10 April

(Cool title…? You can tell I’m an engineer)

(Cool title…? You can tell I’m an engineer)

I was catching up on some reading this Easter weekend and saw one of my old MIT Technology reviews lying around. Article was on Nokia’s new CTO Henry Tirri (Dec 2011). Question came to mind: to what extent does technology influence Nokia’s future success? Is Apple’s current success built on technology? Of course, although any CTO’s job gets harder when their CEO is forming alliances that are 100% potential and 0% market traction…. Oh I forgot Elop also sold your own OS to Accenture so there is “no way back”. (For more background on Nokia/MSFT see this UK Guardian Article).

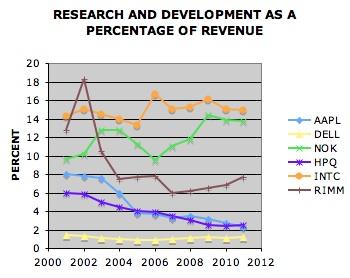

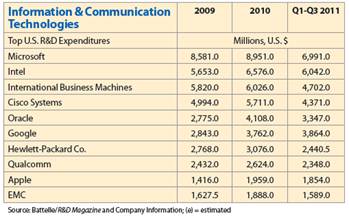

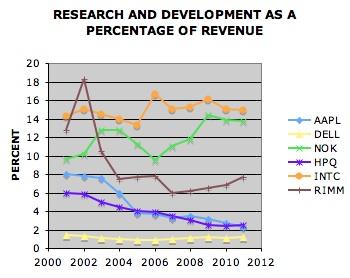

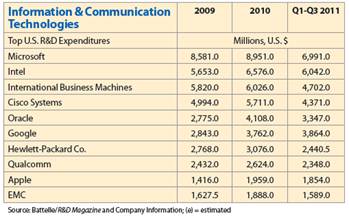

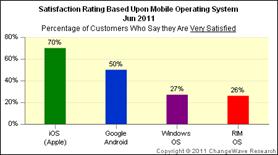

What factors will influence success in Mobile? Obviously it is not R&D, as Nokia’s 2.9B EUR ($3.8B) budget was roughly twice Apple’s $2B (see global 2012 R&D Spending report from Battale). Most would agree that Nokia lost in connecting the phone to the internet.. No amount of internal R&D could have led Nokia to build an equivalent network.. yet they did not fully realize the value that consumers could unlock … at least not much beyond e-mail. (RIM suffered from a similar myopia.. security vs usability locked into the corporate environment). Nokia’s R&D engineers thus toiled away with features they could control and build.. That is what engineers do.. Nokia thought the battle was in feature/function.. and hundreds of specialized designs for many global “segments”. However the consumer opportunity that Apple discovered was not in hardware, but rather in delivering new ways to connect consumers to all things digital… particularly networks (internet, home, social, entertainment, … and eventually office).

What factors will influence success in Mobile? Obviously it is not R&D, as Nokia’s 2.9B EUR ($3.8B) budget was roughly twice Apple’s $2B (see global 2012 R&D Spending report from Battale). Most would agree that Nokia lost in connecting the phone to the internet.. No amount of internal R&D could have led Nokia to build an equivalent network.. yet they did not fully realize the value that consumers could unlock … at least not much beyond e-mail. (RIM suffered from a similar myopia.. security vs usability locked into the corporate environment). Nokia’s R&D engineers thus toiled away with features they could control and build.. That is what engineers do.. Nokia thought the battle was in feature/function.. and hundreds of specialized designs for many global “segments”. However the consumer opportunity that Apple discovered was not in hardware, but rather in delivering new ways to connect consumers to all things digital… particularly networks (internet, home, social, entertainment, … and eventually office).

Will “Apps” be the key to unlocking the value of mobile?

