Tag Archives: visa

Controlling Wallets – Battle of the Cloud Part 3

MNOs giving away Billions to Banks.

Least Cost Routing – Part 1

2013: Payment Predictions – Updated

2 January 2013 (updated typos and added content on kyc, cloud, and push payments)

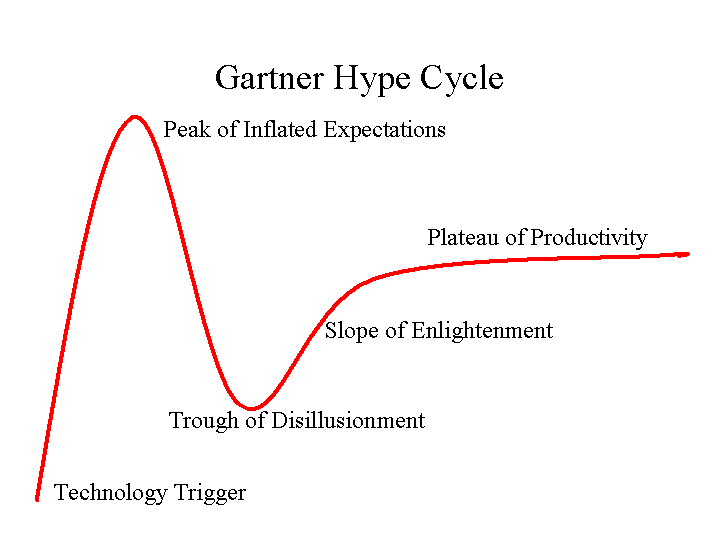

Looking back to my first “prediction” installment 2 years ago, 2011: Rough Start for Mobile Payments, not much has changed. Although I am personally approaching the “trough of disillusionment”. Lessons below are not exclusively payment (ie mobile, commerce, advertising) but seem relevant .. so I mashed them together. Key lessons learned for the industry this year:

- Payment is NOT the key component of commerce, but rather just the easiest part of a very long marketing, targeting, shopping, incentive, selection, checkout, loyalty … process. Payments are thus evolving to “dumb pipes”.

- Value proposition is key to any success for mobile at the POS. There are no payment “problems” today. None of us ever leave the store without our goods because the merchant did not accept our payment. There are however many, many problems in advertising, loyalty, shopping, selection, …

- There is no value proposition for the merchant or the consumer in NFC. NFC as a payment mechanism is completely dead in the US, with some hope in emerging markets (ie transit).

- 4 Party Networks (Visa/MA) can’t innovate at pace of 3 party networks (Amex/Discover). See Yesterday’s blog.

- Visa is in a virtual war with key issuers, their relationship is fundamentally broken. This is driving large US banks to form “new structures” for control of payments and ACH. Control is not a value proposition.

- US Retailers have organized themselves in MCX. They will protect their data and ensure consumer behavior evolves in a way which benefits them. Key issues they are looking to address include bank loyalty programs, consumer data use, consumer behavior in payment (they like chip and PIN but refuse to support contactless).

- Card Linked Offers (CLO) are a house of cards and the wind is blowing. Retailers don’t want banks in control of acquisition, in fact retailers don’t spend much of their own money on marketing in the first place. Basket level statement credits don’t allow retailers to target specific products and it also dilutes their brand without delivering loyalty. Businesses want loyalty… Companies like Fishbowl and LevelUp are delivering.

- Execution. This may be subject of a future blog… Fortune 50 organizations, Consortiums, Networks, Regulated Companies all share a common trait: they are challenged to execute. Put all of these groups together (

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus.

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus. - In a NETWORKED BUSINESS, it’s not enough to get the product right. You must also get retailers, consumers, advertisers, platform providers, …etc. incented to operate together. Today we see broken products and established players throwing sand in the gears of everyone else in order to protect yesterday’s network. Fortune 50 companies have shown poor partnership capabilities. Their strategies are myopic and self interested. For example Banks DO NOT DRIVE commerce, but support it. Their “innovation” today is self serving and built around their “ownership” of the customer. Commerce acts like a river and will flow through the path of least resistance. There can only be so many damns… and they will be regulated.

