Tag Archives: google

MNOs giving away Billions to Banks.

Business Implications of Payment Tokens

2013: Payment Predictions – Updated

2 January 2013 (updated typos and added content on kyc, cloud, and push payments)

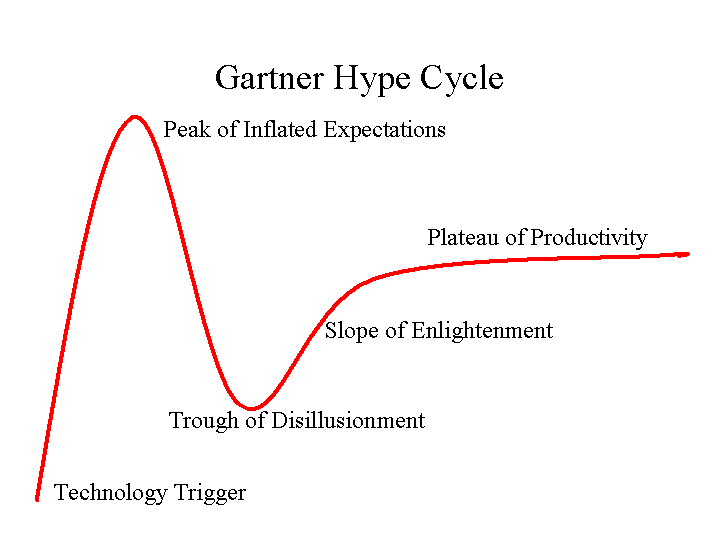

Looking back to my first “prediction” installment 2 years ago, 2011: Rough Start for Mobile Payments, not much has changed. Although I am personally approaching the “trough of disillusionment”. Lessons below are not exclusively payment (ie mobile, commerce, advertising) but seem relevant .. so I mashed them together. Key lessons learned for the industry this year:

- Payment is NOT the key component of commerce, but rather just the easiest part of a very long marketing, targeting, shopping, incentive, selection, checkout, loyalty … process. Payments are thus evolving to “dumb pipes”.

- Value proposition is key to any success for mobile at the POS. There are no payment “problems” today. None of us ever leave the store without our goods because the merchant did not accept our payment. There are however many, many problems in advertising, loyalty, shopping, selection, …

- There is no value proposition for the merchant or the consumer in NFC. NFC as a payment mechanism is completely dead in the US, with some hope in emerging markets (ie transit).

- 4 Party Networks (Visa/MA) can’t innovate at pace of 3 party networks (Amex/Discover). See Yesterday’s blog.

- Visa is in a virtual war with key issuers, their relationship is fundamentally broken. This is driving large US banks to form “new structures” for control of payments and ACH. Control is not a value proposition.

- US Retailers have organized themselves in MCX. They will protect their data and ensure consumer behavior evolves in a way which benefits them. Key issues they are looking to address include bank loyalty programs, consumer data use, consumer behavior in payment (they like chip and PIN but refuse to support contactless).

- Card Linked Offers (CLO) are a house of cards and the wind is blowing. Retailers don’t want banks in control of acquisition, in fact retailers don’t spend much of their own money on marketing in the first place. Basket level statement credits don’t allow retailers to target specific products and it also dilutes their brand without delivering loyalty. Businesses want loyalty… Companies like Fishbowl and LevelUp are delivering.

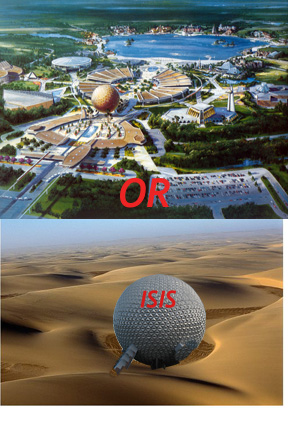

- Execution. This may be subject of a future blog… Fortune 50 organizations, Consortiums, Networks, Regulated Companies all share a common trait: they are challenged to execute. Put all of these groups together (

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus.

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus. - In a NETWORKED BUSINESS, it’s not enough to get the product right. You must also get retailers, consumers, advertisers, platform providers, …etc. incented to operate together. Today we see broken products and established players throwing sand in the gears of everyone else in order to protect yesterday’s network. Fortune 50 companies have shown poor partnership capabilities. Their strategies are myopic and self interested. For example Banks DO NOT DRIVE commerce, but support it. Their “innovation” today is self serving and built around their “ownership” of the customer. Commerce acts like a river and will flow through the path of least resistance. There can only be so many damns… and they will be regulated.

- The Valley and “enterprise” startups. There are billions of dollars to be unlocked at the intersection of mobile, retail, advertising, social. Most of the value requires enterprise relationships. Most investment dollars have flowed to direct to consumer services. I expect this to change.

- Consumer Behavior is hard to change, particularly in payments, it normally follows a 20 yr path to adoption. For example, in every NFC pilots through 7 countries we saw a “novelty” adoption cycle where consumer uses for first 2 months then never uses again. My guess is that there are fewer than 1-2 thousand phone based NFC transactions a week in the entire US. (So much for that Javelin market estimate of $60B in payments).

- Consumer Attention. Who can get it? They don’t read e-mails, watch TV adverts, click on banner ads. My view is that the lack of attention is due to a vicious cycle relating to relevant content and relevant incentives.

- Hyperlocal is hard. The Groupon model is broken, CLO is broken.. Large retailers have a targeting problem AND a loyalty problem. Small retailers have a larger problem as the have no dedicated marketing staff. Their pain is thus bigger, but selling into this space requires either a tremendous sales team or a tremendous brand (self service).

- My favorite quote of the year, from Ross Anderson and KC Federal Reserve. [With respect to payment systems].. if you solve the authentication problem everything else is just accounting.

Predictions

Here are mine, would greatly appreciate any comments or additions.

- Retailer friendly value propositions will get traction (MCX, Square, Levelup, Fishbowl, Google, Facebook, …)

- MCX will not deliver any service for 2 years, but individual retailers will create services that “align” with principals outlined by MCX (Target Redcard, Safeway Fastforward, …etc). The service which MCX should build is a Least Cost Routing Switch to enable the most efficient transaction across payment “dumb pipes”. This will enable merchants who want to take risk on any given customer the ability to do so..

- Banks will build yet another consortium in an attempt to control payments. They will work to “protect consumers” by hiding their account information and issue “payment tokens”. I agree with all of this, yet this is a very poorly formed value proposition and Banks will find it hard to influence consumer behavior.

- We will see more than one bank start a pilot around Push Payments (see blog).

- Facebook and Google will gain significant traction in mobile ad targeting…. following on to targeted incentives… which will lead to mobile success. Bankers, please read this again.. success in mobile will begin with ad targeting and incentives. Payments are an afterthought…

- Retailers at the leading edge will begin to see that their consumer data asset is of greater value than their core business.

