Tag Archives: wallet

Google in Payments: Why Yesterday was BIG News

JPM/V Scenarios… Which one is it?

Least Cost Routing – Part 1

Business Implications of Payment Tokens

Payment Tokenization

V.me: Issuers please give me your customers

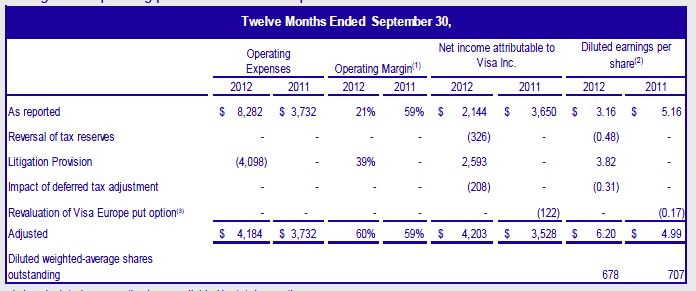

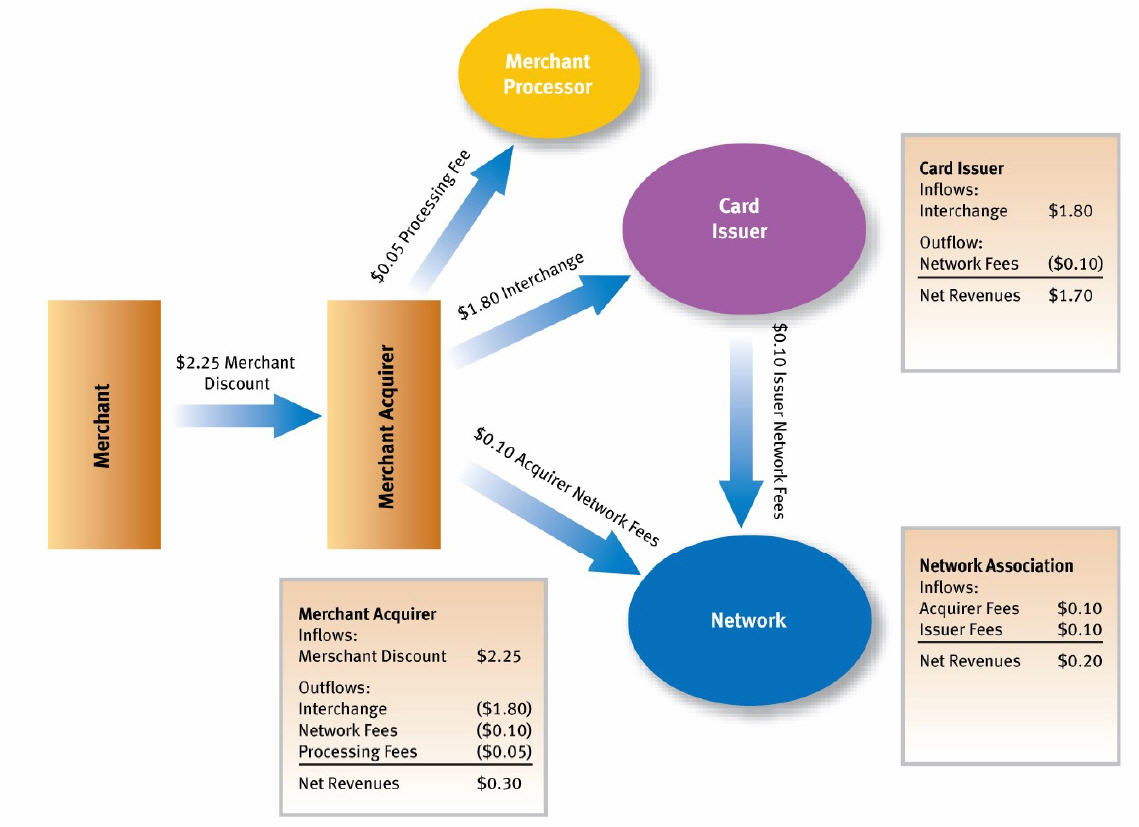

Visa is an independent for profit company… they are on a tear with adjusted earnings up over 19% and the stock up over 40% for the year. Who are Visa’s customers? They are a network, created by banks.. but they only set rules.. historically they don’t have direct relationships with merchants or consumers; the issuing bank owns the consumer, and the acquiring bank owns the merchant. Their primary customer is therefore banks (issuing and acquiring).