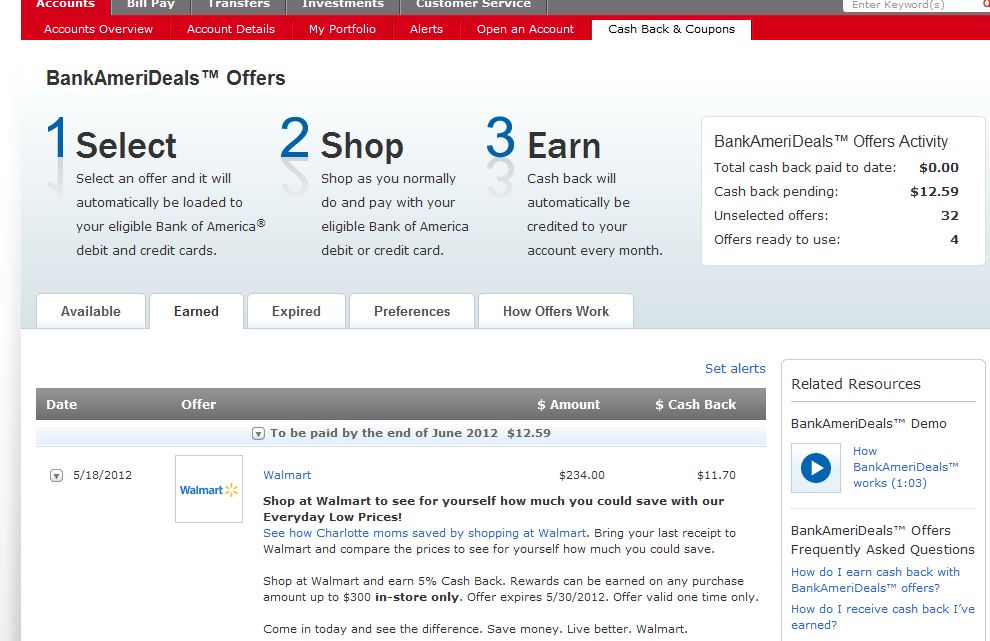

In the press last month, we saw the analysis by Flurry that Amazon is kicking Google’s rear in App store revenue (89%), and that Google itself makes 5x more on IOS than Android. Other recent research from groups like ABI Research reported that mobile app revenue was $8.5B with 39% due to in app purchases (Gartner says $15B). Personally I find both these numbers a little hard to believe, given Google’s Android revenue is $550M and Apple announced back in July that it paid developers $2.5B (cumulatively over life of AppStore). Best guess for Apple’s FY11 Appstore sales is somewhere around $1.6B (see my July Blog)

Total App Store ECOSYSTEM revenue from these Big 3 is therefore approximately

$1.6B + $1.42 (Amazon’s 89% of Apple’s) + $0.55B = $3.57B

Could it be possible that these big 3 contributed less than 50% of global App Revenue? Not likely (sorry Gartner/ABI). As an investor, I’m not keen on Apps as a long lived mobile environment outside of entertainment (subject of another blog). Suffice to say my view is that “apps” are only a temporary technology metaphor for connecting clusters, goods and data. Although not a fan of “apps” I am very grateful that the App environment exists, as it is driving much innovation within a “developer community” (per Platform). Having thousands of brilliant engineers from around the world work to deliver value benefits us all. Which brings me to the topic of distributed innovation.

Open/Distributed Innovation

Open Source is a model most of us are well familiar with. (further reading… I ran across a very nicely done paper from 2 MIT students: Implication of Open Innovation and Open source to Mobile Device Manufacturers). Given that mobile, advertising and payments are all networked businesses… it seems business models supporting distributed innovation will advance at a faster pace than those where only a single entity controls the entire product or supply chain. For example, Amazon, Samsung, Motorola, LG, HTC, Verizon, ATT, Vodafone, .. all make much larger investments in the Android platform (than in IOS). (I would love to see an analysis of combined capital investment in android platform)