- Banks will follow Amex’s lead in creating dedicated data businesses. What is CLO today will morph into retailer analytics, offers and loyalty.

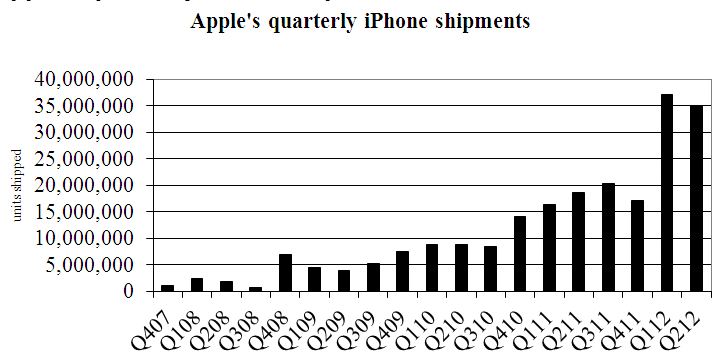

- Apple will put NFC in their iPhone.. but usage is focused on device-device communication… not payment. NFC will be just another radio in the handset, there will be multiple SEs with the carriers owning a SWP/SIM based one.. and the platform provider managing the other. Which will succeed? A: the group that can best ORCHESTRATE value across 1000s of companies.

- Visa will lose a top 5 issuer to MA, and they will see a future where their debit revenue is gone (in the US) as MCX and bank consortiums take ownership of ACH and PIN debit.

- We will see 100s of new companies work to create new physical commerce experiences that include marketing, incentives, shopping, selection. Amazon is the driving force for many, as retailers work to create a better consumer experience at competitive price.

- Chaos in executive ranks. Amex, Citi, MCX, PayPal, Visa all have new CEOs.. all will be shaking up their payment teams.

- Retail banking is going through fundamental change. Bank brands, fee income and NRFF are declining, big dedicated branches will be replaced by more self service. Mass market retail will see significant leakage into products like pre-paid. Retailers and Mobile Operators are better able to profitably deliver basic financial services, to the mass market, than banks…. see my Blog Future of Retail: Prepaid.

- Unlocking the Cloud… and Authentication. KYC is a $5B business. Look for mobile operators to build consumer registration services that will tie biometrics with phone. Digital Signatures on contracts, payment through biometrics, .. all will be possible in a world without plastic. Forget NFC… See previous Blog on KYC and Cloud Wallets.

Battle of the Cloud – Part 2

Previous Blog – Part 1 – May 11, 2012

Let’s update the Cloud Battle story and discuss events since my last post on the subject

Square, Visa, Google, PayPal, Apple, Banks, … have recognized the absurdity of storing your payment instruments in multiple locations. All of us understand the online implications, Amazon’s One Click makes everything so easy for us when you don’t have to enter your payment and ship to information. (V.me is centered around this online experience). Paypal does the same thing on eBay, Apple on iTunes, Rakutan , …etc. But what few understand is the implication for the physical payment world. This is what I was attempting to highlight with PayPal’s new plastic rolled out last week (see PayPal blog, and Target RedCard). If all of your payment information is stored in the cloud, then all that is needed at the POS is authentication of identity (see blog).

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives

Since May, the following “significant” events “in the battle” have occurred:

- Retailers have launched MCX with Wal-Mart’s Mike Cook as the lead. I want to emphasize, this is not “mobile payments” but rather a low cost payment network (Cook talks about $0.05/payment). Some retailers will seek to integrate their loyalty card, others will create plastic (see Target RedCard), others will certainly couple with mobile. WMT will likely integrate with a virtual wallet that manages digital coupons (Coupons.com likely leading)

- Apple has rolled out Passbook in June.. See my Blog, and hardware analysis from Anandtech of why there is no NFC.

- PayPal had a marketing announcement with Discover. Why would you announce something like this with no customers? Paypal is expanding its network… but merchants are just laughing.. MCX wants a $0.05 payment, Durbin gave them a $0.21 payment and Paypal wants to get 180-250bps. As you can tell, I don’t think much of this, as the Merchants are still in control of their payment terminal. This is also not an exclusive deal with Discover. I expect 2 other major players to partner with Discover in next few months. Paypal just wanted to run with this announcement before the other products come out. I also want to emphasize that DFS is a BUY. They will be a partner of choice as they run a subscale 3 party network that can adapt much more quickly than V/MA. As a side note, Paypal will likely expand distribution of their own plastic. See related blog.