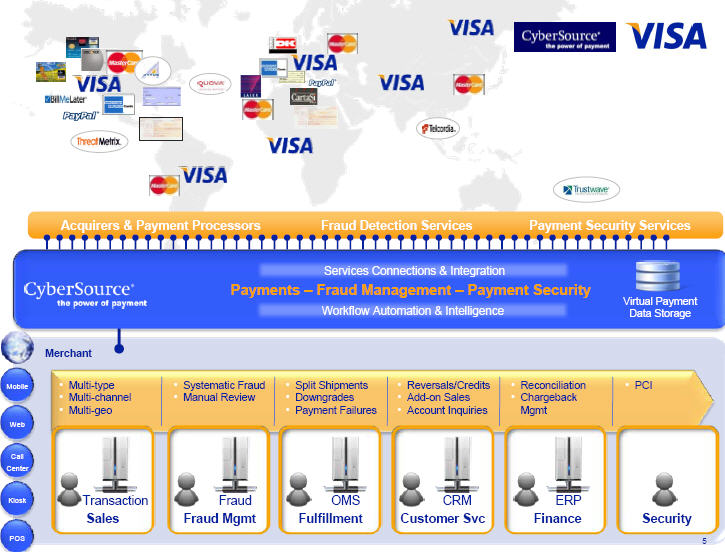

With the CYBS purchase, Visa gained direct merchant relationships. CYBS at one time handled over 25% of eCommerce transactions. The “big 3” in online merchant services are now eBay (Paypal+GSI), Visa (CYBS) and Amazon. Visa is looking for ways to expand its network, services and revenue base. The expansion is very hard to do if you are dependent on your member banks, hence Visa is looking to establish a direct consumer touchpoint in line with Cybersource’s merchant capability.

In my very first blog (2009 Googlization of Financial Services), I outlined both the alert service that Clairmail built for Visa, and the advertising/offer engine they had put in place. Neither the alert service nor the ad service had taken off as issuers were not exactly thrilled with expanding Visa’s services or opening the door to Visa’s efforts to communicate directly to consumers. Clairmail has since been acquired by Monitise ($173M in March 2012). Monitise is the entity that build “Visa Offers” and initially was “the mobile horse” which Visa intended to ride … until they upgraded to Fundamo. Now Monitise seems to be focused on the offers product… (See Visa Mobile Strategy). Visa wants to get into the card linked offers business (Visa Offers, FreeMonee, Monitise,…), and has had the technology working for sometime, they also want to get into the wallet business. (see Battle of the Cloud)

Neither of these services are to the best interest of issuers, which is why we see a hodgepodge of small banks without the resources to properly digest the strategic impact, or build the technology themselves in this recent V.me “50 bank pilot”. Let me be crystal clear on what I believe Visa’s strategy is:

- establish direct consumer service

- start with eCommerce (autofill) functionality to speed checkout and improve conversion

- add alerts to give consumers knowledge of card transactions

- add incentives/offers in 18 months (they already have built the service)

This is why Visa hates the Google service.. it steps all over their plans online.. as well as at POS (not in scope for this blog).

Take a look at V.me terms and conditions. They have done a great job in obfuscating their strategy in this document, as it clearly states that issuers have control

These Terms do not amend or otherwise modify the cardholder agreement or any other terms and conditions of your Issuer. In the event of any inconsistency between these Terms and your cardholder agreement with your Issuer, these Terms govern as to the relationship between you and Visa solely with respect to V.me and your cardholder agreement with your Issuer governs as to the relationship between you and your Issuer. You are responsible for ensuring that your use of the Services complies with your cardholder agreement with your Issuer.

Visa Alerts is the service where banks should start to become concerned. For the first time, visa is creating a list of consumer names, emails (above) and mobile phone numbers. Alerts will start with card usage, and then they will morph into incentives and offers based on spending patterns. These incentives will be offered completely separate from the issuers. In the V.me privacy policy “We share some information, but not your full card number, with merchants you pay with V.me” and “We may contact you about your V.me account, service updates, and new V.me features”.

I’ve got news for the V.me participating banks.. why don’t you just give Visa your customer list and give them permission to use it as they want? You have just given Visa much more.. They can now act on transactions they see on the switch.

I see Visa quickly expanding the service beyond eCommerce to physical commerce primarily around offers and alerts. You will be able to redeem offers across any card stored in your V.me wallet. This means that V.me will work without eCommerce merchant adoption… and could be a stand alone offers platform. Of course they don’t want to lead with this… but it is indeed where Visa sees the best margin.