- The Valley and “enterprise” startups. There are billions of dollars to be unlocked at the intersection of mobile, retail, advertising, social. Most of the value requires enterprise relationships. Most investment dollars have flowed to direct to consumer services. I expect this to change.

- Consumer Behavior is hard to change, particularly in payments, it normally follows a 20 yr path to adoption. For example, in every NFC pilots through 7 countries we saw a “novelty” adoption cycle where consumer uses for first 2 months then never uses again. My guess is that there are fewer than 1-2 thousand phone based NFC transactions a week in the entire US. (So much for that Javelin market estimate of $60B in payments).

- Consumer Attention. Who can get it? They don’t read e-mails, watch TV adverts, click on banner ads. My view is that the lack of attention is due to a vicious cycle relating to relevant content and relevant incentives.

- Hyperlocal is hard. The Groupon model is broken, CLO is broken.. Large retailers have a targeting problem AND a loyalty problem. Small retailers have a larger problem as the have no dedicated marketing staff. Their pain is thus bigger, but selling into this space requires either a tremendous sales team or a tremendous brand (self service).

- My favorite quote of the year, from Ross Anderson and KC Federal Reserve. [With respect to payment systems].. if you solve the authentication problem everything else is just accounting.

Predictions

Here are mine, would greatly appreciate any comments or additions.

- Retailer friendly value propositions will get traction (MCX, Square, Levelup, Fishbowl, Google, Facebook, …)

- MCX will not deliver any service for 2 years, but individual retailers will create services that “align” with principals outlined by MCX (Target Redcard, Safeway Fastforward, …etc). The service which MCX should build is a Least Cost Routing Switch to enable the most efficient transaction across payment “dumb pipes”. This will enable merchants who want to take risk on any given customer the ability to do so..

- Banks will build yet another consortium in an attempt to control payments. They will work to “protect consumers” by hiding their account information and issue “payment tokens”. I agree with all of this, yet this is a very poorly formed value proposition and Banks will find it hard to influence consumer behavior.

- We will see more than one bank start a pilot around Push Payments (see blog).

- Facebook and Google will gain significant traction in mobile ad targeting…. following on to targeted incentives… which will lead to mobile success. Bankers, please read this again.. success in mobile will begin with ad targeting and incentives. Payments are an afterthought…

- Retailers at the leading edge will begin to see that their consumer data asset is of greater value than their core business.

- Banks will follow Amex’s lead in creating dedicated data businesses. What is CLO today will morph into retailer analytics, offers and loyalty.

- Apple will put NFC in their iPhone.. but usage is focused on device-device communication… not payment. NFC will be just another radio in the handset, there will be multiple SEs with the carriers owning a SWP/SIM based one.. and the platform provider managing the other. Which will succeed? A: the group that can best ORCHESTRATE value across 1000s of companies.

- Visa will lose a top 5 issuer to MA, and they will see a future where their debit revenue is gone (in the US) as MCX and bank consortiums take ownership of ACH and PIN debit.

- We will see 100s of new companies work to create new physical commerce experiences that include marketing, incentives, shopping, selection. Amazon is the driving force for many, as retailers work to create a better consumer experience at competitive price.

- Chaos in executive ranks. Amex, Citi, MCX, PayPal, Visa all have new CEOs.. all will be shaking up their payment teams.

- Retail banking is going through fundamental change. Bank brands, fee income and NRFF are declining, big dedicated branches will be replaced by more self service. Mass market retail will see significant leakage into products like pre-paid. Retailers and Mobile Operators are better able to profitably deliver basic financial services, to the mass market, than banks…. see my Blog Future of Retail: Prepaid.

- Unlocking the Cloud… and Authentication. KYC is a $5B business. Look for mobile operators to build consumer registration services that will tie biometrics with phone. Digital Signatures on contracts, payment through biometrics, .. all will be possible in a world without plastic. Forget NFC… See previous Blog on KYC and Cloud Wallets.