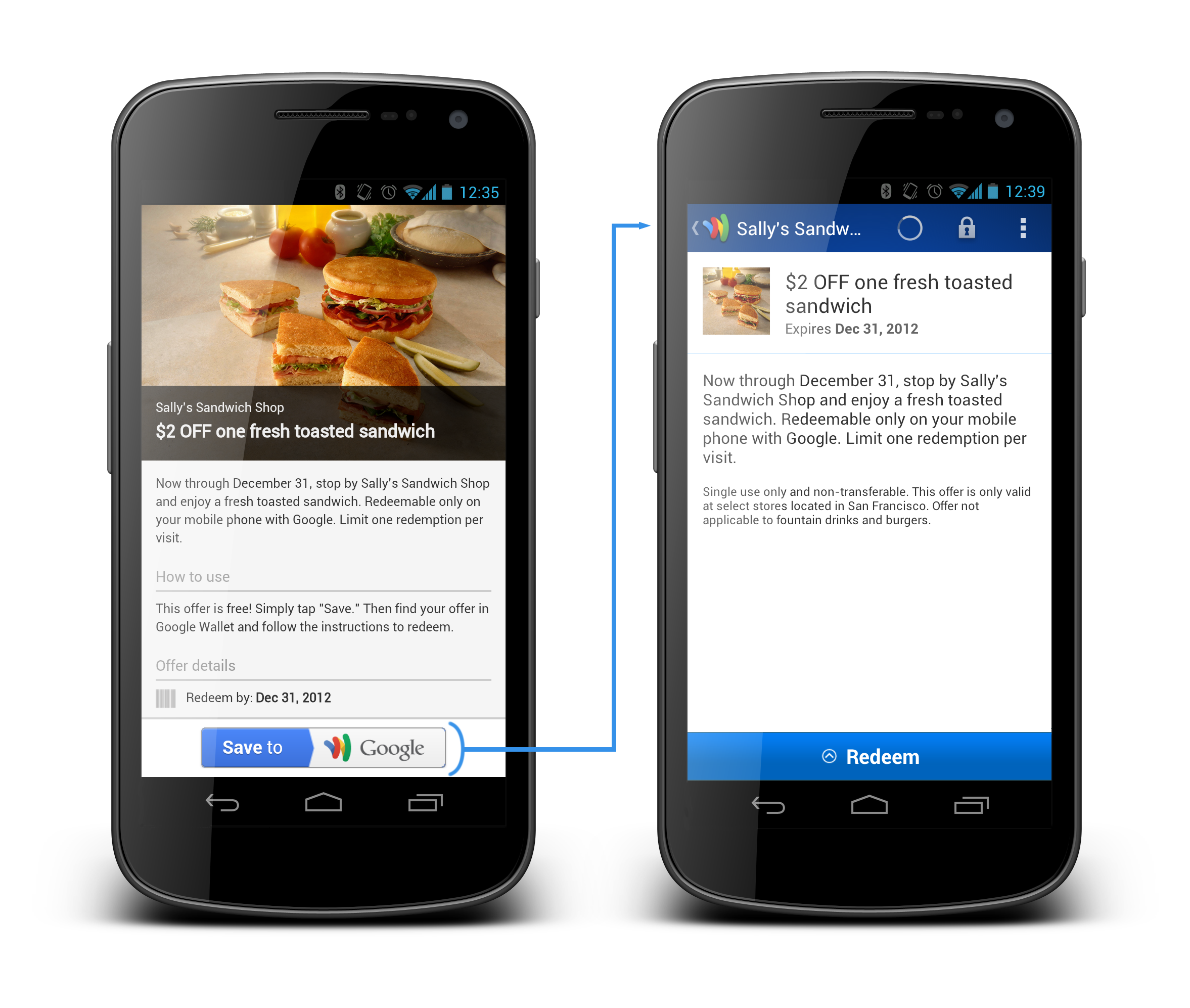

- Google rolled out Wallet 1.5 on August 1 (see blog). This is one of the biggest moves in payments and provides an enormous retailer value proposition (aligned to MCX). Google didn’t follow PayPal, Passbook, or Microsoft.. they rolled out product that was 1.5 yrs in progress. Google’s new cloud wallet allows the consumer to select any payment method, and provides the merchant with a debit rate (Bancorp non-Durbin 1.05% + $0.15 (note Google/Issuer can lower this for merchants, as any issuer could, this is a MAX rate). Google is CURRENTLY loosing money on the payment side of the business in hopes of making it up on the advertising side. This is no marketing announcement like Apple, Microsoft and Paypal.. this is a product announcement.. it is working today in my new Galaxy phone. This is also the first PRODUCTION cloud wallet for the POS. Apple, Amazon and Paypal dominate cloud wallets in eCommmerce and mCommerce. Google and Amex’s Revolution money are the only one’s doing it at the POS.

- Square acquired all 30M Starbucks mobile payment customers (see Blog). Square has done a great job acquiring merchants.. but was hurting on the consumer side. Square wants to build network and needed a pop on the consumer side. Square’s business is pivoting toward marketing and consumer experience. Within the next year, the little Square doggle will be a thing of the past. Starbucks is committing to the Square register experience, and Square is relabeling “card case” to “Pay with Square”.

- LevelUp is making payments “free” for merchants as part of a loyalty value proposition. This is an example deal.. expect more to follow. Issue is that different merchants have different priorities. LevelUp is focused in QSR/Casual Dining and is operating as part of a loyalty play. I’ve outline their revenue in this blog, don’t think it is sustainable unless they can move into acquisition.

- ISIS has lost key executives in its product area, AT&T is rumored to have a NFC/Wallet RFP of its own out and even Verizon is planning to let Google go ahead and put its wallet on the Samsung Galaxy III phones.. after all what choice does it have?

- Card linked offers and incentives in the cloud. No one is making money in this space, large retailers are not participating, hyper local merchants (who are interested) are very hard to sell to, and consumers don’t see relevant content (thus redemption rates under 2%).

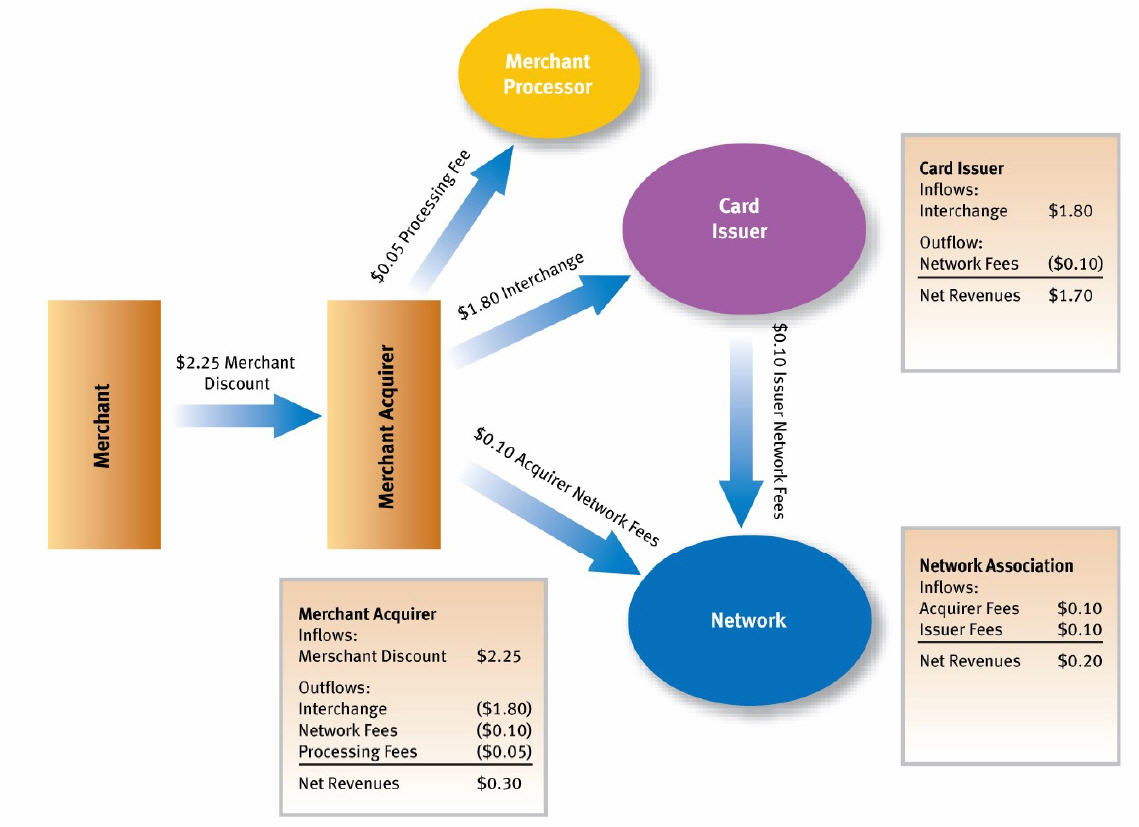

Where are the cloud battle lines? Well most significantly the battle lines are forming away from NFC (as I stated in January). Even my old friends at Gartner have caught up and placed NFC in the trough of disillusionment. To restate, NFC is not bad technology.. but it delivers no “value” in itself beyond control. Mobile operators have consistently failed to build a business around a “control” strategy (see my Walled Garden Blog). In the ISIS example they mandated use of credit cards only, as this higher credit interchange was the only way to make revenue. Well guess who pays the freight here? Yep the merchants… Wal-Mart and its peers were not thrilled at giving issuers and MNOs 3.5% of sales for the privilege of accepting a mobile payment.