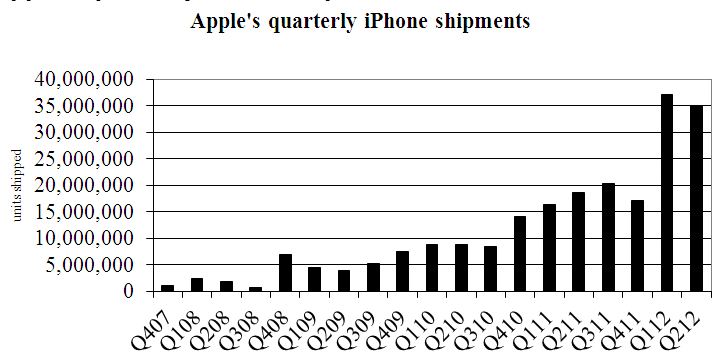

However, this distributed innovation hypothesis is NOT playing itself out (ie Apple). Apple’s 1Q12 showed iPhone revenue alone was $24.4B, which is bigger than all of MSFT revenue combined. Analysts have shown that Apple now garners 75% of mobile handset profits, with only 9% of handset market share. So while Samsung alone has outsold Apple in Units this quarter (41M vs. 32.6M), and Android just topped 50% market share (vs Apple’s 30.2%).. Apple’s handset business PROFITABILITY dwarfs that of all of the competition (COMBINED).

So… What are the factors of competition today? Can someone else change the game?

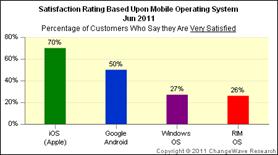

Most would agree that Apple has won through a focus on design and customer satisfaction. Nothing looks as good, or works as reliably as an iPhone. It brings a consumer’s digital life together; it is also the channel by which we stay connected when we are not at home.  Apple’s unique ability to control design and manufacturing quality has obviously provided many benefits (which customers have proven willing to pay a premium for).

Apple’s unique ability to control design and manufacturing quality has obviously provided many benefits (which customers have proven willing to pay a premium for).

The big downside in distributed innovation is complexity, there is a need for a “channel master” or chaos reigns. Many Android users witness this chaos when an app won’t work on a new hardware/OS combination.. Distributed innovation is not something that established businesses are good at. It has proven most successful in product PLATFORMS where the pace of change in each component is changing at a rate where no one company can make the capital investment to remain competitive (ex. Moore’s Law, PC architecture through present day). Intel played a very important role in this process, as it worked outside the scope of the CPU in areas such as: Intel Architecture Lab (IAL, developed common standards like PCI), stimulated external innovation (developer training, testing, Intel Capital), industry marketing, patent/licensing. Intel defined what the PLATFORM was.. something that is common sense to us today.. but rest assured it was not given to them, rather it was something that they stepped into and took leadership of.

As we look for where the form of mobile competition may change, it would seem to be outside: hardware, software and network bandwith. With respect to hardware, features have recently begun to surpass “good enough” . Samsung’s Galaxy Nexus is an excellent example of how focused hardware innovation has enabled them to surpass the iPhone’s capabilities. If hardware is good enough, and not the primary factor of competition, it must be software, services or data that will drive competition in the next phase…

If platform is decided on software only.. then software platform with most open standard and most users (ANDROID) should dominate as any connected devices (handsets and everything else) have lower cost and more ability to “specialize”, particularly if intelligence is in the network (not the device). But software is currently not the point of competition either… If not DEVICE software.. then what?