Banks.. get serious about this. Why would you want to let Visa step all over your brand and start delivering services to consumers directly? This is the start of a major tipping point for Visa… the Top issuers are fuming… but Visa may be able to build consumer adoption ahead of banks pulling the plug on it.

There is certainly no reason to worry.. take a look at the participating merchants https://www.v.me/shopping/ not exactly a whose who of online merchants. Why is this? well my merchant friends are also aware of Visa’s efforts to do the incentive business and the last thing they want is another entity switching consumers to the lowest cost provider. V.me on an eCommerce perspective is fine.. but what Visa doesn’t realize is that Google, Paypal an Amazon all have this today. (ex Google has autofill in Chome browser and Android…). If Visa has trouble signing up its own CYBS merchants.. what issues do you think they will have in signing up with those on GSI?

Battle of the Cloud – Part 2

Previous Blog – Part 1 – May 11, 2012

Let’s update the Cloud Battle story and discuss events since my last post on the subject

Square, Visa, Google, PayPal, Apple, Banks, … have recognized the absurdity of storing your payment instruments in multiple locations. All of us understand the online implications, Amazon’s One Click makes everything so easy for us when you don’t have to enter your payment and ship to information. (V.me is centered around this online experience). Paypal does the same thing on eBay, Apple on iTunes, Rakutan , …etc. But what few understand is the implication for the physical payment world. This is what I was attempting to highlight with PayPal’s new plastic rolled out last week (see PayPal blog, and Target RedCard). If all of your payment information is stored in the cloud, then all that is needed at the POS is authentication of identity (see blog).

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives

Since May, the following “significant” events “in the battle” have occurred:

- Retailers have launched MCX with Wal-Mart’s Mike Cook as the lead. I want to emphasize, this is not “mobile payments” but rather a low cost payment network (Cook talks about $0.05/payment). Some retailers will seek to integrate their loyalty card, others will create plastic (see Target RedCard), others will certainly couple with mobile. WMT will likely integrate with a virtual wallet that manages digital coupons (Coupons.com likely leading)

- Apple has rolled out Passbook in June.. See my Blog, and hardware analysis from Anandtech of why there is no NFC.

- PayPal had a marketing announcement with Discover. Why would you announce something like this with no customers? Paypal is expanding its network… but merchants are just laughing.. MCX wants a $0.05 payment, Durbin gave them a $0.21 payment and Paypal wants to get 180-250bps. As you can tell, I don’t think much of this, as the Merchants are still in control of their payment terminal. This is also not an exclusive deal with Discover. I expect 2 other major players to partner with Discover in next few months. Paypal just wanted to run with this announcement before the other products come out. I also want to emphasize that DFS is a BUY. They will be a partner of choice as they run a subscale 3 party network that can adapt much more quickly than V/MA. As a side note, Paypal will likely expand distribution of their own plastic. See related blog.

- Google rolled out Wallet 1.5 on August 1 (see blog). This is one of the biggest moves in payments and provides an enormous retailer value proposition (aligned to MCX). Google didn’t follow PayPal, Passbook, or Microsoft.. they rolled out product that was 1.5 yrs in progress. Google’s new cloud wallet allows the consumer to select any payment method, and provides the merchant with a debit rate (Bancorp non-Durbin 1.05% + $0.15 (note Google/Issuer can lower this for merchants, as any issuer could, this is a MAX rate). Google is CURRENTLY loosing money on the payment side of the business in hopes of making it up on the advertising side. This is no marketing announcement like Apple, Microsoft and Paypal.. this is a product announcement.. it is working today in my new Galaxy phone. This is also the first PRODUCTION cloud wallet for the POS. Apple, Amazon and Paypal dominate cloud wallets in eCommmerce and mCommerce. Google and Amex’s Revolution money are the only one’s doing it at the POS.

- Square acquired all 30M Starbucks mobile payment customers (see Blog). Square has done a great job acquiring merchants.. but was hurting on the consumer side. Square wants to build network and needed a pop on the consumer side. Square’s business is pivoting toward marketing and consumer experience. Within the next year, the little Square doggle will be a thing of the past. Starbucks is committing to the Square register experience, and Square is relabeling “card case” to “Pay with Square”.