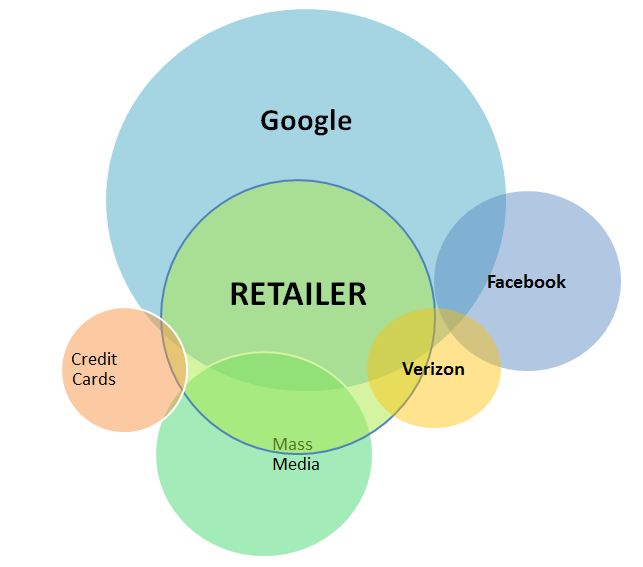

The Cloud battle is complex, as the strategies are about MUCH MORE THAN PAYMENT. Payment is the ubiquitous service that is the last phase of a successful marketing, engagement, shopping, selection, deliver, retention, loyalty process. Leaders from my vantage point:

Payment Networks:

- Mastercard focused on acting in supporting role globally.

- Discover similar to MA, but with much greater flexibility as it operates in a 3 party network and is both issuer and acquirer.

- MCX – Not a leader yet, but has CEO mindshare of every top US retailer. They seem overly focused on the cost side. There is a very big whole in their customer acquisition strategy. MCX is bidding out its infrastructure now, my guess is that Discover or Target will win it.. and the the RFPs are just a way of keeping Banks “in the tent” to keep them from changing ACH rules to kill it like they did to Scott Grimes at Cap One (decoupled Debit).

- Google – has more consumer “accounts” than any company on the planet. Can it convert them to accounts with a linked payment instrument? Google also “touches” more customers, more times per day than any other company, its heavy influence in the shopping process positions it well with retailers. Also has the best retailer sales force of anyone on this list, as they bring in customers to retailers every day. Android/Google Wallet….

- Square – Best customer experience hands down (register). It also has the most traction among small retailers

eCommerce/mCommerce:

- Apple – expect Passbook to dominate mCommerce. It will be the killer app.

- PayPal – Challenged in market adoption beyond eBay/GSI customer base. Top ecommerce sites like Amazon and Rakuten have their own integrated payment, also 50% of eCommerce/mCommerce goes through Cybersource which Visa acquired. Paypal’s future growth driven by international

- Amazon – leading eCommerce/mCommerce player. When will it take one-click beyond Amazon? Amazon’s experience is best from end-end…. PayPal/Apple will operate around the periphery of non-Amazon purchases.

- Rakuten – “Amazon of Japan” who now also owns buy.com. Fantastic experience and leading eCommerce loyalty program.

How many places do you want to store your payment credentials? Who do you trust to keep them? What data do you want providers to know about you?

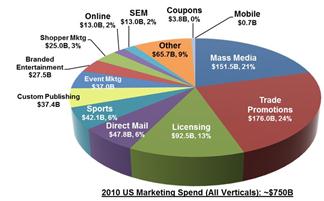

From a macro economic perspective, total payment revenue for all major participants is just under $200B in the US. Total marketing spend in the US is over $750B. Total retail sales in the US is $2.37T (not including oil/gas, Fin services, T&E). Marketing is fundamentally broken… payments is not. Retail sales gross margin has been compressed from 4.2% in 2006 to 2.4% in 2010. Who is best able to execute on the combined retail and marketing pain points? Who can be retailer friendly? Consumer friendly? Marketing friendly?

I start my analysis with #1 the consumer value proposition, and #2 the merchant value proposition. Entities like Google, Paypal, Apple already have tremendous consumer relationships and traction. They thus have very few “acquisition” costs. However, these entities do bear the costs of changing customer behavior. There are many approaches for changing customer behavior:

- Incent behavior – direct/indirect/merchant

- Customer Experience (ex Square)

- Service integration (reduce effort or # of parties)

- Reduce risk – financial (security/anonymity…)

- Reduce risk – purchasing (social, community reviews, …)

- Value proposition in commerce process (indirect incentives)

- Marketing

- ..etc

Other groups like MCX and ISIS bear the cost of both customer “acquisition” AND behavior change for: Consumer, Merchant or Both. As I state previously. one of my favorite arcane books I’ve ever read was “Weak Links” I’m almost reluctant to recommend it because it is so good you may jump ahead of me on some of my investment hypothesis. One my favorite quotes from the book

Scale-free distribution (completely open networks) is not always the optimal solution to the requirement of cost efficiency. .. in small world networks, building and maintaining links between network elements requires energy…. [in a world with limited resources] a transition will occur toward a star network [pg 75] where one of a very few mega hubs will dominate the whole system. The star network resembles dictatorships in social networks.

Networks like V, MA, PayPal, Amex and DFS are working to participate in this new Macro economic opportunity. But established networks are hard to change

“The network forms around a function and other entities are attracted to this network (affinity) because of the function of both the central orchestrator and the other participants. Of course we all know this as the definition of Network Effects. Obviously every network must deliver value to at least 2 participants. Networks resist change because of this value exchange within the current network structure, in proportion to their size and activity.”

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives (new digital coupons).

The current chaos will abate when an entity delivers a substantial value proposition that attracts a critical mass of participants. Today most mobile solutions are just replacing a card form factor… this is NOT VALUE. I am currently placing my bets on solutions that merchants support (Square, Google, MCX, LevelUp, …) as this is a key “fault” of almost every other initiative.

Comments Appreciated (as always sorry for the typos…)

PayPal vs Google (at POS)

3 Aug 2012

Paypal COULD do everything that Google wallet does today.. so why won’t they? (Note I’m talking about the Physical POS… not online)

I’ve had a PayPal debit MasterCard for 6 yrs, when I use it at any merchant PayPal deducts from any stored balance I have, and then hits one of my stored payment instruments. I use this card exclusively on international trips because they have always offered the best cross border fees (.. and just 3 years ago paid an interest rate higher than any of my banks). I looked on the back of my new PayPal debit card and see that JP Morgan Chase is the issuing bank. Given that Chase has over $10B in assets, this card costs the merchant $0.21 + 5bps in the US. This is a great deal for retailers. A REALLY great deal.

