Summary

The digital asset ecosystem has graduated from a decade of speculative experimentation to a decisive phase of infrastructure modernization. For fifteen years, the discourse surrounding blockchain technology has been dominated by the volatility of crypto-assets, effectively obscuring the underlying utility of the technology. That era has concluded. We are now witnessing the industrialization of the sector, where stablecoins have emerged not as a new form of money, but as a fundamental settlement innovation (see blog).

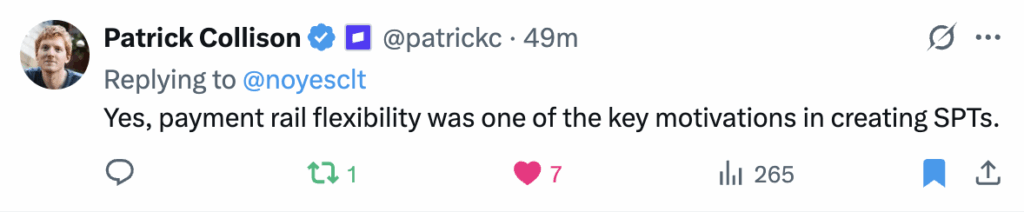

The GENIUS Act has provided the regulatory clarity required to transition stablecoins from the periphery of finance to its very core. This legislative milestone has catalyzed a geopolitical shockwave, prompting European finance ministers to declare U.S. stablecoins a greater threat to monetary sovereignty than trade tariffs. But while the Genius act codified “trust” in an instrument (reducing settlement risk to stablecoin issuer balance sheet), it does not address disputes and broader governance issues associated with managing participants across diverse processes and regulatory regimes.

The maturation of stablecoins is not a revolution that overthrows established banks and payments system; it is an evolution that upgrades it. The rails are being replaced while the train is moving, and those who understand the mechanics of the new tracks will determine the destination of global capital.