V.me: Issuers please give me your customers

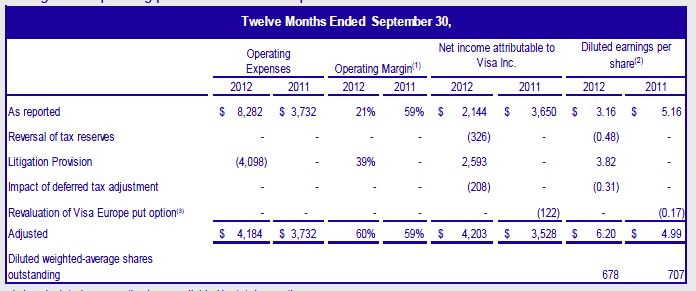

Visa is an independent for profit company… they are on a tear with adjusted earnings up over 19% and the stock up over 40% for the year. Who are Visa’s customers? They are a network, created by banks.. but they only set rules.. historically they don’t have direct relationships with merchants or consumers; the issuing bank owns the consumer, and the acquiring bank owns the merchant. Their primary customer is therefore banks (issuing and acquiring).

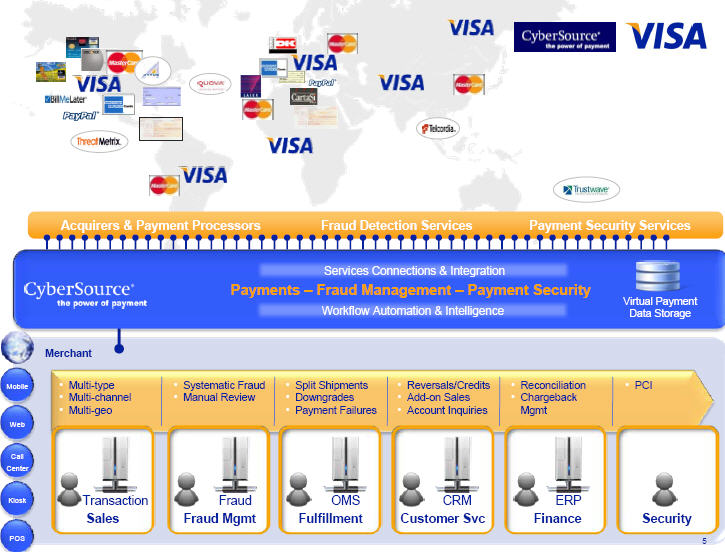

With the CYBS purchase, Visa gained direct merchant relationships. CYBS at one time handled over 25% of eCommerce transactions. The “big 3” in online merchant services are now eBay (Paypal+GSI), Visa (CYBS) and Amazon. Visa is looking for ways to expand its network, services and revenue base. The expansion is very hard to do if you are dependent on your member banks, hence Visa is looking to establish a direct consumer touchpoint in line with Cybersource’s merchant capability.

In my very first blog (2009 Googlization of Financial Services), I outlined both the alert service that Clairmail built for Visa, and the advertising/offer engine they had put in place. Neither the alert service nor the ad service had taken off as issuers were not exactly thrilled with expanding Visa’s services or opening the door to Visa’s efforts to communicate directly to consumers. Clairmail has since been acquired by Monitise ($173M in March 2012). Monitise is the entity that build “Visa Offers” and initially was “the mobile horse” which Visa intended to ride … until they upgraded to Fundamo. Now Monitise seems to be focused on the offers product… (See Visa Mobile Strategy). Visa wants to get into the card linked offers business (Visa Offers, FreeMonee, Monitise,…), and has had the technology working for sometime, they also want to get into the wallet business. (see Battle of the Cloud)

Neither of these services are to the best interest of issuers, which is why we see a hodgepodge of small banks without the resources to properly digest the strategic impact, or build the technology themselves in this recent V.me “50 bank pilot”. Let me be crystal clear on what I believe Visa’s strategy is:

- establish direct consumer service

- start with eCommerce (autofill) functionality to speed checkout and improve conversion

- add alerts to give consumers knowledge of card transactions

- add incentives/offers in 18 months (they already have built the service)

This is why Visa hates the Google service.. it steps all over their plans online.. as well as at POS (not in scope for this blog).