Why is PayPal pushing out its own Plastic? Unbranded? Obviously they really don’t like the standard debit interchange (above) and want a bigger cut (than $0.21 flat fee) from the retailer. (see PayPal at POS)

Why won’t PayPal expand its online wallet to allow me to select any card for any given purchase? In this I mean creating an app that works like Google wallet, prompting the customer “what card do you want to use”? The answer is that they want to drive the underlying account selection decision to ensure the instrument with the lowest cost is selected.

Take a look at your payment instruments in PayPal today, they let you define a DDA account as “primary” but NOT a card. In other words PayPal incents you to link DDA in order to get money out.. then PayPal looks to leverage this account whenever possible (sometimes taking take settlement risk). The most costly customer for PayPal would be an Amex customer with no linked DDA and a PayPal debit card (for ATM withdrawals). See my related blog on PayPal’s funding mix (estimate 150bps)

PayPal is a payments business.. not an advertising business. Their goal is to maximize revenue. This is not a bad thing… But their recent moves are a “replay” of what happened to the bank payment networks as they pushed to ramp up merchant fees and grow interchange revenue at the expense of retailers. Why on earth would any merchant agree to take on Paypal’s new plastic? If it is above $0.21 it makes no sense at all… UNLESS Paypal is driving incremental sales.

PayPal today could create a Virtual “wallet” tied to either a Sticker or a Card that would work across Android, iOS, Blackberry, … and do everything that Google has done.. Why won’t they? Because the instrument must operate as a debit card, and the interchange “arbitrage” could kill them. In other words they will bear the cost of 350bps for a CNP Amex transaction and only charge the merchant $0.21 flat fee. If they rolled this out, I’m sure they would have MASSIVE success.. but if customers unlink DDAs and delete debit cards they would risk a funding mix that is “unsustainable” because they have no other revenue channel.

The true “payment innovation” from Google has little to do with payment and much to do about risk management and monetization of data. Google drives business to retailers today.. google helps consumers find the right product… they also “know you” from your history. They can use this information drive value to consumers AND to retailers.. they are also willing to take a very big risk that the benefits of Google will out weigh the COSTS of WALLET. Google Wallet will likely loose money on every single transaction. If you never accept an offer, incentive or coupon.. never search.. never use maps to find a business, never use Zagat to find a restaurant, never watch you tube commercials… they will likely loose money on you. However Merchants will ALWAYS win.. no matter what, they will have the lowest cost payment when accepting a Google payment.

This is either INNOVATION OR INSANITY. From my perspective, what Osama and team have done is fundamentally game changing.. ! Bearing costs, giving consumers and retailers complete control.. in the hope that they can deliver value in other services. Payment is now just a small part of an overall Commerce Process. For example, a “new” feature of Google Wallet that has not received enough attention is the “saveto” API release at Google I/O . Google allows merchants to store 3rd party offers and payment types in the wallet. These offers don’t have to be created by Google.. it is a true “wallet” function.

As I stated yesterday, Visa, Mastercard, Amex, all of the banks are REALLY worried about data. Google will be in a position to deliver value to consumers independent (or dependent) on the card you use. Few other companies can do this… Consumers will always have a choice.. no one will be forcing them to use their Google wallet. But why not? Why didn’t the banks use their information to help me earlier? Why did the banks and payment networks stop retailers from passing their real costs along, of delivering incentives that they could control?

This “aggregate” model is something ANY company could do in short order.. Square is doing it, Revolution Money, LevelUp, … but no one else can make it profitable.

PayPal’s new POS “hope” is to re-engineer the customer experience at the POS, allow merchants to throw away their custom POS terminals.. As most of you know I believe Square Register was by far the best POS experience I have ever seen. From PayPal’s June Video it looks like they agree and have replicated the Square Register “voice” experience. While the customer experience is FANTASTIC.. it did not bring the customer into the store.. nor is payment cost competitive with Google.

[youtube=http://www.youtube.com/watch?feature=player_profilepage&v=CMByV-k9Oc4]

Investment take

PayPal has enormous runway left for them globally. I don’t see Google wallet denting current growth for 2 years. However this is VERY disruptive. IF google is successful in getting all Android users to register with a payment instrument (like Apple does in the App Store), and Google pushes Wallet out beyond NFC phones, it could result in a Tsunami wave which Paypal could not overcome in mCommerce.. This is a scenario where there are 3 primary mCommerce payments options: Apple Passbook, Google Wallet and Amazon. For physical commerce.. nothing will impact this world in next 5 yrs if it does not entail a physical plastic card. NFC phones and payment terminals just aren’t materializing fast enough. IF google creates physical plastic.. watch out… In this scenario Google should be pursuing an unbranded card.. “let the consumer decide”.. .”let the retailer influence” these are themes not heard in the payment world and would seem to resonate.

The Directory Battle PART 1 – Battle of the Cloud

11 May 2012

This week we had both Finnovate and CTIA going on, and behind the scenes the battle lines are being formed in a forthcoming “BATTLE OF THE CLOUD” wallet. I didn’t include wallet in the quote because Battle of the Cloud sounds so much more ominous. Perhaps I should take a page from George Lucas’ playbook and start with Chapter 4.

I’ve been talking about the directory battle for some time now (see Clearxchange post). Who keeps the directory of consumer information? As I outlined in Digital Wallet Strategies: “ securing information AND giving Consumers the exclusive ability to control what is shared with whom is a challenge (beyond technology and trust). We thus have many limited “Wallets” that are constructed around specific purposes”.

This week we had Visa’s President tell the CTIA audience that Visa has moved beyond NFC to V.me (see my previous post on Visa Wallet). What is really going on? What is the battle of the cloud?

Square, Visa, Google, PayPal, Apple, Banks, … have recognized the absurdity of storing your payment instruments in multiple locations. All of us understand the online implications, Amazon’s One Click makes everything so easy for us when you don’t have to enter your payment and ship to information. (V.me is centered around this online experience). Paypal does the same thing on eBay, Apple on iTunes, Rakutan , …etc. But what few understand is the implication for the physical payment world. This is what I was attempting to highlight with PayPal’s new plastic rolled out last week (see PayPal blog, and Target RedCard). If all of your payment information is stored in the cloud, then all that is needed at the POS is authentication of identity (see blog). Remember US online commerce is $170B/yr, physical commerce is $2.37T (not including FS, Travel/Entertainment).

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives (new digital coupons). Another example is Paypal’s ability to selectively assume settlement risk on some transactions as they route through low cost ACH, or even allow customers to use BillMeLater to selectively convert certain purchase to loans AFTER THE FACT. In these 2 examples, traditional payments revenue will be significantly disrupted by: lower cost transactions, competitive credit terms (each purchase), and incentives tied to payment type.

