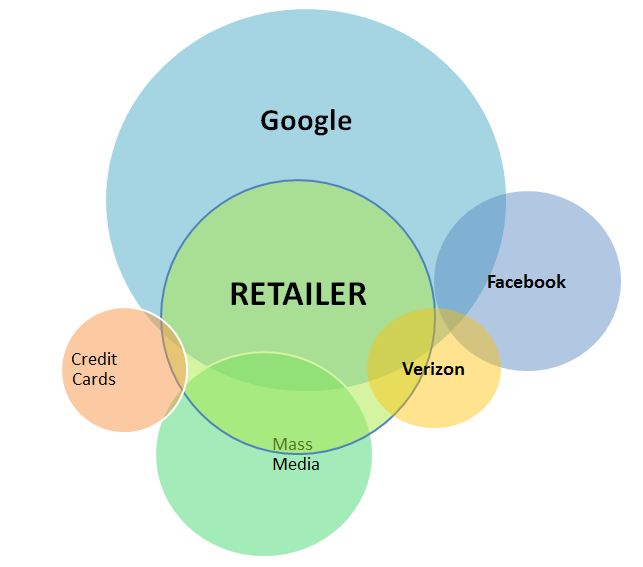

The Cloud battle is complex, as the strategies are about MUCH MORE THAN PAYMENT. Payment is the ubiquitous service that is the last phase of a successful marketing, engagement, shopping, selection, deliver, retention, loyalty process. Leaders from my vantage point:

Payment Networks:

- Mastercard focused on acting in supporting role globally.

- Discover similar to MA, but with much greater flexibility as it operates in a 3 party network and is both issuer and acquirer.

- MCX – Not a leader yet, but has CEO mindshare of every top US retailer. They seem overly focused on the cost side. There is a very big whole in their customer acquisition strategy. MCX is bidding out its infrastructure now, my guess is that Discover or Target will win it.. and the the RFPs are just a way of keeping Banks “in the tent” to keep them from changing ACH rules to kill it like they did to Scott Grimes at Cap One (decoupled Debit).

- Google – has more consumer “accounts” than any company on the planet. Can it convert them to accounts with a linked payment instrument? Google also “touches” more customers, more times per day than any other company, its heavy influence in the shopping process positions it well with retailers. Also has the best retailer sales force of anyone on this list, as they bring in customers to retailers every day. Android/Google Wallet….

- Square – Best customer experience hands down (register). It also has the most traction among small retailers

eCommerce/mCommerce:

- Apple – expect Passbook to dominate mCommerce. It will be the killer app.

- PayPal – Challenged in market adoption beyond eBay/GSI customer base. Top ecommerce sites like Amazon and Rakuten have their own integrated payment, also 50% of eCommerce/mCommerce goes through Cybersource which Visa acquired. Paypal’s future growth driven by international

- Amazon – leading eCommerce/mCommerce player. When will it take one-click beyond Amazon? Amazon’s experience is best from end-end…. PayPal/Apple will operate around the periphery of non-Amazon purchases.

- Rakuten – “Amazon of Japan” who now also owns buy.com. Fantastic experience and leading eCommerce loyalty program.

How many places do you want to store your payment credentials? Who do you trust to keep them? What data do you want providers to know about you?

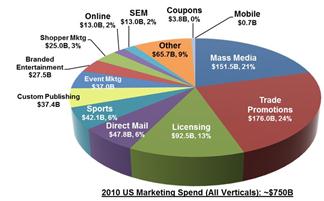

From a macro economic perspective, total payment revenue for all major participants is just under $200B in the US. Total marketing spend in the US is over $750B. Total retail sales in the US is $2.37T (not including oil/gas, Fin services, T&E). Marketing is fundamentally broken… payments is not. Retail sales gross margin has been compressed from 4.2% in 2006 to 2.4% in 2010. Who is best able to execute on the combined retail and marketing pain points? Who can be retailer friendly? Consumer friendly? Marketing friendly?

I start my analysis with #1 the consumer value proposition, and #2 the merchant value proposition. Entities like Google, Paypal, Apple already have tremendous consumer relationships and traction. They thus have very few “acquisition” costs. However, these entities do bear the costs of changing customer behavior. There are many approaches for changing customer behavior:

- Incent behavior – direct/indirect/merchant

- Customer Experience (ex Square)

- Service integration (reduce effort or # of parties)

- Reduce risk – financial (security/anonymity…)

- Reduce risk – purchasing (social, community reviews, …)

- Value proposition in commerce process (indirect incentives)

- Marketing

- ..etc

Other groups like MCX and ISIS bear the cost of both customer “acquisition” AND behavior change for: Consumer, Merchant or Both. As I state previously. one of my favorite arcane books I’ve ever read was “Weak Links” I’m almost reluctant to recommend it because it is so good you may jump ahead of me on some of my investment hypothesis. One my favorite quotes from the book

Scale-free distribution (completely open networks) is not always the optimal solution to the requirement of cost efficiency. .. in small world networks, building and maintaining links between network elements requires energy…. [in a world with limited resources] a transition will occur toward a star network [pg 75] where one of a very few mega hubs will dominate the whole system. The star network resembles dictatorships in social networks.

Networks like V, MA, PayPal, Amex and DFS are working to participate in this new Macro economic opportunity. But established networks are hard to change

“The network forms around a function and other entities are attracted to this network (affinity) because of the function of both the central orchestrator and the other participants. Of course we all know this as the definition of Network Effects. Obviously every network must deliver value to at least 2 participants. Networks resist change because of this value exchange within the current network structure, in proportion to their size and activity.”

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives (new digital coupons).

The current chaos will abate when an entity delivers a substantial value proposition that attracts a critical mass of participants. Today most mobile solutions are just replacing a card form factor… this is NOT VALUE. I am currently placing my bets on solutions that merchants support (Square, Google, MCX, LevelUp, …) as this is a key “fault” of almost every other initiative.

Comments Appreciated (as always sorry for the typos…)