Take a look at V.me terms and conditions. They have done a great job in obfuscating their strategy in this document, as it clearly states that issuers have control

These Terms do not amend or otherwise modify the cardholder agreement or any other terms and conditions of your Issuer. In the event of any inconsistency between these Terms and your cardholder agreement with your Issuer, these Terms govern as to the relationship between you and Visa solely with respect to V.me and your cardholder agreement with your Issuer governs as to the relationship between you and your Issuer. You are responsible for ensuring that your use of the Services complies with your cardholder agreement with your Issuer.

Visa Alerts is the service where banks should start to become concerned. For the first time, visa is creating a list of consumer names, emails (above) and mobile phone numbers. Alerts will start with card usage, and then they will morph into incentives and offers based on spending patterns. These incentives will be offered completely separate from the issuers. In the V.me privacy policy “We share some information, but not your full card number, with merchants you pay with V.me” and “We may contact you about your V.me account, service updates, and new V.me features”.

I’ve got news for the V.me participating banks.. why don’t you just give Visa your customer list and give them permission to use it as they want? You have just given Visa much more.. They can now act on transactions they see on the switch.

I see Visa quickly expanding the service beyond eCommerce to physical commerce primarily around offers and alerts. You will be able to redeem offers across any card stored in your V.me wallet. This means that V.me will work without eCommerce merchant adoption… and could be a stand alone offers platform. Of course they don’t want to lead with this… but it is indeed where Visa sees the best margin.

Banks.. get serious about this. Why would you want to let Visa step all over your brand and start delivering services to consumers directly? This is the start of a major tipping point for Visa… the Top issuers are fuming… but Visa may be able to build consumer adoption ahead of banks pulling the plug on it.

There is certainly no reason to worry.. take a look at the participating merchants https://www.v.me/shopping/ not exactly a whose who of online merchants. Why is this? well my merchant friends are also aware of Visa’s efforts to do the incentive business and the last thing they want is another entity switching consumers to the lowest cost provider. V.me on an eCommerce perspective is fine.. but what Visa doesn’t realize is that Google, Paypal an Amazon all have this today. (ex Google has autofill in Chome browser and Android…). If Visa has trouble signing up its own CYBS merchants.. what issues do you think they will have in signing up with those on GSI?

EMV Battle Impacts Mobile Payments

20 September

Most of everyone knows of the EMV efforts in the US, with Visa implementing a liability shift on October 1, 2015. In this model, any merchant that is presented with a chip and pin card, but is not capable of processing it (as an EMV), will bear fraud loss. There have been very BIG swings in strategy over the last 6-8 months. The big issuers were all dead set against EMV.. saying they could not afford the cost to re-issue. Now all are on board… why? This is what I’m thinking about  today….

today….