But do consumers really want to store all of their information in one place? With one entity given the ability to see all of your spend? For an mCommerce transaction, there is nothing I hate more than having to type in my name, address and card number in that tiny little screen. Most of these mCommerce solutions (like V.me) are little more than an “autofill” where the merchant checkout page leverages API integration to the cloud service to retrieve user information (see diagram here). If I’m on my phone, my carrier already knows who I am, so seems fairly logical for them to help me with the autofill. This is a reason I’m now a big fan of Payfone. I could also see why it makes sense for Apple and Google. But why Visa? Does it make any sense at all for Visa to hold my Amex card? Oh.. let me cast a few more stones on ISIS/NFC.. that payment instrument that locked in your phone.. yeah it can’t be used for the online purchase. Perhaps someday someone will write a secure NFC mobile browser plug in to extract data from the SE.. but that opens up a whole new can of worms.

Today’s online merchants are getting a very small taste of the war as they are asked to integrate auto-fill plug ins (Paypal, V.me/CYBS, Payfone, Google, soon to be Apple). Merchants should get on board with all of them, as they do represent a tremendous improvement in customer experience, and you may be able to squeeze some free marketing/implementation money from each of them. However, the cloud battle at the physical POS is still a few years off, as existing card products have a substantial advantage in risk modeling/fraud. This is where Square is taking a lead, as it has the best consumer experience hands down. Low volume merchants really should assess whether they need a specialized POS system, as the parameters for selecting one have shifted from ISO/Processor/Cost/Acct Recon/Book Keeping to Sales, incentives and customer experience.

Battle starts in mCommerce/eCommerce

My guess on timing of V.me is driven by knowledge of Apple’s impending plans to “extend” its iTunes account to payment outside of the Apple ecosystem. Visa sees this network risk and is in an all out war to protect its network, by leveraging its CYBS asset online. The banks have worked on a directory concept for quite some time. The Clearing House (TCH) built a working system called UPICK to solve the problem of consumers giving their RTN/ACCT# out in the open.. assigning a virtual number to the account. A sort of “virtual account number” that could only be translated by TCH. It never took off, because ACH fraud was low and banks were much more excited about having merchants accept cards as payment.

Retailers are not silent participants to this war.. their champions are Target, Tesco, Amazon, and Rakutan. I hope Amazon will finally dust the plans off of One Click expansion. Other retailers are also aligning to assess creation of shared cloud infrastructure. Sorry I can’t comment more. Similarly MNOs are also in the cloud game, for example Payfone may be one of the best services in the market..

Who are the players in the Cloud [Payments] War?

The initial battle will be in mobile/online purchases.

- Banks: V.me, Mastercard,

- Platforms: Apple, Google, PayPal

- Retailers: Amazon, Rakutan,

- MNOs: Payfone, Boku, payforit, billtomobile, …

Most confusing is that there are few alliances.. it is many against many.

http://tomnoyes.wordpress.com/2011/10/26/apples-commerce-future-square/

Carriers as dumb pipes?

25 April 2012

I just bought a brand new Galaxy Nexus on Google’s new play store today (https://play.google.com/store), very excited to have an unlocked GSM phone that I can take with me around the world. Better yet, I can now take advantage of Google wallet and many new NFC based applications.. independent of any carrier (… although the Sprint people are A+).

I just bought a brand new Galaxy Nexus on Google’s new play store today (https://play.google.com/store), very excited to have an unlocked GSM phone that I can take with me around the world. Better yet, I can now take advantage of Google wallet and many new NFC based applications.. independent of any carrier (… although the Sprint people are A+).

This week, I was struck by how similar the carriers “walled garden” NFC strategy is to previous attempts to create a “Walled Garden” . Why are the MNOs recycling the same control strategy? Remember Einstein said “the definition of insanity is doing the same thing over and over again, but expecting different results”. As background, VZ (and most MNOs) love the “walled garden” strategy.

Version 1(2004-Present). BREW platform from Qualcomm (dumb phones).

Version 2 Handset capabilities

- Verizon invested over $300M in GPS “platform”, an investment they planned to recover by charging for Apps that wanted to use GPS. RIM was the first to realize that it could not deliver consumer features at odds with what VZ would authorize.

- Firethorn was the first payment related application that VZ promoted. Objective was to limit all consumers to Firethorn as the only approved “signed application” where consumers could check their bank balance. Banks were each asked for $1M to allow for their customers to check their balances on this MNO controlled application.. yeah.. great idea (2007)

- Search. $600M exclusive deal w/ MSFT in 2009. Unfortunately for MSFT, Android was not included agreement and then VZ make “Droid” THE key marketing theme.

- I could go on.. but

Version 3 NFC

- Control SE (http://tomnoyes.wordpress.com/2011/02/03/isis-platform-ecosystem-or-desert/)

- ISIS. Consensus is that the carriers will keep plugging along at this for 10 years.. however without talent, retailers and handsets I don’t see how they can sustain investment.

- Create a new BREW.. handset platform that leverages NFC and secure customer data.. payment (ISIS) is just one of the applications. Note that most carriers are in midst of issuing RFPs for SE management (my vote is for Sequent here). The objective of this effort is to create a “secure platform” where applications can leverage customer data (for a fee).

Would you want to “play” in a walled garden? The owner gets to make the rules and take the rug out from under your feet (ie MSFT $600M). Where the star (ie Apple) is able to negotiate special treatment or go over the top without you ever being aware? No way.. you can’t run a business like this. I wouldn’t even want to play..

Carriers must think about value creation before they can think about control. Apple earns its margin from brand and experience… they are not forcing people into their store. For example, the Samsung Galaxy Nexus is an unbelievable phone… easily on par with the iPhone.. But the carriers won’t let it in the market unless Google give them the keys to the SE. It’s just crazy…My 11 yr old son can guess what happens next.. Google starts selling the phone directly (which I bought today). As most readers know, the US handset market is a very strange place (handset subsidies and post paid plans). The rest of the world buys their handsets and selects the carriers based upon cost/coverage. What if Google and Apple were to subsidize handsets through marketing, as opposed to anticipated spend? If telephone calls and data were routed through wi-fi whenever available? What do carriers have left?