- LevelUp is making payments “free” for merchants as part of a loyalty value proposition. This is an example deal.. expect more to follow. Issue is that different merchants have different priorities. LevelUp is focused in QSR/Casual Dining and is operating as part of a loyalty play. I’ve outline their revenue in this blog, don’t think it is sustainable unless they can move into acquisition.

- ISIS has lost key executives in its product area, AT&T is rumored to have a NFC/Wallet RFP of its own out and even Verizon is planning to let Google go ahead and put its wallet on the Samsung Galaxy III phones.. after all what choice does it have?

- Card linked offers and incentives in the cloud. No one is making money in this space, large retailers are not participating, hyper local merchants (who are interested) are very hard to sell to, and consumers don’t see relevant content (thus redemption rates under 2%).

Where are the cloud battle lines? Well most significantly the battle lines are forming away from NFC (as I stated in January). Even my old friends at Gartner have caught up and placed NFC in the trough of disillusionment. To restate, NFC is not bad technology.. but it delivers no “value” in itself beyond control. Mobile operators have consistently failed to build a business around a “control” strategy (see my Walled Garden Blog). In the ISIS example they mandated use of credit cards only, as this higher credit interchange was the only way to make revenue. Well guess who pays the freight here? Yep the merchants… Wal-Mart and its peers were not thrilled at giving issuers and MNOs 3.5% of sales for the privilege of accepting a mobile payment.

The Cloud battle is complex, as the strategies are about MUCH MORE THAN PAYMENT. Payment is the ubiquitous service that is the last phase of a successful marketing, engagement, shopping, selection, deliver, retention, loyalty process. Leaders from my vantage point:

Payment Networks:

- Mastercard focused on acting in supporting role globally.

- Discover similar to MA, but with much greater flexibility as it operates in a 3 party network and is both issuer and acquirer.

- MCX – Not a leader yet, but has CEO mindshare of every top US retailer. They seem overly focused on the cost side. There is a very big whole in their customer acquisition strategy. MCX is bidding out its infrastructure now, my guess is that Discover or Target will win it.. and the the RFPs are just a way of keeping Banks “in the tent” to keep them from changing ACH rules to kill it like they did to Scott Grimes at Cap One (decoupled Debit).

- Google – has more consumer “accounts” than any company on the planet. Can it convert them to accounts with a linked payment instrument? Google also “touches” more customers, more times per day than any other company, its heavy influence in the shopping process positions it well with retailers. Also has the best retailer sales force of anyone on this list, as they bring in customers to retailers every day. Android/Google Wallet….

- Square – Best customer experience hands down (register). It also has the most traction among small retailers

eCommerce/mCommerce:

- Apple – expect Passbook to dominate mCommerce. It will be the killer app.

- PayPal – Challenged in market adoption beyond eBay/GSI customer base. Top ecommerce sites like Amazon and Rakuten have their own integrated payment, also 50% of eCommerce/mCommerce goes through Cybersource which Visa acquired. Paypal’s future growth driven by international

- Amazon – leading eCommerce/mCommerce player. When will it take one-click beyond Amazon? Amazon’s experience is best from end-end…. PayPal/Apple will operate around the periphery of non-Amazon purchases.

- Rakuten – “Amazon of Japan” who now also owns buy.com. Fantastic experience and leading eCommerce loyalty program.

How many places do you want to store your payment credentials? Who do you trust to keep them? What data do you want providers to know about you?