Stage 4 – Shift from Integrated Platform to Value Orchestration

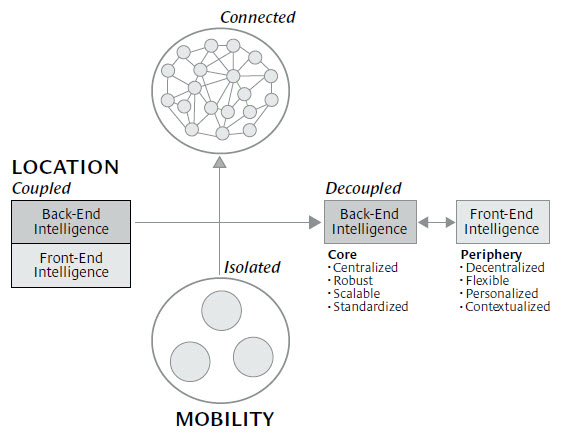

Keeping with the assumptions above: hardware becomes “good enough”, platform/software become “ubiquitous”, patents are widely shared (ok this is a joke.. checking if you were sleeping), and the mobile phone transforms into the networked device “bridging” the virtual and physical world then value (and profitability) will shift from platforms executing transactions to entities coordinating interactions. This interaction of entities is what I refer to as Value Orchestration, certainly not a concept I developed. A January 2001 Harvard Business Review Article: Where Value Lives in a Networked World put it this way:

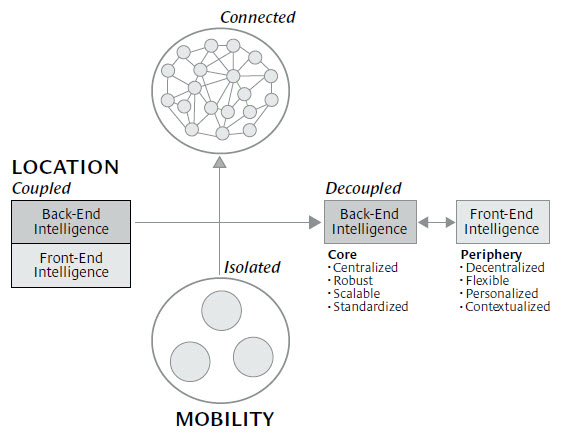

In more general terms, modern high-speed networks push back-end intelligence and front-end intelligence in two different directions, toward opposite ends of the network. Back-end intelligence becomes embedded into a shared infrastructure at the core of the network (cloud), while front-end intelligence fragments into many different forms at the periphery of the network, where the users are. And since value follows intelligence, the two ends of the network become the major sources of potential profits. The middle of the network gets hollowed out; it becomes a dumb conduit, with little potential for value creation. Moreover, as value diverges, so do companies and competition. …. In a connected world, intelligence becomes fluid and modular. Small units of intelligence float freely like molecules in the ether, coalescing into temporary bundles whenever and wherever necessary to solve problems.

This orchestration hypothesis seems to have proven itself in PCs as margin shifted away from the integrated manufacture to component “performance” differentiation (ex. peripheral price/performance) then again to software finally transforming again to orchestrators and “connected” businesses that orchestrate network value (like Amazon, Facebook and Google)…. as hardware evolves into a commodity like business.

The long term investor risk for Apple is that it will not be able to shift to a value orchestration role, and its handset business (while excellent) will no longer garner 75% of industry profits. Where will the high margin businesses develop? If we take a network view, opportunities to create value exist in interaction between clusters (ex. Retailer to consumer, Facebook community to Retailer) and within a cluster (ex Supply chain, healthcare , …etc.). Within this cluster matrix, l like to take a Clayton Christensen view: “what problems are there that the mobile phone can solve”? which each “opportunity” assigned 5 key measures:

1) TAM (Consumers, $ Volume, Growth, …)

2) Disruptive innovation measure – price/performance (ex. Mobile targeted advertising vs. Coupons)

3) Information Control. Who owns it, how is it obtained, accuracy, privacy, (impacts pricing power)

4) Key Alliances and stakeholders

5) Execution risk (ex. Compete with Facebook vs. Building a mobile application for a retailer)

Much of Value orchestration is dependent on data. Consumer data is highly fragmented in the physical world, do consumers/clusters want it consolidated? What are the benefits? Where is it stored (node or cloud)? The HRB quote above painted a picture where “small units of intelligence float freely like molecules in the ether, coalescing into temporary bundles whenever and wherever necessary to solve problems”. Perhaps it is my time as a senior director within Oracle that has ruined my views on data.. but if it floats freely …how on earth can anyone organize it? Doesn’t someone need a directory? for at least one side? How can intelligence be “self assembling” in business?