Every point of “friction” which carriers create.. FURTHER ERODES their future profitability as this friction improves the profitability and market opportunities for companies going above, around and under them. Carrier business culture and experience all surrounds the walled garden “control” approach. This control approach works well for Apple as it has developed an integrated value proposition.. It does not work for the carriers that offer connectivity. To expand beyond connectivity carriers must create new services.. the must become orchestrators of value.. not controllers of handsets. In other words they need to shift from a “permission/transaction/payment” paradigm to one of discovery->need->->fulfillment. (see my previous blog).Attention US Mobile operators… today your trajectory is headed toward dumb pipes. You cannot deliver value through control.. no one trusts you.. and you can’t sustain investments to compete against Google, Apple, Facebook, …

What should you do? Where is the revenue opportunity? It is in value orchestration. You have direct consumer relationships… leverage them for marketing, authentication, personalization, awareness. The good news is that Hardware will peak and reach a “good enough” stage. If hardware is a commodity, then brands will begin to deteriorate.. and value orchestration will shift further from the handset node into the Cloud. If any operator agrees with this.. then ask why on earth are you locking all of this customer data inside a phone (NFC) where it cannot be used or sync’d with the cloud.

I will get off my soap box now.

BTW.. AT&T I fully appreciate that you can disable my new Nexus.. please dont make me go to an MNVO.. just another point of friction.

Google/TXVIA

3 April 2012

http://googlecommerce.blogspot.com/2012/04/google-acquires-txvia.html

Congrats to Google and the TXVIA team. Given that Google is a client of mine I’m not going to comment on anything specific here.. but clearly this deal significantly expands the reach of Google at the POS. No longer will Google Wallet be dependent on a few thousand NFC phones in market.

The primary reason for my post is that a senior retail executive just rang me to tell me they are concerned about Google’s wallet and card strategy. It seems I was incorrect in dismissing the WSJ article on a Retailer Wallet. There is MUCH more structure here than I realized, and it is not just wallet that the retailers are contemplating.. but ownership of a new payment/incentive network. I would laugh if I didn’t want to cry..

- Banks are working to form “the next Visa” because they don’t trust the one in market today

- Retailers are forming their own payment network

- Banks are worried that Google will be the next PayPal, or Visa

- Retailers are concerned about Google killing their customer relationship

- Mobile operators what to own payments.. err… that was last week sorry… now they want to own marketing

- Retailers are refusing to adopt NFC because everything is a card transaction…

- …etc. I could go on.. but the chaos just continues

Retailers, I admit I am VERY biased toward Google. The issue in market perception is: through Google’s effort to be a neutral platform for consumers, banks, operators, retailers, … they appear friendly to the competition. For example, they have no desire to be a Bank.. or to be a Paypal.. but if Banks don’t allow for efficient payments (consumers and retailers) they must deliver an alternative. Google wants to “enable” .. which can mean not picking winners.. but letting the marketplace select them (principle example is Card Linked Offers). This approach is embedded in to Google’s culture of billiant engineers running with a great idea, and letting the market determine if it will work. Apple on the other hand engineers great customer experiences.. In a very, very controlled fashion. How many “partners” has Apple enabled? How many non-Apple businesses benefit from Apple’s platform? How many other brands does Apple support?

Google has no desire to take over retail.. they want to create fantastic consumer shopping experiences. Yes that means Google’s customers are the same as a Retailer’s customers.. and consumers will use a generic andriod shopping app vs. one your IT team built..

The paranoia is just contagious.. billions of dollars are being wasted because few know how to partner… In Google’s efforts to be “neutral” they appear to be friendly to all. To retailers they are “too bank friendly”, to banks they are “trying to be a payment network”, to consumers “they are tracking everything I do”..

TXVIA will be a major turning point for Google in payments. This new platform will enable them to support their internal marketplaces in new ways, and give retailers new tools to deliver incentives on their brand. In the Google Press Release, they mentioned TXVIA support for 100M cards. Take a guess how many of these cards have a TXVIA brand on them? NONE.. It is a company that provides a platform to support many business models (like Blackhawk). If Google continues this approach they will win big. Note, if they do develop a “Google Card”.. it may just be a pilot.. they are not taking over the world with their own plastic.

My top market question is: “what will Blackhawk do now that Google owns your card platform”? TXVIA is the best pre-paid software platform in the market.. hands down.

Digital Wallet Strategies

Warning.. I ramble a bit in this one.

23 March 2012

Does anyone remember Microsoft Wallet circa 1997 (See Wikipedia)? Digital wallets are certainly not a new phenomena. Today we are struck with eWallet saturation: Google Wallet, ISIS Wallet, Visa Wallet, iTunes accounts, Amazon Accounts, Square, PayPal, … How many places must store all of my credentials?

Does anyone remember Microsoft Wallet circa 1997 (See Wikipedia)? Digital wallets are certainly not a new phenomena. Today we are struck with eWallet saturation: Google Wallet, ISIS Wallet, Visa Wallet, iTunes accounts, Amazon Accounts, Square, PayPal, … How many places must store all of my credentials?

For my own benefit I thought I would take a brief look at the history to determine what the future may look like (As the future holds the key for my investment decisions). With respect to Wallets, what are they? What are successes and why? What is the consumer value proposition? What are the risks? What does the future hold?

My last blogs on this topic were in November 2009, Investors Guide to Mobile Money, and in 2011 – Tough Start for Mobile Payments.

What is a Digital Wallet?

My all time favorite YouTube video definition is below (Courtesy of Google)

http://www.youtube.com/watch?v=gKGptWtzeaU

[youtube=http://www.youtube.com/watch?v=gKGptWtzeaU]

Proposed Definition: A consumer owned and controlled account that can store any electronic form of what is normally held in a physical wallet, including: payment, ID, coupons, loyalty, access cards, business cards, receipts, keys, passwords, shopping lists, …etc.

This definition sounds broad enough..

As a consumer, what would you think of having multiple physical wallets? I personally don’t have that many people I trust. Trust is a very important element to a consumer. Some of the information in my wallet is sensitive, and there is also a financial risk associated with loss of payment information (particularly outside of the US). What kind of entity would want to assume the risk of holding all of this information? Which reminds me of a story,

I was in a Board Meeting with a senior partner of a “Top 3” VC discussing consolidated sign on. A start up was proposing to hold all of the login credentials for all of your bank accounts. As the former internet head for both Wachovia and Citi I had some firm views on the topic and asked “who is going to take the risk if credentials are compromised”? I further explained “it is not a technology problem, but a risk problem.. Bank’s will not let someone keep their Customer’s keys if they can’t insure the risk”. As a side note, I also instituted a policy that if a customer discloses their credentials to anyone, they are responsible for any losses that result (sorry Yodlee).

Within a Digital Wallet, securing information AND giving Consumers the exclusive ability to control what is shared with whom is a challenge (beyond technology and trust). We thus have many limited “Wallets” that are constructed around specific purposes, for example Microsoft’s wallet has evolved to LiveID. From a pure technology perspective, the mobile phone (with NFC) seems to present an opportunity to provide the Consumer with a device that can uniquely handle the security and authorization aspects of a holistic digital wallet. In my view, the challenges faced by the “phone as wallet” are business related. Per my definition above, a wallet should allow consumers to control what goes in and how it is used. Today we see the carriers (ex ISIS) create a platform based upon their control, allowing only cards that have paid a fee to enter into their wallet. I digress…

What makes for a successful wallet?