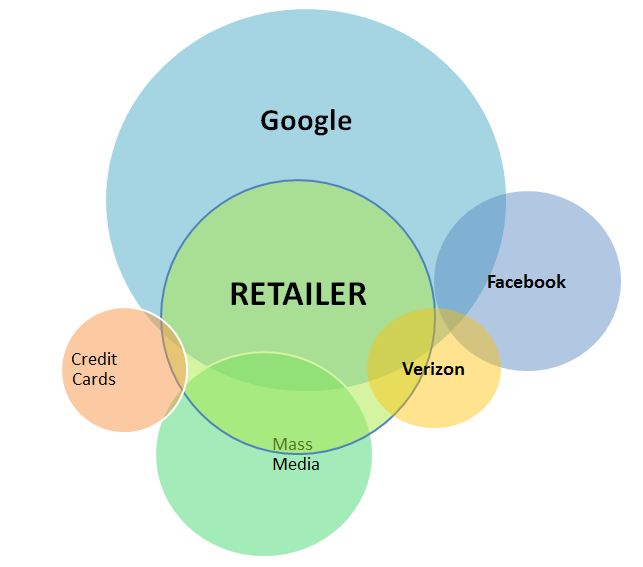

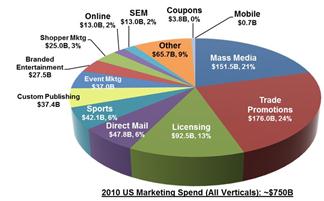

From a macro economic perspective, total payment revenue for all major participants is just under $200B in the US. Total marketing spend in the US is over $750B. Total retail sales in the US is $2.37T (not including oil/gas, Fin services, T&E). Marketing is fundamentally broken… payments is not. Retail sales gross margin has been compressed from 4.2% in 2006 to 2.4% in 2010. Who is best able to execute on the combined retail and marketing pain points? Who can be retailer friendly? Consumer friendly? Marketing friendly?

I start my analysis with #1 the consumer value proposition, and #2 the merchant value proposition. Entities like Google, Paypal, Apple already have tremendous consumer relationships and traction. They thus have very few “acquisition” costs. However, these entities do bear the costs of changing customer behavior. There are many approaches for changing customer behavior:

- Incent behavior – direct/indirect/merchant

- Customer Experience (ex Square)

- Service integration (reduce effort or # of parties)

- Reduce risk – financial (security/anonymity…)

- Reduce risk – purchasing (social, community reviews, …)

- Value proposition in commerce process (indirect incentives)

- Marketing

- ..etc

Other groups like MCX and ISIS bear the cost of both customer “acquisition” AND behavior change for: Consumer, Merchant or Both. As I state previously. one of my favorite arcane books I’ve ever read was “Weak Links” I’m almost reluctant to recommend it because it is so good you may jump ahead of me on some of my investment hypothesis. One my favorite quotes from the book

Scale-free distribution (completely open networks) is not always the optimal solution to the requirement of cost efficiency. .. in small world networks, building and maintaining links between network elements requires energy…. [in a world with limited resources] a transition will occur toward a star network [pg 75] where one of a very few mega hubs will dominate the whole system. The star network resembles dictatorships in social networks.

Networks like V, MA, PayPal, Amex and DFS are working to participate in this new Macro economic opportunity. But established networks are hard to change

“The network forms around a function and other entities are attracted to this network (affinity) because of the function of both the central orchestrator and the other participants. Of course we all know this as the definition of Network Effects. Obviously every network must deliver value to at least 2 participants. Networks resist change because of this value exchange within the current network structure, in proportion to their size and activity.”

The implications for cloud based payment at the POS are significant because the entity which leads THE DIRECTORY will have a significant consumer advantage, and will therefore also lead the breakdown of existing networks and subsequent growth of new “specialized” entities. For example, I firmly believe new entities will develop that shift “payment” revenue from merchant borne interchange to incentives (new digital coupons).

The current chaos will abate when an entity delivers a substantial value proposition that attracts a critical mass of participants. Today most mobile solutions are just replacing a card form factor… this is NOT VALUE. I am currently placing my bets on solutions that merchants support (Square, Google, MCX, LevelUp, …) as this is a key “fault” of almost every other initiative.

Comments Appreciated (as always sorry for the typos…)

PayPal vs Google (at POS)

3 Aug 2012

Paypal COULD do everything that Google wallet does today.. so why won’t they? (Note I’m talking about the Physical POS… not online)

I’ve had a PayPal debit MasterCard for 6 yrs, when I use it at any merchant PayPal deducts from any stored balance I have, and then hits one of my stored payment instruments. I use this card exclusively on international trips because they have always offered the best cross border fees (.. and just 3 years ago paid an interest rate higher than any of my banks). I looked on the back of my new PayPal debit card and see that JP Morgan Chase is the issuing bank. Given that Chase has over $10B in assets, this card costs the merchant $0.21 + 5bps in the US. This is a great deal for retailers. A REALLY great deal.

Why is PayPal pushing out its own Plastic? Unbranded? Obviously they really don’t like the standard debit interchange (above) and want a bigger cut (than $0.21 flat fee) from the retailer. (see PayPal at POS)

Why won’t PayPal expand its online wallet to allow me to select any card for any given purchase? In this I mean creating an app that works like Google wallet, prompting the customer “what card do you want to use”? The answer is that they want to drive the underlying account selection decision to ensure the instrument with the lowest cost is selected.