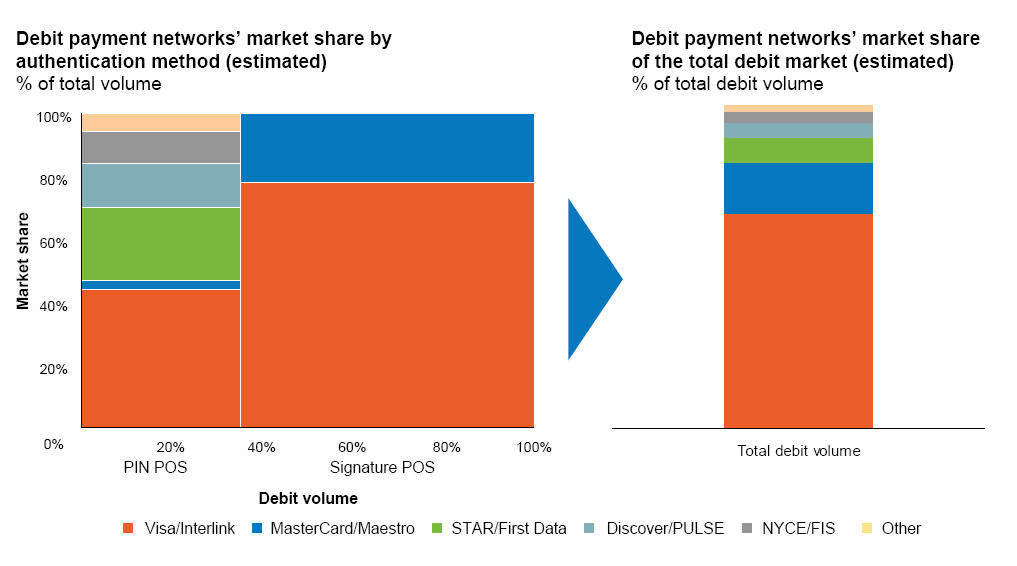

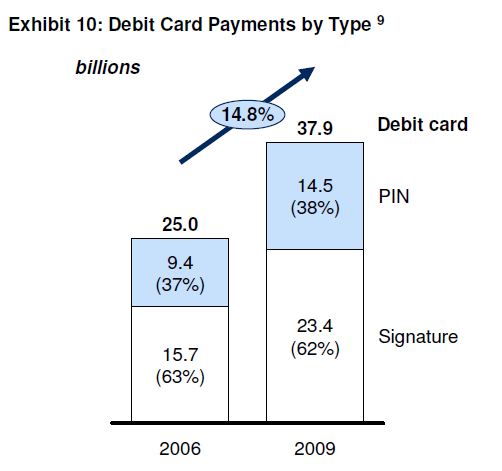

Merchants have always loved PIN Debit (see blog). PIN was the cheapest transaction type prior to Durbin, and post Durbin PIN still has the unique advantage of allowing the merchant to route without going to Visa at all. Remember PIN Debit leniage was from ATM networks. Merchants also like the fact that 96% of PIN Debit fraud losses are assumed by issuers..

Visa/MA hate PIN Debit.. the countries where it has taken off like Canada-Interac, Australia EFTPOS, China Union Pay… have domestic clearing networks. This means that transactions are no longer routed through Visa/MA. In the US we have 8 debit networks (see blog). It makes little sense to continue all of these separate PIN debit networks if merchants can route directly to banks… The banks were thus looking at consolidation similar to what was done in countires above. In other words, banks were planning to take Debit back from Visa/MA in a bank owned network. After all, Bank margin improves in the PIN model (post Durbin) when payments are routed directly to them (they don’t pay a network fee ~10 bps).

Visa read the tea leaves… So how can Visa/MA stop the bank and merchant love affair w/ PIN? Force EMV…

The Merchant Stick? How will Visa “force” merchant’s to accept contactless? (See Visa Document)

Domestic and cross-border counterfeit liability shift. Merchants that cannot accept an EMV or contactless card when presented one by a customer will bear the liability of a fraudulent transaction instead of the issuer after October 1, 2015.

The Merchant “Carrot”? Visa TIP program

TIP program allows merchants to be excused from validating their PCI DSS compliance for any year that at least 75 percent of their Visa transactions come from chip-enabled point-of-sale terminals. There are also subsidies for terminal upgrades … To qualify, terminals must be enabled to support both EMV contact and contactless chip acceptance, including mobile contactless payments based on NFC technology. Contact chip-only or contactless-only terminals will not qualify for the U.S. program

Visa’s effort to include contactless in the TIP program is very strategic. To gain the benefits of TIP, merchants must reterminalize with both contact and contactless EMV capability. Why? Well for one reason there are no contactless debit cards out there… yes everything is a credit card. These of course carry much higher fees… The other advantage of TIP is that the PCI-DSS wavier is like a “get out of jail free” card. Merchants can’t get the card without contactless… If this weren’t enough… not only does VISA want contactless.. they also want signature.

Visa says PIN not necessary – Green Sheet

“There’s a lot of confusion around the myth that EMV means ‘chip-and-PIN,'” Stephanie Ericksen, Visa Head of Authentication Product Integration, said in a blog published Jan. 13, 2012. “It doesn’t in many countries, including the U.S. That’s because, in the U.S., we can rely on online processing where transactions are transmitted in real time to the issuer for approval. With that in place, there’s no need for the offline authentication that was the genesis of chip-and-PIN.