Customer Trust, Customer Control, Convenience, Ubiquity (opposite of lock in), Intuitiveness, Experience in Use (buying, redeeming, accessing, ..), Security,

If I have a wallet that only accepts 3 cards that are not accepted at any of the top 20 retailers (ie ISIS), it is of little value. Why not let consumers control what goes in? This is where carriers must get to in order for NFC to survive. Even then, NFC phones are far from my recommendation. After all if your payment information is locked in a mobile phone how do you use it when you are at your computer buying something on Amazon? Locking information in a phone is just plain stupid in the age of the cloud.. most agree that individuals should have a their information in a cloud they control. The NFC zealots reading this blog will respond that it NFC doesn’t require a network and is more reliable… my response, the POS and payment terminals are connected.. NFC doesn’t need to hold the card in the SE.. it just needs some sort of identifier.. or in the Square cardcase example no NFC at all just your voice print. After all if there is no auth from the payment network.. the transaction will not happen.. so something is connected in 99%+ of card transactions.

Consumer Value Proposition

My primary digital wallet is Amazon, with Paypal as a close #2. The buying experiences are just superb, unfortunately neither extend well into the POS. I have a PayPal debit card I use here.. but I have a hard time justifying why I would use a paypal debit card that pulls money from a pre-funded account which is tied to my Bank of America Checking.. why not just use my BAC Debit Card? I don’t think I’m alone here.. The thought that comes to mind: why do I use PayPal at all? Convenience is certainly a key element, but I also really don’t like giving out all of my personal information to every vendor I do business with. Why does any vendor need to know my name? Is there a business case for anonymity? For Readers in Germany I know your answer… of course there is.

My primary digital wallet is Amazon, with Paypal as a close #2. The buying experiences are just superb, unfortunately neither extend well into the POS. I have a PayPal debit card I use here.. but I have a hard time justifying why I would use a paypal debit card that pulls money from a pre-funded account which is tied to my Bank of America Checking.. why not just use my BAC Debit Card? I don’t think I’m alone here.. The thought that comes to mind: why do I use PayPal at all? Convenience is certainly a key element, but I also really don’t like giving out all of my personal information to every vendor I do business with. Why does any vendor need to know my name? Is there a business case for anonymity? For Readers in Germany I know your answer… of course there is.

Most Silicon Valley eWallet business cases are being built around data sharing and “closing the loop”. In a network analysis model, every step away from the optimal consumer experience (control, anonymity, ubiquity,..) impacts broad based adoption. Alternatively, new value propositions (ex incentives, rewards, loyalty, …) can reverse entropy, but only within specific groups/clusters (that realize the value). Thus a highly fragmented world of wallets, each built around specific functions limited to narrow networks, where customers exercise only limited control and hence participate in a limited fashion.

Risks

My last blog on Payment Risk was associated with Square (I still don’t like the swipe, but I have eaten my shoe now that they have surpassed $4B GDV and have developed CardCase… which I love). Microsoft had grand visions for Wallet and Passport, and pulled back for a number of reasons. Globally, most consumers still have problems putting all of their information in one place. The Fed, OCC, FTC, CPFB, Banks have all been circling around the broad proliferation of consumer data.. what are the risks of having your payment instrument stored with 100s of vendors? While at the The Clearing House’s annual event, I was pinged by a JPM Chase exec.. what will be done to secure payment information? At the policy level, many believe there is a national security risk in the compromise of our payment systems… It is something all of the Banks are thinking about.

While cloud based storage of information sounds fantastic… there remains a gap in integrated controls, security and authentication. This is where I see both the US and EU taking action on consumer data access and controls much beyond what is now within PCI. Given today’s technology, there is little reason for any merchant to hold your actual credit card number.. yet it is still the case.

What business incentive is there for any entity to hold “unlimited” sensitive consumer information? If the information cannot be accessed without user consent? All of these factors will shape wallet functionality to either something focused within a given domain, or under complete control of the Consumer.

Wallet Strategies

1) Consumer Friendly.. Single store for all consumer information. Payment, loyalty, reciepts, … The players I see here are Google, Square. (note I acknowledge everyone at PayPal just rolled their eyes and point them to my Disclaimer above). Business case is around customer data access.

2) Marketplace focused. Obvious players here: Starbucks, Rakutan, Amazon, Apple, Paypal, Target Red Card. Objective: Deliver a fantastic customer experience in purchasing within a focused marketplace.

3) Form Factor/Device Focused. Mobile Operators, Card Networks, . Deliver technology and incent buyers/retailers to participate. This is not working out so well, exception is Edy.. may work in markets with dominant carrier.

4) Bank Consortium. We see this more in Europe at the moment, but I believe the US regulatory bodies are pushing banks to work together here. Much more payment focused, and thus minimal consumer value… Banks/Fed must realize mobile is not about a new form factor, but a new value network.

5) Retail/Transit Consortium. Transit is already clear leader here in Asia…. Transit actually resembles more of #2. Where there is only one transit company provider I believe it is.. this Category is defined as one wallet working across multiple retailers.. I look at this as incentives tied to something like a decoupled debit.

6) Commercial. Example outbound payments, payroll distribution, global dividend payments – hyperWALLET.

7) Other???

Future of Wallets

“Limited Wallets” can obviously be very successful: Starbucks, PayPal, Amazon, Apple iTunes, Oyster, Edy, Suica, Octopus, hyperWallet…. But all started around an existing marketplace/system. In order for an independent wallet to thrive it must deliver value within a core network. My approach to evaluating retail payments evolves around a central hypothesis: payments support a commercial system, they are only the last phase of a long marketing, incentive, shopping, selection, and buying process.

Networks are resilient to change, this is both an asset and a hindrance. The value that is delivered within an existing payment network is tied to the commercial system in which it operates. This includes both business agreements AND technology, neither of which are easy to change. As the nature of retail changes (example payments, and incentives across virtual and physical channels) new “value exchange” networks will form. Existing payment networks will certainly attempt to change, but given their distributed ownership, nodal control over rules, and legacy infrastructure it will be “a challenge”.

In the US today, this is what is happening with Google Wallet, Bank initiatives to form “the next Visa” and Large US retailer’s plans to form a new payment network that they control. Today’s wallet initiatives are operating in a very dynamic landscape: retail is changing, technology is changing, new value networks are forming, new marketing platforms are emerging.. The margin is always better in orchestrating the interaction, than in coordinating the transaction. Thus I place my “wallet” bets in the short term with groups that can control the commercial marketplace (ie Apple, Amazon, eBay, Retailers, … ), and with groups that can orchestrate new value propositions (ie. Google, Square, hyperWallet, ..etc).

Have a great weekend… My Asia thoughts are next.