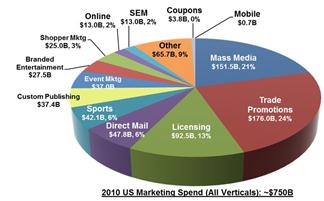

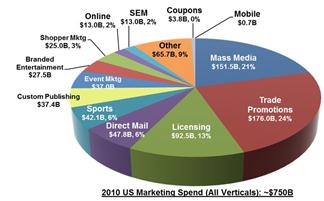

My firm belief is that we will start a mobile “boom” that will dwarf what we have seen with either the internet, PCs or the industrial revolution. How big? Will at the top of my list for calculating the basis of a “New Mobile” TAM is marketi ng.. With the US alone accounting for over $750B .. how much of that spend is targeted?

ng.. With the US alone accounting for over $750B .. how much of that spend is targeted?

Because mobile is at the intersection of both virtual and physical, the network is larger.. it touches every consumer, every business and every “cluster”… it is therefore many orders of magnitude more complex. In this dynamic environment, small companies are much better positioned to deliver “focused”, simple orchestrated solutions between clusters.

Examples of Cluster ochestration:

- Machine-machine interaction (mobile to open hotel room door)

- Person-Person interaction (health history, alergies to Doctor)

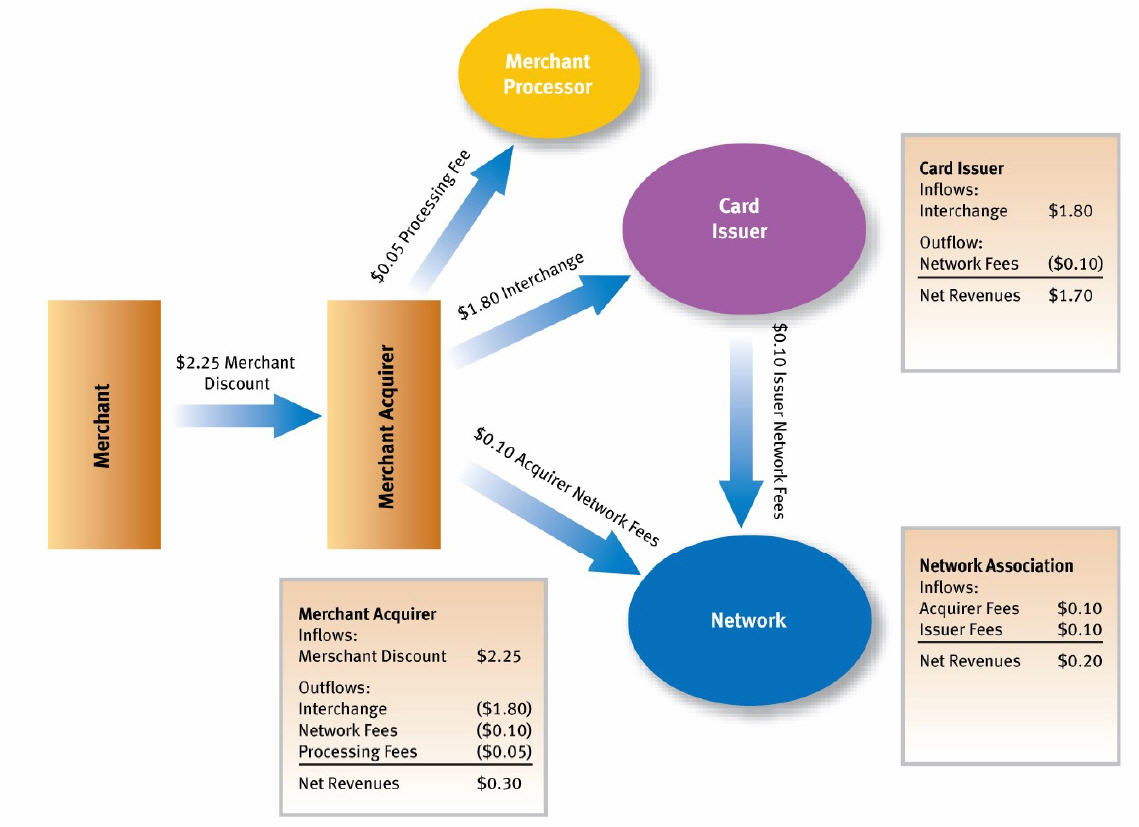

- Consumer-Retailer interaction (ex Mobile marketing in brick and mortar retail)

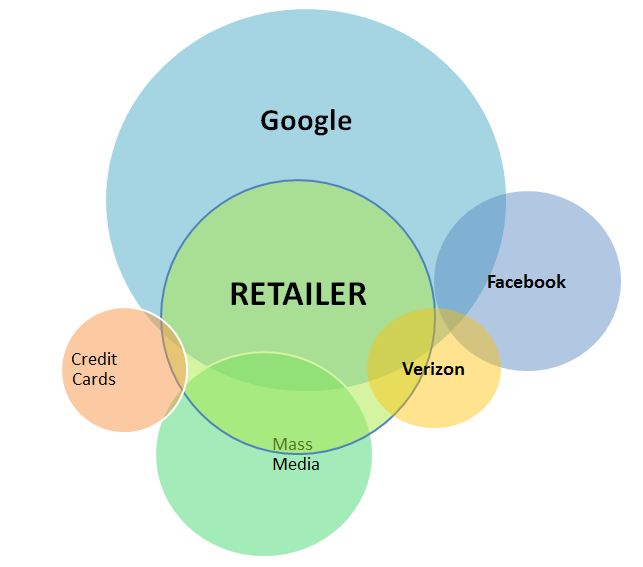

As intelligence develops, it will aggregate (ex Google/Facebook). I covered this topic back my December post Building Networks “The network forms around a function and other entities are attracted to this network (affinity) because of the function of both the central orchestrator and the other participants”. Given that each node and cluster is resource constained.. they maintain connections to a finite number of “efficient” orchestrators/networks. Early networks build very substantial momentum..

Summary

Wow.. this went on too long.. They say a blog over 2 min of reading is a looser.. hey.. you get what you pay for.