From Chip and PIN to Chip and Choose? Visa wants encourage signature as these transactions must be routed through them.. my position (and that of most non network people) is that AUTHORIZATION and AUTHENTICATION are completely different problem sets. The availability of real time approval means nothing if you don’t know WHO you are approving for WHICH CARD. PIN answers the “who” question and the chip is the account number or “how” you are going to pay. I just can’t believe that Visa has come up with this story.. but they must in order to support “contactless”. Most consumers don’t know that today contactless transactions have limits. These limits are set by the issuer, in Europe they are typically around $25. However the issuer can choose to increase the limit (no PIN required), or require a PIN with a contactless payment. All of this is a little absurd for Visa as PIN is always viewed as key to authentication, AND Visa just waved the signature requirement for mobile payments. So no signature required for Square.. but Visa wants it optional at the merchant POS so it can retain the volume?…. Expect some Regulatory involvement here.

Large Merchants are very, very aware of this strategy to improve the credit transaction mix and make mobile/contactless payments a “premium” service. The top 20 retailers have put their foot down and said “no way” will we be putting contactless readers in our store (MCX members particularly). The terminals that they are ordering DO NOT have contactless capabilities.. only EMV chip and PIN. Most retailers agree that signature is a worthless authentication mechanism. Visa clings to signature in order to ensure transactions are routed through them. Expect MCX to look toward a PIN model..

So this EMV “battle” has many sides to it.. it impacts mobile payment adoption, EMV rollout, plastic re-issuer, consumer behavior, consolidation of national PIN debit networks, …

Comments appreciated.

Interpreting Square-Starbucks Deal

18 August

From Press Release, key deal points are:

- Customers will be able to use Pay with Square, Square’s payer application, from participating company operated U.S. Starbucks stores later this fall, and find nearby Starbucks locations within Square Directory;

- Square will process Starbucks U.S. credit and debit card transactions, which will significantly expand Square’s scale and accelerate the benefits to businesses on the Square platform, especially small businesses, while reducing Starbucks payment processing costs;

- Using Square Directory, Starbucks customers will be able to discover local Square businesses — from specialty retailers to crafts businesses — from within a variety of Starbucks digital platforms, including the Starbucks Digital Network and eventually the Starbucks mobile payment application;

- Starbucks will invest $25 million in Square as part of the company’s Series D financing round;

- Starbucks chairman, president and CEO Howard Schultz will join Square’s Board of Directors

My interpretation: Starbucks is selling their customer base to Square for a revenue share and an equity upside.

- Square is buying the Starbucks payment user base, with all stored “reload” cards. This customer directory will move from Starbucks to Square and support both legacy Starbucks payment and enable all Starbucks customers to be “PaybySquare” capable with acceptance of new terms. Square is “processor” in the sense that it is now responsible for pre-paid balance and reload.

- Its about DATA.. payments will be free (for Starbucks), and SBUX hopes to enable Square incentives that are BOTH loyalty and line item based. Square’s driver is to find a way to monetize Starbuck’s payment and location data before it gets to Chase PaymentTech. This means increasing consumer network so that it can make better case to prospective merchants.

My guess is that Square is processing payments at no costStarbucks is paying a lower overall cost for payment acceptance through Square/ChasePaymentTech for all existing Starbucks customers, and will actually PAY Starbucks (revenue share) for any ad revenue they can generate from Starbucks customers. There are 3 consumer transaction tranches: Starbucks mobile payment, Starbucks card, and Pay with Square (Square Register). All will go through Square so they can use the data. - Starbucks will start to roll out a new service: SquareRegister (pay by voice, see my previous blog). This will eventually replace the bar code if all things go well. Again, my belief is that Square will bear all of the cost here.

Revenue implications?

Short term there is no revenue upside for Square in this deal, it is about growing network (primarily on consumer side). Starbucks will see costs decline slightly and open up a new revenue channel by monetizing its consumer network outside of its stores. I have some thoughts on precise numbers, but making my own bets right now so I can’t share them.

Retailers Discourage Credit Cards

9 July 2012

WSJ Article Today: Price of Plastic Going Up?

