Short Blog

Continue readingReal-Time Settlement Coming to US Cards?

US Payment Infrastructure is in the midst of completing a major renovation.

- The Clearing House (TCH) Real-Time Payment (RTP)

- FedNow

- JPM’s ONYX (now renamed Kinexsys)

Let me preempt the #1 question most of you are about to ask “are card volumes at risk”? Nope, why on earth would banks want to walk away from the most profitable retail banking product in the history of man (see Future of Retail Banking)!?

eCommerce 2025 – Wallets, Share Shift, Conversion Rates and Key Segments

© Starpoint LLP, 2025. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner. Also, see our Legal/Disclaimer (this is a highly opinionated and partially informed blog).

My estimates for how US eCom market share will shift in next 3 yrs are at the end of this blog.

eCommerce is not a single monolithic market. There are many “segments” to optimize that vary by geography, retailer type, consumer device, customer type (guest vs loyal), transaction type (recurring vs new), ad type, payment type,…etc. A great source of this information is Monetate (highly recommend). For example, let’s look at conversion rates by industry, device and region.

Continue readingWinning in Network of Networks: Collaboration

Tokens and Binding 101

Let’s talk about tokens. When discussing tokens and payments, it’s important to clarify which category of tokens you’re talking about. Today, I’m not discussing NFTs; instead, I’m discussing card network tokens. It’s hard to believe I’ve been writing on this subject for almost 15 years. For a historical refresh, here are a few of my old blogs

Continue readingSling Money – StableCoin Model that will be the future of P2P and more

Wrapping up 2024 – Key Areas I’m Tracking

As we wrap up 2024, I thought I’d outline a few key areas I’m tracking and things to look for in 2025.

Continue readingNetworks, Value Assembly and Organizational Structures

Bull Case For Visa and Mastercard

Very Long Blog. 4 Page Exec Summary. Feedback appreciated. This blog has been my “blocker” as I’ve iterated over the last 7 months. I’ve thinned this down from 31 pages (which no one would read) to 23. No I will never write something this big again.

The thoughts below are an update to my 2016 Small Wins, where I outlined how the forces that have driven scale, and shaped organizations, are atrophying (Transaction Cost Economics, asset intensity, information intensity, finance… etc). Paul Graham’s calls this change Refragmentation, I call it Transformation of Networks.

It’s as if the gravitational constant (the big G) is changing and new forces are driving the formation of new networks influenced by a rapidly evolving world of “weak links”. Information intensity has moved beyond “tweaking” 100 yr old business models to transform the design of industries, communities and people.

Whereas the 2016 blog was more about the “possibilities” enabled by tech, this blog is about the reality of how things will evolve.

© Starpoint LLP, 2024. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner. Also see our Legal/Disclaimer (this is a highly opinionated and partially informed blog).

Digital Wallets – Core Functions and Competitive Strategies

What are the core functions of a digital wallet and what will the future bring now that Apple has opened up their Secure Element (see blog)?

I’ve been writing about wallets for over 12 yrs. Let me recap some history

- In 2006, mobile operators had control of what “apps” could operate on a phone. In the US Qualcom bought Firethorne in an effort to create a single bank application, where banks had to pay $1 for every balance request. I’m not joking.. Open app stores destroyed this model quickly, but so the MNOs pivoted to the SE and SIM card.