Take a look at your payment instruments in PayPal today, they let you define a DDA account as “primary” but NOT a card. In other words PayPal incents you to link DDA in order to get money out.. then PayPal looks to leverage this account whenever possible (sometimes taking take settlement risk). The most costly customer for PayPal would be an Amex customer with no linked DDA and a PayPal debit card (for ATM withdrawals). See my related blog on PayPal’s funding mix (estimate 150bps)

PayPal is a payments business.. not an advertising business. Their goal is to maximize revenue. This is not a bad thing… But their recent moves are a “replay” of what happened to the bank payment networks as they pushed to ramp up merchant fees and grow interchange revenue at the expense of retailers. Why on earth would any merchant agree to take on Paypal’s new plastic? If it is above $0.21 it makes no sense at all… UNLESS Paypal is driving incremental sales.

PayPal today could create a Virtual “wallet” tied to either a Sticker or a Card that would work across Android, iOS, Blackberry, … and do everything that Google has done.. Why won’t they? Because the instrument must operate as a debit card, and the interchange “arbitrage” could kill them. In other words they will bear the cost of 350bps for a CNP Amex transaction and only charge the merchant $0.21 flat fee. If they rolled this out, I’m sure they would have MASSIVE success.. but if customers unlink DDAs and delete debit cards they would risk a funding mix that is “unsustainable” because they have no other revenue channel.

The true “payment innovation” from Google has little to do with payment and much to do about risk management and monetization of data. Google drives business to retailers today.. google helps consumers find the right product… they also “know you” from your history. They can use this information drive value to consumers AND to retailers.. they are also willing to take a very big risk that the benefits of Google will out weigh the COSTS of WALLET. Google Wallet will likely loose money on every single transaction. If you never accept an offer, incentive or coupon.. never search.. never use maps to find a business, never use Zagat to find a restaurant, never watch you tube commercials… they will likely loose money on you. However Merchants will ALWAYS win.. no matter what, they will have the lowest cost payment when accepting a Google payment.