Merchants may soon begin to impose a surcharge each time a customer pays with credit card, a practice Visa Inc. and MasterCard Inc. currently prohibit…. [But provision will likely go away as part of impending settlement].

The “accept all cards” rule is likely to undergo a huge change, with implications for Visa/MA earnings, new retailer led payment networks, mobile wallets, issuer loyalty programs, EMV reissue, and “new products” (ex. Instant credit, pre-paid, decoupled debit, …).

Take a look at this excellent GAO Report to gain detailed insight into the battle being fought.

Several of the large merchants that we interviewed attributed their rising card acceptance costs to customers’ increased use of rewards cards. Staff from these merchants all expressed concerns that the increasing use of rewards cards was increasing merchants’ costs without providing commensurate benefits. For example, one large merchant provided us with data on its overall sales and its card acceptance costs. Our analysis of these data indicated that from 2005 to June 2009, this merchant’s sales had increased 23 percent, but its card acceptance costs rose 31 percent. Rewards cards were presented as payment for less than 1 percent of its total sales volume in 2005 but accounted for almost 28 percent of its sales volume by June 2009.

This will have an impact on Visa’s volumes if card issuers don’t start immediately renegotiating the rates with the top retailers. This taken together with Durbin (see previous blog), retailer driven payment networks (ex See Target RedCard), Retailers acting as banks (see GDot/WMT), Google/PayPal at POS (as MSBs), Pre-paid cards, …etc. We have a VERY exciting time in payments that the banks will be challenged in responding to.

Why will this impact Visa’s US volumes? Well if signature debit it dead, consumers will use PIN debit (just like Canada and Australia). In the Post Durbin world, Retailers don’t have to route PIN debit transactions through Visa at all. If retailers aggressively reprice credit card transactions (adding fee of 1-2%) we will have consumers shift spend back to debit.. a PIN debit… This also is happening at a time when consumers aren’t exactly fond of banks and fees. If the top 20 US retailers add fee to credit card use, this could impact Visa’s growth buy 2-6% in 2 years. The main dependencies here are Issuer’s ability to lower interchange for these retailers and survival of Signature debit (over bank controlled PIN Debit).

Certain merchants obviously benefit from access to ubiquitous consumer credit facilities, and these merchants are unlikely to add on any fee. But retailers in non-discretionary and low margin segments will likely move aggressively to stem the growth of loyalty driven credit card use. I would also expect retailers to add lower cost payment options, instant credit (ex paypal’s BillMeLater) and new products which may replace some of the “lost” loyalty benefits (ex Target RedCard).

I maintain that Banks have the facilities to win in payments (see blog).. but winning is more than leveraging your user base and ubiquity to extract tolls from merchants.. and more about delivering value. Unfortunately Banks are working to restrict growth of new payment mechanisms by enhancing control points (ie ACH) .. they have seen this coming and are looking to lock any door they can. If you lock the door.. someone will just jump through the window.

BIG winners if there is a settlement on passing credit card costs:

- Payment service providers not dependent on credit, or offering alternative PayPal, Google, Square,

- Instant Credit

- Retailer Led payment networks

- Pre-paid,

- PIN Debit

Loosers:

- Anyone dependent on a credit card (NFC, issuers, loyalty, …).

For my mobile friends.. this may give you additional context on why many merchants don’t accept NFC?

The Directory Battle PART 1 – Battle of the Cloud

11 May 2012

This week we had both Finnovate and CTIA going on, and behind the scenes the battle lines are being formed in a forthcoming “BATTLE OF THE CLOUD” wallet. I didn’t include wallet in the quote because Battle of the Cloud sounds so much more ominous. Perhaps I should take a page from George Lucas’ playbook and start with Chapter 4.

I’ve been talking about the directory battle for some time now (see Clearxchange post). Who keeps the directory of consumer information? As I outlined in Digital Wallet Strategies: “ securing information AND giving Consumers the exclusive ability to control what is shared with whom is a challenge (beyond technology and trust). We thus have many limited “Wallets” that are constructed around specific purposes”.

This week we had Visa’s President tell the CTIA audience that Visa has moved beyond NFC to V.me (see my previous post on Visa Wallet). What is really going on? What is the battle of the cloud?