Given the mobile device’s unique ability to serve as a point of convergence between the virtual and physical world, a Stage 4 evolution will take place where handsets are cheap and ubiquitous and networks are high speed dumb pipes (both low margin businesses). This Stage may be the leverage point where Apple’s competitors gain differentiation. Perhaps if they had some cash.. and a few bright people they could respond. 🙂

There are certainly many scenarios where stage 4 could evolve from. Orchestration requires both back end “cloud” infrastructure and localized intelligence. Both entail a complex interaction of: data, distribution, platform, cluster relationships, business intelligence, control, regulation, trust, … to deliver value. Companies like Google, IBM, Oracle, Facebook… should be able to succeed in the central function. If any of them agree with this blog.. they should actively endeavor to build “interfaces” and standards by which small companies can deliver the localized intelligence.. much the way Facebook has started giving some access to data.

Sorry for size

Comments appreciated.

(Cool title…? You can tell I’m an engineer)

(Cool title…? You can tell I’m an engineer) What factors will influence success in Mobile? Obviously it is not R&D, as Nokia’s 2.9B EUR ($3.8B) budget was roughly twice

What factors will influence success in Mobile? Obviously it is not R&D, as Nokia’s 2.9B EUR ($3.8B) budget was roughly twice

Apple’s unique ability to control design and manufacturing quality has obviously provided many benefits (which customers have proven willing to pay a premium for).

Apple’s unique ability to control design and manufacturing quality has obviously provided many benefits (which customers have proven willing to pay a premium for). ng.. With the US alone accounting for over $750B .. how much of that spend is targeted?

ng.. With the US alone accounting for over $750B .. how much of that spend is targeted?