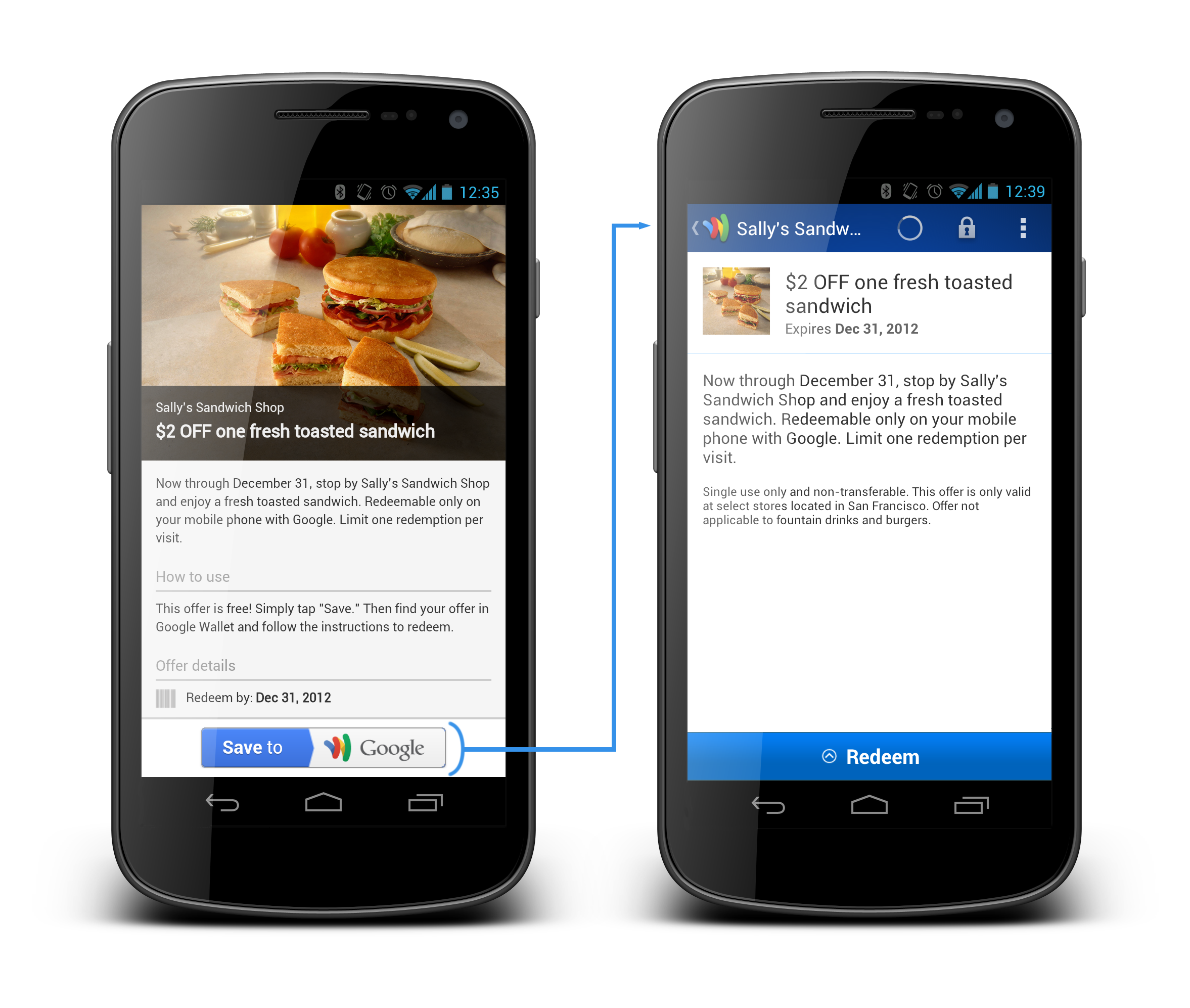

This is either INNOVATION OR INSANITY. From my perspective, what Osama and team have done is fundamentally game changing.. ! Bearing costs, giving consumers and retailers complete control.. in the hope that they can deliver value in other services. Payment is now just a small part of an overall Commerce Process. For example, a “new” feature of Google Wallet that has not received enough attention is the “saveto” API release at Google I/O . Google allows merchants to store 3rd party offers and payment types in the wallet. These offers don’t have to be created by Google.. it is a true “wallet” function.

As I stated yesterday, Visa, Mastercard, Amex, all of the banks are REALLY worried about data. Google will be in a position to deliver value to consumers independent (or dependent) on the card you use. Few other companies can do this… Consumers will always have a choice.. no one will be forcing them to use their Google wallet. But why not? Why didn’t the banks use their information to help me earlier? Why did the banks and payment networks stop retailers from passing their real costs along, of delivering incentives that they could control?

This “aggregate” model is something ANY company could do in short order.. Square is doing it, Revolution Money, LevelUp, … but no one else can make it profitable.

PayPal’s new POS “hope” is to re-engineer the customer experience at the POS, allow merchants to throw away their custom POS terminals.. As most of you know I believe Square Register was by far the best POS experience I have ever seen. From PayPal’s June Video it looks like they agree and have replicated the Square Register “voice” experience. While the customer experience is FANTASTIC.. it did not bring the customer into the store.. nor is payment cost competitive with Google.

[youtube=http://www.youtube.com/watch?feature=player_profilepage&v=CMByV-k9Oc4]

Investment take

PayPal has enormous runway left for them globally. I don’t see Google wallet denting current growth for 2 years. However this is VERY disruptive. IF google is successful in getting all Android users to register with a payment instrument (like Apple does in the App Store), and Google pushes Wallet out beyond NFC phones, it could result in a Tsunami wave which Paypal could not overcome in mCommerce.. This is a scenario where there are 3 primary mCommerce payments options: Apple Passbook, Google Wallet and Amazon. For physical commerce.. nothing will impact this world in next 5 yrs if it does not entail a physical plastic card. NFC phones and payment terminals just aren’t materializing fast enough. IF google creates physical plastic.. watch out… In this scenario Google should be pursuing an unbranded card.. “let the consumer decide”.. .”let the retailer influence” these are themes not heard in the payment world and would seem to resonate.

Random Thoughts: Settlement, NFC and CLO

16 July 2012

Retail settlement

As most of you have read a $7.25B settlement was reached with some US retailers (led by Kroger, Safeway, Payless, Rite-Aid). I’m not going into depth on the settlement but rather the likely response by retailers, and potential impact on Visa/MA earnings. The big retailers have been assuming that this settlement would be reached and have been in the midst of a plan. What would you do if someone was taking 3% of your sales and your average profit margin was 2.4% (ref page Aii IMAP Study)? Well the retailers have plans to leverage a portion of this $6B windfall and invest it in a payment network they can control. Perhaps they should turn around and buy Discover (DFS market cap $18B). This rumor has been in the market (perhaps a driver of 2012 performance).