Square, Visa, Google, PayPal, Apple, Banks, … have recognized the absurdity of storing your payment instruments in multiple locations. All of us understand the online implications, Amazon’s One Click makes everything so easy for us when you don’t have to enter your payment and ship to information. (V.me is centered around this online experience). Paypal does the same thing on eBay, Apple on iTunes, Rakutan , …etc. But what few understand is the implication for the physical payment world. This is what I was attempting to highlight with PayPal’s new plastic rolled out last week (see PayPal blog, and Target RedCard). If all of your payment information is stored in the cloud, then all that is needed at the POS is authentication of identity (see blog). Remember US online commerce is $170B/yr, physical commerce is $2.37T (not including FS, Travel/Entertainment).

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives (new digital coupons). Another example is Paypal’s ability to selectively assume settlement risk on some transactions as they route through low cost ACH, or even allow customers to use BillMeLater to selectively convert certain purchase to loans AFTER THE FACT. In these 2 examples, traditional payments revenue will be significantly disrupted by: lower cost transactions, competitive credit terms (each purchase), and incentives tied to payment type.

But do consumers really want to store all of their information in one place? With one entity given the ability to see all of your spend? For an mCommerce transaction, there is nothing I hate more than having to type in my name, address and card number in that tiny little screen. Most of these mCommerce solutions (like V.me) are little more than an “autofill” where the merchant checkout page leverages API integration to the cloud service to retrieve user information (see diagram here). If I’m on my phone, my carrier already knows who I am, so seems fairly logical for them to help me with the autofill. This is a reason I’m now a big fan of Payfone. I could also see why it makes sense for Apple and Google. But why Visa? Does it make any sense at all for Visa to hold my Amex card? Oh.. let me cast a few more stones on ISIS/NFC.. that payment instrument that locked in your phone.. yeah it can’t be used for the online purchase. Perhaps someday someone will write a secure NFC mobile browser plug in to extract data from the SE.. but that opens up a whole new can of worms.

Today’s online merchants are getting a very small taste of the war as they are asked to integrate auto-fill plug ins (Paypal, V.me/CYBS, Payfone, Google, soon to be Apple). Merchants should get on board with all of them, as they do represent a tremendous improvement in customer experience, and you may be able to squeeze some free marketing/implementation money from each of them. However, the cloud battle at the physical POS is still a few years off, as existing card products have a substantial advantage in risk modeling/fraud. This is where Square is taking a lead, as it has the best consumer experience hands down. Low volume merchants really should assess whether they need a specialized POS system, as the parameters for selecting one have shifted from ISO/Processor/Cost/Acct Recon/Book Keeping to Sales, incentives and customer experience.

Battle starts in mCommerce/eCommerce

My guess on timing of V.me is driven by knowledge of Apple’s impending plans to “extend” its iTunes account to payment outside of the Apple ecosystem. Visa sees this network risk and is in an all out war to protect its network, by leveraging its CYBS asset online. The banks have worked on a directory concept for quite some time. The Clearing House (TCH) built a working system called UPICK to solve the problem of consumers giving their RTN/ACCT# out in the open.. assigning a virtual number to the account. A sort of “virtual account number” that could only be translated by TCH. It never took off, because ACH fraud was low and banks were much more excited about having merchants accept cards as payment.

Retailers are not silent participants to this war.. their champions are Target, Tesco, Amazon, and Rakutan. I hope Amazon will finally dust the plans off of One Click expansion. Other retailers are also aligning to assess creation of shared cloud infrastructure. Sorry I can’t comment more. Similarly MNOs are also in the cloud game, for example Payfone may be one of the best services in the market..

Who are the players in the Cloud [Payments] War?

The initial battle will be in mobile/online purchases.

- Banks: V.me, Mastercard,

- Platforms: Apple, Google, PayPal

- Retailers: Amazon, Rakutan,

- MNOs: Payfone, Boku, payforit, billtomobile, …

Most confusing is that there are few alliances.. it is many against many.

http://tomnoyes.wordpress.com/2011/10/26/apples-commerce-future-square/