Riding on my blog Plaid and Decoupled Debit.. It looks like Plaid and Marqeta just created a new product with Affirm as the first customer.

Affirm Debit Card – https://www.affirm.com/debit

Riding on my blog Plaid and Decoupled Debit.. It looks like Plaid and Marqeta just created a new product with Affirm as the first customer.

Affirm Debit Card – https://www.affirm.com/debit

Updated 17 Nov

At Money2020 this week and I have to say I’m having a blast. Seeing friends face to face and getting back to “normal” was well worth taking my first plane flight in 20 months.

Visa Announces earnings today at 5pm, the big question institutional investors are asking me is about the Amazon – Visa discussions. It is a big game of chicken right now, with earnings ramifications. To understand whats going on here, let me attempt to give some abbreviated history.

As I sit down with my coffee this morning I’m asking myself what are the key questions to answer:

PayPal and Pinterest – Super Distraction?

What’s behind this deal?

PayPal needs

Thought I would give more detail on whats going on with V/MA, Issuers and Apple (from WSJ article yesterday Apple Pay Fees Vex Issuers). Perhaps I’ll collect a fee from the WSJ.. odd that I mention Apple Pay fees on Monday to have it come up in the WSJ on Tuesday. Oh well..

I was quite surprised to see the front page of my Saturday WSJ emblazoned with “Google Is Scrapping Its Plan to Offer Bank Accounts to Users”. As the former guy responsible for Citi’s online banks globally, and also a guy working in creation of the original Google Pay (as consultant), I thought I would provide some much needed clarity here (consistent w/ blog Google’s Bank Plans and the 20 others I’ve written on Google Pay over the last decade).

Most of you techie’s out there had a physics class at some point and can recall the Observer Effect in Quantum Physics: the act of observation can change the measured results. Observation in payments has become the second largest driver of margin and has enabled many new specialists…. so I thought I’d outline some broad thoughts and tell a few stories.

Why is observation important? Payment behavior is truth marked data of what a consumer actually did (offline). While I may search for Ferrari’s, or visit dealership (mobile location) what I actually bought is much more important in predicting behavior and evaluating risk. Purchase data is the most valuable data for that reason (and issuing banks had a lock on it.. Until about 5 yrs ago). The lock has been broken and payment data has become the “missing link” to unite heterogeneous data sets.

Quick thoughts on today’s announcement

This is a solid product.. Not a “super app” but perhaps the best mobile first bank in the US (and beyond). What is NEW?

PayPal has been my #1 holding for last 5 yrs, and it has been on a fantastic ride… especially so over the last 18 months! (see MVP – Continued Domination for more).

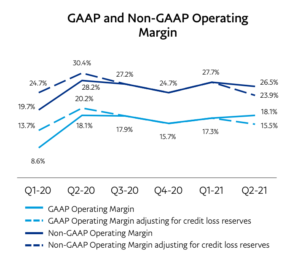

Paypal announced 2Q21 earnings 2 weeks ago (7.28). TPV growth was 40% with eBay, 48% without out, while sales grew at a 32% clip without  eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

eBay versus 19% with. Earnings? Not so much as margin erosion has hit the business. One core driver of margin has investors particularly concerned: “Take rate” (net merchant revenue less cost to clear payments) fell from 2.21% in the fourth quarter of 2020 to 2.11% in the first quarter and 2.01% in the second quarter.

From Bloomberg yesterday 16 July

Why is this a great thing for Square and DeFi?

#1 Today DeFi and Crypto in Commerce (POS and eCom) are in need of a “core” that can manage either compliance and connections to existing financial services, or operate in critical mass with minimal interaction to banks (ex – custody, exchange, platform, consortium-diem).