The US has 2 other countries which serve as benchmarks for a shift away from credit card at POS: Canada (Interact – debit launched 1994) and Australia (EFTPOS). Unfortunately I have limited information on Visa/MA transactions in these geographies to generate a decent analysis of spend shift. From http://www.interac.ca/media/stats.php we see in Canada that roughly 80% of all retail card present transaction are done via Interact (2011 GDV was $182B). I’m not implying a 40% hit to Visa’s GDV is imminent (US is $507B out of global $956B GDV for quarter 31Mar12), particularly since there is no competing network like Ineract (YET). But there are certainly references for success.

I presented some of the Retail Drivers last week and also in my March post (Retailer Wallet). My bet on retailer plans? Well Retailers are not exactly a small group marching in unison, so response will likely differ by segment, ticket size, purchase type (ex non-discretionary gas) and influence.

Gas/Automotive

- Credit card use fee in 2-4 months nationally

Grocery

- Slower roll.. we will see marketing to inform customers of the costs of credit and plans to implement a fee for use of credit cards

- We will also see tests of fees in isolated stores/geographies. Not only assessing customer issues, but also competitive responses.

- Loyalty cards that will be integrated into a payment system

- Loyalty cards that have integrated digital wallet (WalMart issued a Digital Coupon RFP over 18 months ago).

- Incentives dependent on payment type

- Push for PIN Debit.. as it allows the retailer to route away from Visa/MA directly to the bank.

Big Ticket Retail

- No fee likely as they benefit from access to consumer credit

- “Carrot Trials” of Rewards programs and targeted offers will be contingent on payment type

- New loyalty cards

Apparel / Luxury

- Least likely to implement a fee.. wait for other stores to establish customer behavior.

Travel/Entertainment

- No fee likely…

- Discounts for debit, particularly with airlines.

NFC

I’m still just laughing at the mainstream press’ reaction to Apple iPhone 5 plans. Perhaps I should crying at the disinformation that mobile payments (at POS) are taking off. Everyone should ask: what kind of mobile payments?… Transit/ticketing is a slam dunk for NFC technology, yet NFC is having problems (witness London TFL’s decision to defer). Other mobile payments segments which are doing quite well: mCommerce with Amazon reporting around $2B, Digital goods with Zynga leading the category around $1.2B (investor relations).

But the mobile payments at the physical POS? This has not even started. (update.. Starbucks is clear leader here)

I don’t know how much more bluntly I can educate the NFC aficionados, but retailers have not gone gaga over mobile POS payments.. In fact I will state that Payment is not the killer app for NFC.. payment delivers NO VALUE to the Retailer.

For all of you looking at Apple’s patents and thinking they will eventually put NFC in… here is news for you: every one of the patent claims could be fulfilled by Bluetooth (replacing NFC). In order for NFC to take off, the carriers must let go of control (see my long blog here on MNOs walled garden strategy). There is nothing wrong with NFC technology, but unless the carriers are willing to front all investment for retailers, consumers, marketing , … this will never take off. There is a value proposition problem (payments only) AND a control problem. The US MNOs won’t even work with Google who has built everything for free.. free is not good enough for them…. They want control…

Card Linked Offers

I have new stories of just how bad the open rates are on these offers, but most revolve around a central problem. It goes something like this

1) Banks want to get consumers interested in offers. The consumer experience is TERRIBLE (no discount on the receipt) and banks are experimenting with 3 types of distribution. Integrated into online banking (Bank of America), e-mail, and secure messaging.

2) Retailers are not buying basket level discount advertising.. they never have. Retailers must pay for the offer (15% back), the revenue share (% of margin) AND the tax on the offer since it is technically treated as a retailer rebate. Total Retail cost for the offer is approaching 25%.

3) Given lack of retailer participation, Banks (and the offer companies) are thus forced to create offers themselves with no retailer participation (see my WalMart Story)

4) Banks do not want to let consumers go with “no offers” so all available inventory is distributed to “everyone”

5) The poor targeting (universal distribution) has a twofold effect: Consumers see garbage offers and start to tune out the channel, retailers see poor lift in performance as the offer redemption is done by existing customers that would have normally come to store

I could go on.. the exception to the rule of CLOs is Card Spring.. I like them quite a bit. Also Linkable just purchased the assets of Offermatic, which will enable them to link offers across card networks (using Yodlee)..