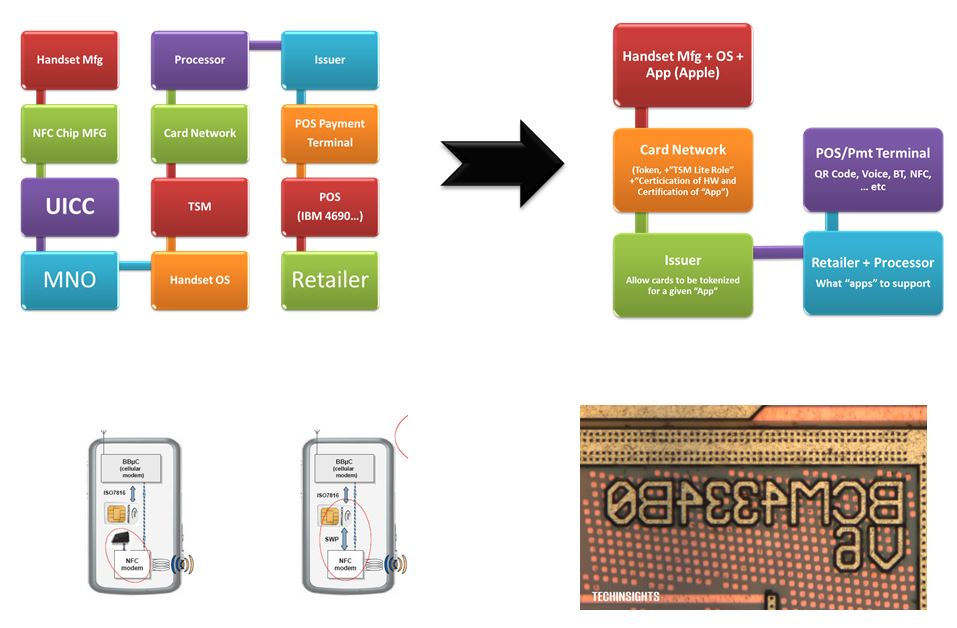

- In 2010, Mobile Network Operators (MNOs) had control of the encryption keys for secure elements. Their pitch to Google was, “Give us a billion dollars, and we’ll give you the keys”. The absurdity here was only surpassed by Doug Bergeron (CEO of Verifone) marching into Google the next year and asking for a “Billion dollars” for Verifone to support contactless (I was just outside the meeting room). Of course there was no economic model for Google to make a single penny off of payments back then. Even worse, there were 12 parties in the NFC ecosystem, all looking for economics, yet there wasn’t a dime to share between all of them (blog). Now wrap all this silliness into a MNO consortium with the name ISIS.. yep.. What a great brand!

- From 2008-2014 the GSMA had a global vision for managing the phone’s secure storage (see blog) and monetizing it for the MNOs. MNOs could control either the secure storage within the SIM card with Single Wire Protocol (SWP) or within the secure element.

- ApplePay’s 2014 launch did several things that changed the game. 1) Ripped away control of the SE from MNOs and OEMs, 2) integrated payments and security into the OS (Card in SE, biometrics in Secure Enclave), 3) required a card to activate a new phone, 4) Created economics with the networks for payment (see blog).

- From 2007-2014, US Issuers wanted to only enable credit cards for contactless (a premium experience). 27 Issuers (led by Citi’s Paul Galant) were working on their own wallet, to “own” mobile payments (see Civil War). In 2014 launch of ApplePay, Apple forced the Issuers to enable debit at parity to Credit, and also gave Issuers a take it or leave it revenue share (15bps in US, 7bps in EU and ROW). Charlie Sharff (then CEO of Visa) also established a fundamental network rule in “no wrapping”. You can’t wrap a Visa card with another number and let it operate. A rule that was ahead of its time and also more formerly established with Durbin regulations.

- The 27 bank project thus floundered for 16 yrs until last year when saw the light of day in PAZE. Paze is Gen 5 of this effort, and really a white label version of SRC. A wallet that abandons the POS and focuses on eCom with Visa given the reigns as the lead architect only last year (see eCom Politics and Scenarios)

- Today, Issuers classify Apple as “enemy number 1” because of the 15bps fee that the Issuers voluntarily signed up for. Their renewed complaint is that merchant discounts (ie 45 bps and Costco, Walmart and Target) puts them upside down on transaction economics. Apple’s position (anecdotally) is “you knew what my fee was when you gave the discounts.. You voluntarily signed the agreement.. And now its successful you want a discount”? (see 2022 US Payments Environment)

- Visa and Mastercard have become the identity infrastructure for the internet because of the binding of identity to payment. India’s UIDAI and UPI have shown the power of separating identity from payment. Europe is working to build a new digital identity infrastructure (and wallet) in eIDAS. Commerccially, Fast Identity Online (FIDO) is at the heart of new eCommerce experiences that will massively disrupt investments in risk and fraud infrastructure. These services are in Card Networks Payment Passkeys, PayPal’s Fastlane and others. These first generation identity services will be surpassed by 2nd generation identity solutions with hardware bound credentials. Google’s Seccure Payment Authentication (SPA) is the best in class authentication solution globally. (also see Adios 3DS hello FIDO2).

- While the tech changing eCom is amazing, there are only 3 options for organizing it into a successful platform: 1) Government Led, 2) Standards Led, 3) Commercial (payment) Network. Of the 3 only V/MA have established an economic model where participants can invest (see Identity Models and my new blog this week on topic)

- Wallets have grown substantially from “payments” to the consumer interaction point for “everything” between the virtual and physical world. Door keys, concert tickets, boarding passes, DLs, loyalty cards, student IDs (see Apple’s list of UC’s it will support).

RTP and Pay By Bank Challenges

US Focused Blog

Last week I wrote about 3 banks live with TCH RfP, today’s blog covers

- Operational overview of TCH RTP and FedNow

- Bank motivations in RTP

- Challenges of pay by bank in the US (an update to last year’s A2A, FedNow and “Instant” Payments – Threat to V/MA? – Nope).

- Areas where RTP will succeed